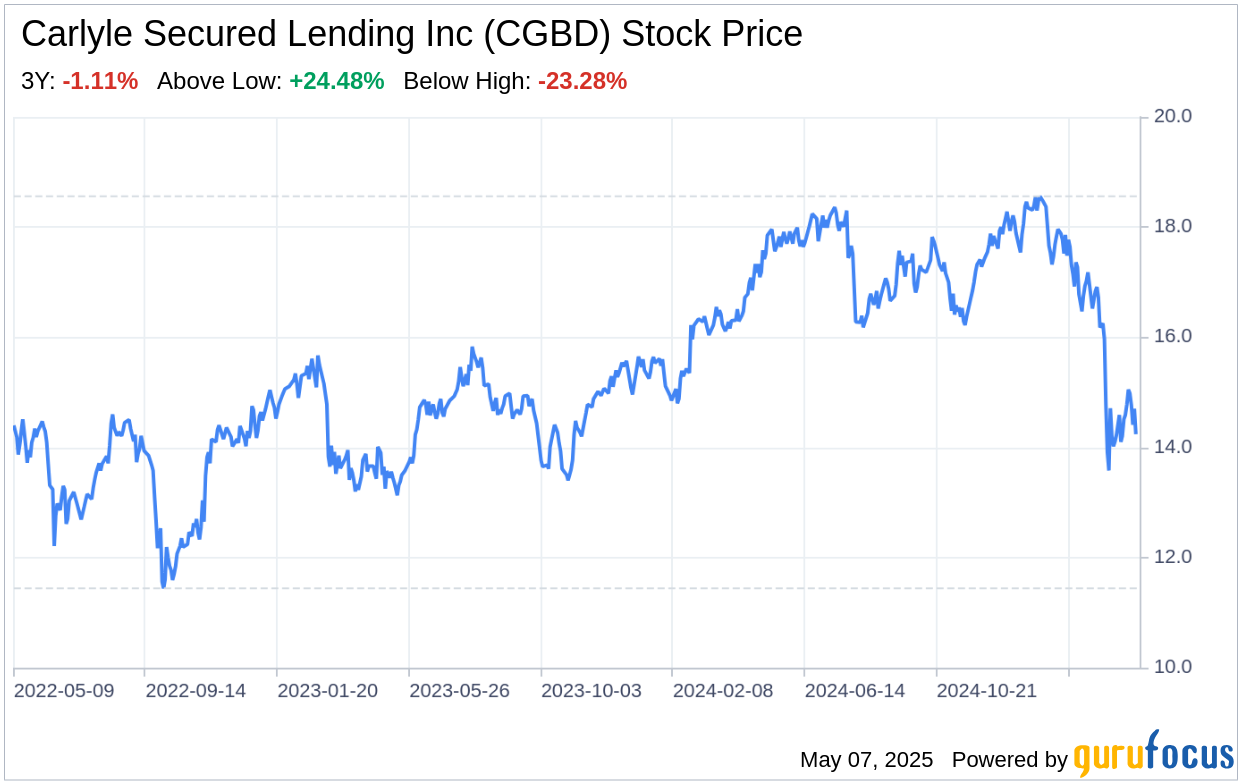

On May 6, 2025, Carlyle Secured Lending Inc (CGBD, Financial), a specialty finance company and a closed-end, externally managed, non-diversified management investment company, filed its 10-Q report with the SEC. This SWOT analysis delves into the financials and strategic positioning of CGBD, providing investors with a clear understanding of the company's performance and potential. The financial overview for the quarter ended March 31, 2025, reveals a total investment income of $54.864 million, a decrease from the previous year's $62.007 million. Net investment income after taxes stood at $21.629 million, down from $28.449 million. The company also reported a net increase in net assets resulting from operations at $14.054 million, a significant drop from the prior year's $29.264 million. These figures set the stage for a nuanced SWOT analysis, reflecting the company's current financial health and its implications for future growth and stability.

Strengths

Robust Investment Strategy and Diversification: Carlyle Secured Lending Inc's strength lies in its strategic focus on providing senior secured lending to middle-market companies in the United States. With a portfolio that spans across various industries, CGBD demonstrates a robust diversification strategy that mitigates risks associated with market volatility and sector-specific downturns. The company's investment approach is further bolstered by its affiliation with Carlyle's Global Credit platform, which provides access to a broad array of lending and investing strategies, enhancing its ability to generate current income and capital appreciation.

Experienced Management and Carlyle Group Support: The expertise of Carlyle Secured Lending Inc's management team, backed by the extensive resources and relationships of The Carlyle Group, positions the company as a strong competitor in the specialty finance market. The company benefits from over 190 investment professionals who bring in-depth knowledge and experience across multiple asset classes, supported by a comprehensive administrative infrastructure. This professional prowess is a critical asset in identifying and capitalizing on investment opportunities, as well as in managing and administering the investment portfolio effectively.

Weaknesses

Declining Investment Income and Net Asset Value: The recent 10-Q filing indicates a year-over-year decline in total investment income and net investment income, which could signal underlying weaknesses in the company's investment strategy or market conditions. Additionally, the net asset value (NAV) per common share has decreased, suggesting potential challenges in maintaining or growing the value of the company's assets. These financial trends necessitate careful scrutiny and may require strategic adjustments to ensure long-term profitability and investor confidence.

Exposure to Below Investment Grade Securities: Carlyle Secured Lending Inc's focus on lending to middle-market companies whose debt is often rated below investment grade exposes the company to higher credit risks. These "junk" securities, while offering the potential for higher yields, carry speculative characteristics regarding the issuer's ability to pay interest and repay principal. This exposure could lead to increased default rates, particularly in economic downturns, and may impact the company's financial stability and performance.

Opportunities

Expansion of Direct Origination Capabilities: The company's direct origination model presents significant opportunities for growth. By leveraging its network and expertise, Carlyle Secured Lending Inc can expand its portfolio with high-quality, secured debt instruments. The ability to originate loans directly allows for better control over the investment process and the potential to negotiate favorable terms, leading to improved yields and stronger relationships with borrowers.

Strategic Acquisitions and Partnerships: Carlyle Secured Lending Inc's recent mergers and acquisitions, such as the CSL III Merger and the Credit Fund II Purchase, demonstrate its capacity for strategic growth through consolidation. These transactions not only expand the company's asset base but also provide access to new markets and investment opportunities. Continued focus on strategic partnerships and acquisitions can further enhance CGBD's market position and diversification, driving long-term value creation.

Threats

Economic Uncertainty and Market Volatility: The specialty finance industry is sensitive to macroeconomic factors and market volatility. Economic downturns, rising interest rates, and geopolitical tensions can adversely affect the creditworthiness of borrowers and the performance of Carlyle Secured Lending Inc's investments. The company must navigate these uncertainties carefully to mitigate potential losses and ensure the resilience of its portfolio.

Regulatory Changes and Compliance Risks: As a BDC and RIC, Carlyle Secured Lending Inc is subject to stringent regulatory requirements. Changes in laws, policies, or regulations, including those related to tariffs and trade disputes, can impact the company's operations and the operations of its portfolio companies. Ensuring compliance and adapting to regulatory changes are critical to maintaining the company's standing and avoiding potential legal and financial repercussions.

In conclusion, Carlyle Secured Lending Inc (CGBD, Financial) presents a mixed picture in its SWOT analysis. The company's strategic investment approach, experienced management, and affiliation with Carlyle's Global Credit platform are notable strengths that provide a competitive edge. However, the recent decline in investment income and NAV, along with exposure to below investment grade securities, highlight areas that require attention. Opportunities for growth through direct origination and strategic acquisitions are promising, yet economic uncertainty and regulatory challenges pose significant threats. Carlyle Secured Lending Inc must leverage

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.