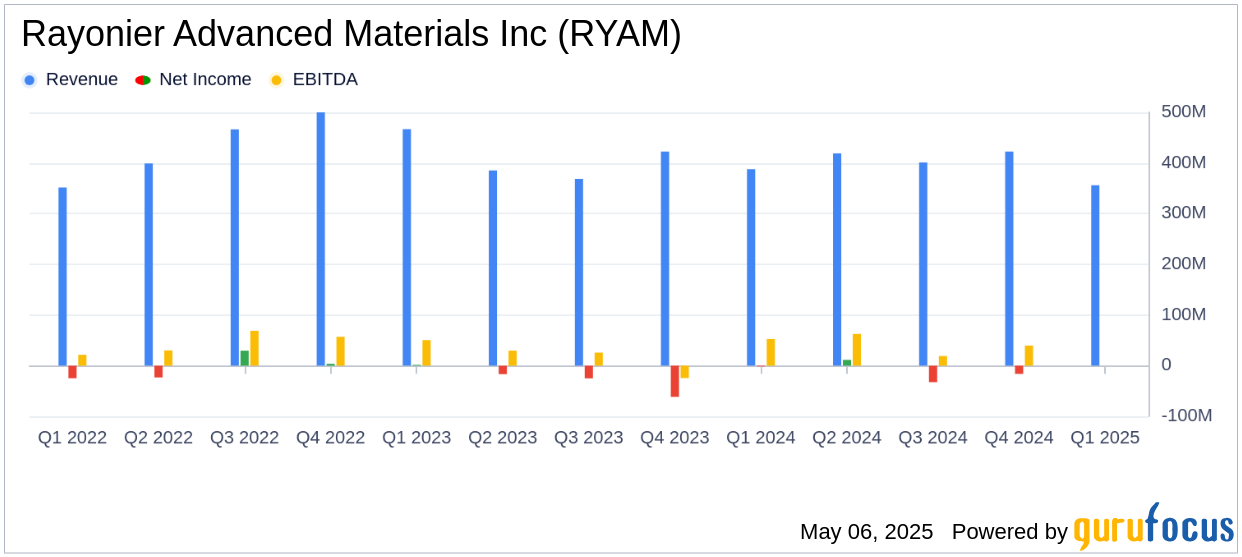

Rayonier Advanced Materials Inc (RYAM, Financial) released its 8-K filing on May 6, 2025, reporting a challenging first quarter with net sales of $356 million, falling short of the analyst estimate of $384.83 million. The company also reported a net loss of $32 million, translating to a loss of $0.49 per share, which is significantly below the analyst estimate of a $0.14 loss per share.

Company Overview

Rayonier Advanced Materials Inc is a producer of cellulose specialties, a natural polymer used in various specialty chemical products. The company's operations are divided into segments including High Purity Cellulose, Paperboard, and High-Yield Pulp, with the majority of revenue derived from the High Purity Cellulose segment. The company primarily generates its revenue from the United States.

Performance and Challenges

The first quarter results were impacted by several factors, including a $12 million non-cash environmental charge, lower cellulose specialties sales volumes, and higher input costs. Additionally, the company faced operational challenges and soft demand in its Paperboard and High-Yield Pulp businesses. The global trade environment also posed challenges, with approximately $85 million of RYAM's annual revenues exposed to a 125% import tariff from China.

Financial Achievements

Despite the challenges, Rayonier Advanced Materials Inc managed to generate $40 million in cash from operating activities and achieved an adjusted free cash flow of $10 million. The company maintained a total debt of $736 million and a net secured debt of $624 million, with a covenant net secured leverage ratio of 2.9 times. These achievements are crucial for maintaining liquidity and managing debt obligations in the chemicals industry.

Key Financial Metrics

The company's net sales decreased by $32 million compared to the prior year quarter, while the net loss increased by $30 million. Adjusted EBITDA for the quarter was $17 million, down $35 million from the previous year. The company's balance sheet showed total assets of $2,118 million, with cash and cash equivalents of $130 million.

| Segment | Net Sales (Q1 2025) | Operating Income (Loss) (Q1 2025) |

|---|---|---|

| Cellulose Specialties | $201 million | $31 million |

| Cellulose Commodities | $75 million | $(13) million |

| Biomaterials | $7 million | $2 million |

| Paperboard | $49 million | $(2) million |

| High-Yield Pulp | $31 million | $(7) million |

Analysis and Outlook

The company's performance in the first quarter highlights significant challenges, including operational inefficiencies and external trade pressures. The impact of tariffs and a weaker U.S. dollar further complicates the outlook. However, Rayonier Advanced Materials Inc remains focused on long-term value creation and strategic positioning. The company projects 2025 adjusted EBITDA to range between $175 million and $185 million, with adjusted free cash flow expected to be between $5 million and $15 million.

“Despite near-term challenges in the macroeconomic and regulatory environment, we remain focused on creating long-term value and are confident in the strength of our core business and strategic positioning,” said De Lyle Bloomquist, President and CEO of RYAM.

Investors and stakeholders will be closely monitoring the company's ability to navigate these challenges and capitalize on its strategic initiatives in the coming quarters.

Explore the complete 8-K earnings release (here) from Rayonier Advanced Materials Inc for further details.