In recent updates, Macquarie analyst Ross Compton has reaffirmed his "Outperform" rating on Maplebear (CART, Financial), maintaining the stock's price target at $55.00 USD. This decision reflects a steady outlook for the company as the rating and price target remain unchanged from prior assessments.

The analyst's report, dated May 6, 2025, suggests confidence in Maplebear's (CART, Financial) future performance, with a consistent price target in view despite current market conditions. The retention of both the previous price target and the "Outperform" rating indicates sustained expectations for the stock's market potential.

It is important for investors to note that Maplebear (CART, Financial) continues to be evaluated positively by Ross Compton from Macquarie, offering a stable perspective amidst a volatile stock market environment. As the stock remains under the spotlight, no percentage change in the price target is reported.

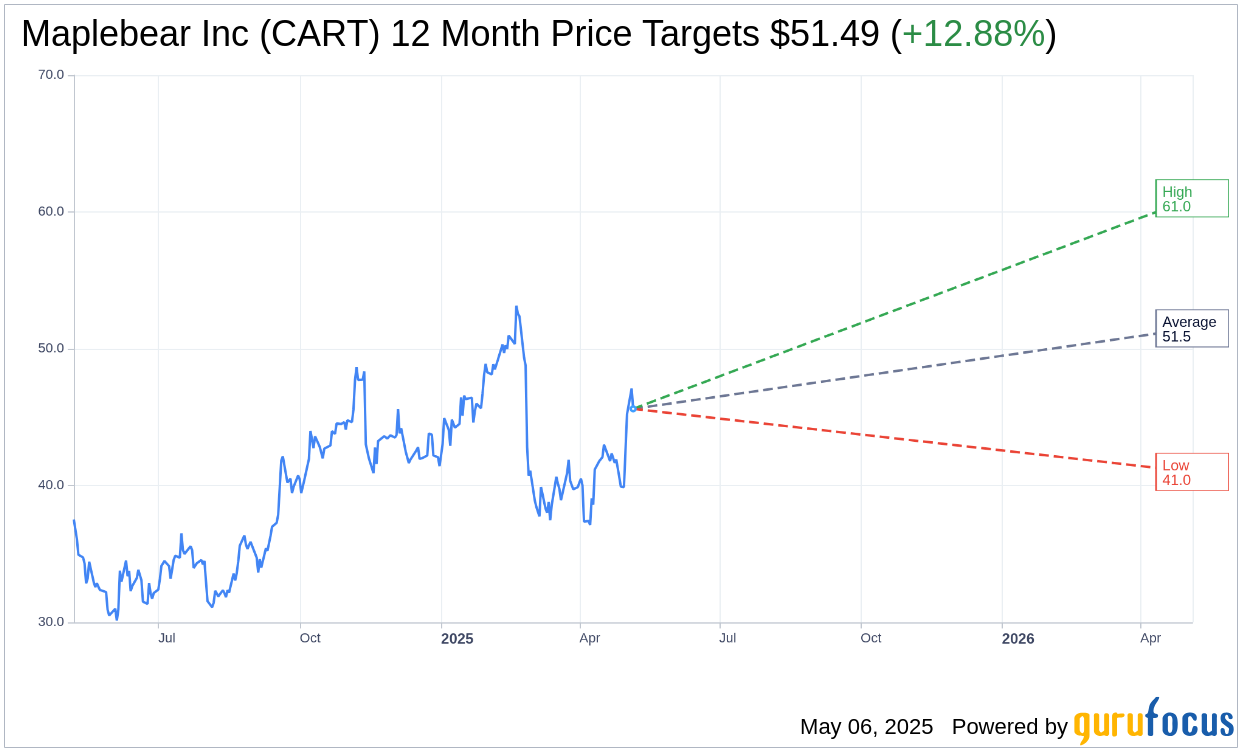

Wall Street Analysts Forecast

Based on the one-year price targets offered by 27 analysts, the average target price for Maplebear Inc (CART, Financial) is $51.49 with a high estimate of $61.00 and a low estimate of $41.00. The average target implies an upside of 12.88% from the current price of $45.61. More detailed estimate data can be found on the Maplebear Inc (CART) Forecast page.

Based on the consensus recommendation from 34 brokerage firms, Maplebear Inc's (CART, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.