- Suncor Energy's first-quarter earnings reveal strong operational performance despite a slight decline in revenue.

- Analysts maintain a positive outlook with an average price target reflecting a potential upside of over 22%.

- GuruFocus estimates a fair value slightly below the current price, highlighting potential market discrepancies.

Suncor Energy (SU, Financial) announced its Q1 financial results, showcasing a Non-GAAP EPS of C$1.31 alongside revenue figures reaching C$12.45 billion, representing a modest 0.6% year-over-year decrease. Despite the dip in revenue, the company excelled in operational metrics with record-breaking upstream production and refining throughput, which contributed to an impressive over $3 billion generated in adjusted funds from operations. Demonstrating commitment to shareholder value, Suncor returned $1.5 billion through a mix of share buybacks and dividends.

Wall Street Analysts Forecast

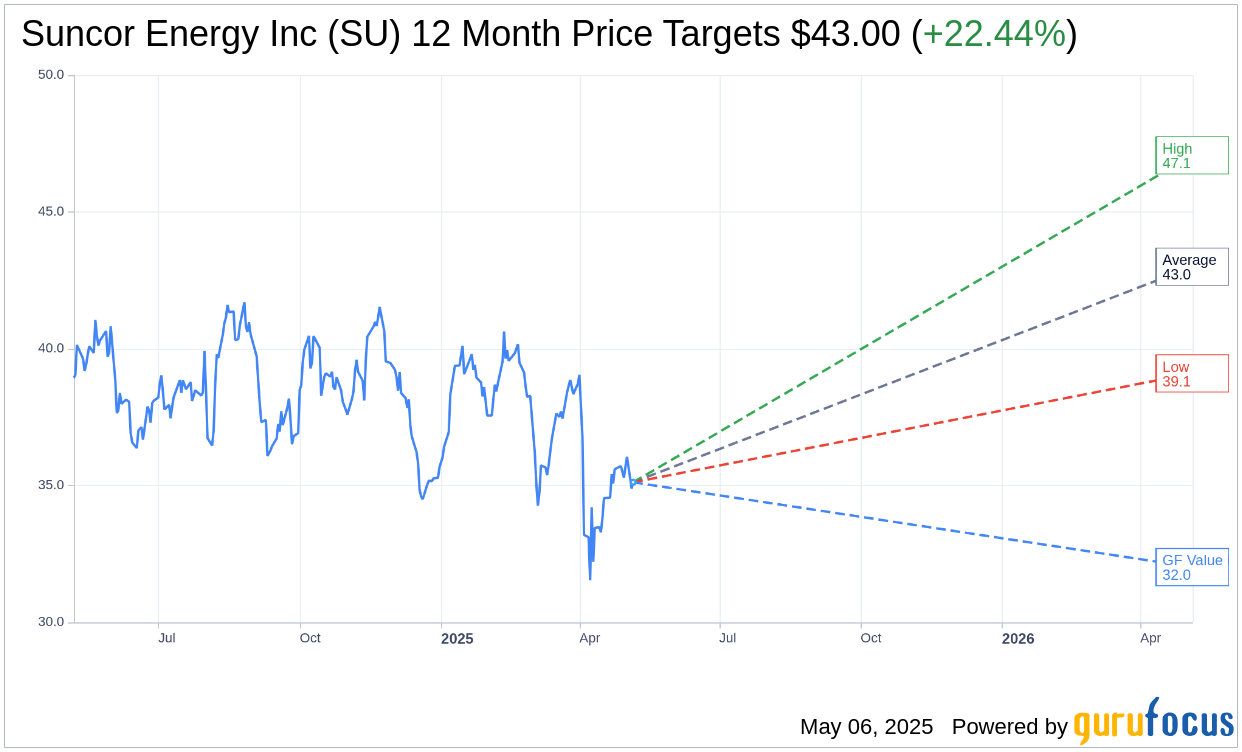

Market sentiment remains largely optimistic as reflected in the price targets provided by 9 analysts. The consensus estimates suggest an average target price for Suncor Energy Inc (SU, Financial) at $43.00, peaking at a high estimate of $47.07 and a low of $39.10. This average target anticipates a promising upside potential of 22.44% from the current trading price of $35.12. For a deeper dive into these estimates, visit the Suncor Energy Inc (SU) Forecast page.

Analysts from 10 brokerage firms have issued an average brokerage recommendation of 2.4 for Suncor Energy Inc (SU, Financial), indicating an "Outperform" status. On this scale, 1 reflects a Strong Buy while 5 signifies a Sell recommendation, signifying general confidence in the company's future performance.

Meanwhile, GuruFocus has estimated the GF Value for Suncor Energy Inc (SU, Financial) at $32.02, pointing to a possible downside of 8.83% from its current trading price of $35.12. The GF Value is a comprehensive valuation metric, calculated from the stock's historical trading multiples, past business growth, and anticipated future performance metrics. For more detailed insights, investors can refer to the Suncor Energy Inc (SU) Summary page.