- LifeMD, Inc. (LFMD, Financial) reports an impressive 70% increase in telehealth revenues for Q1 2025.

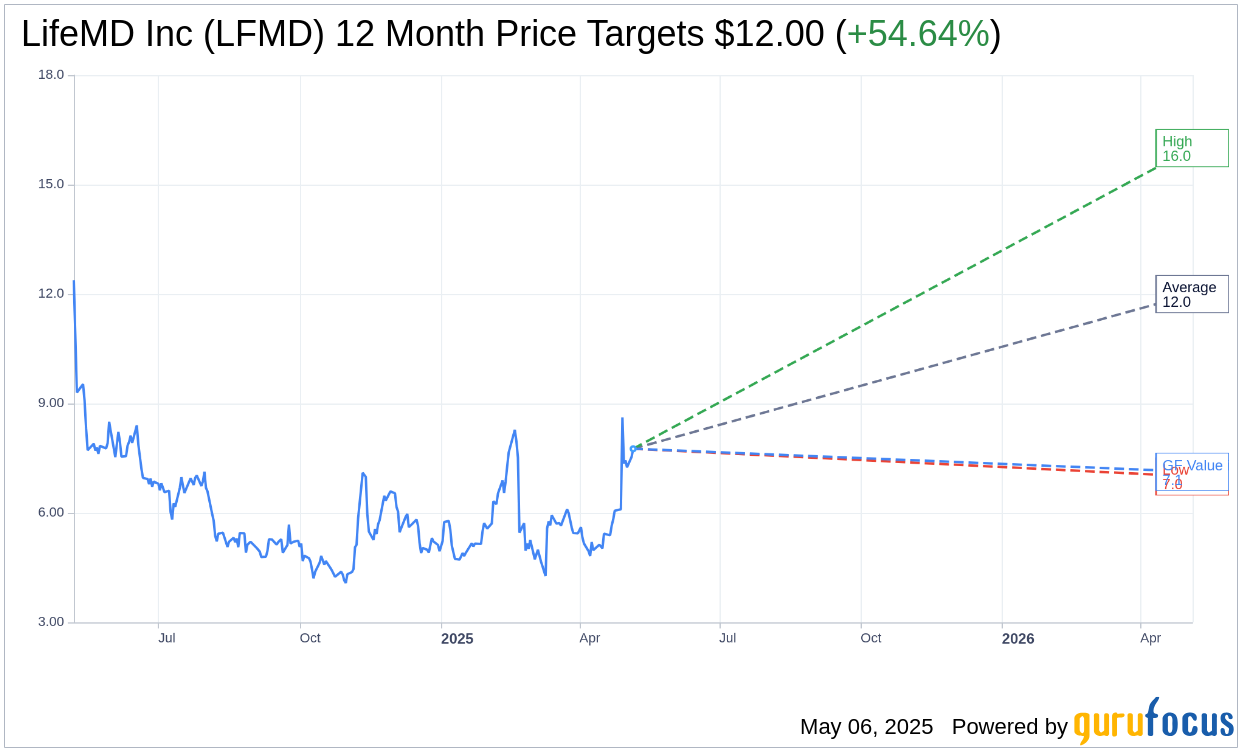

- Analysts forecast a potential 54.64% upside for LifeMD's stock with a target price of $12.00.

- Current GF Value estimates suggest a possible downside, indicating strategic investment consideration.

LifeMD, Inc. (LFMD) has showcased substantial growth by reporting a remarkable 70% year-over-year increase in telehealth revenues for the first quarter of 2025. This growth has been primarily driven by the success of their weight management programs and the introduction of new services. Strategic partnerships and broadened Medicare coverage have further fortified their market position. In light of these developments, LifeMD has revised its 2025 revenue guidance upward, projecting earnings between $268 million and $275 million.

Wall Street Analysts Forecast

According to projections from nine analysts over the next year, LifeMD Inc (LFMD, Financial) is anticipated to reach an average target price of $12.00, with estimates ranging from a high of $16.00 to a low of $7.00. This average target suggests a significant potential upside of 54.64% from the current price of $7.76. For a deeper dive into these projections, explore the LifeMD Inc (LFMD) Forecast page.

The consensus recommendation from nine brokerage firms pegs LifeMD Inc's (LFMD, Financial) average rating as 2.0, signaling an "Outperform" status. The rating scale varies from 1 to 5, with 1 indicating a Strong Buy and 5 suggesting a Sell.

GuruFocus estimates place the GF Value for LifeMD Inc (LFMD, Financial) at $7.13 in one year, which implies a potential downside of 8.12% from its current market price of $7.76. The GF Value is a measure of the fair value at which the stock should ideally trade, calculated using the stock's historical trading multiples, past growth trajectory, and future performance projections. For further insights and detailed analysis, please visit the LifeMD Inc (LFMD) Summary page.