Key Highlights:

- Fiverr International (FVRR, Financial) exceeds earnings expectations with a non-GAAP EPS of $0.64.

- With a 14.7% increase, revenue hits $107.2 million in Q1 2025.

- Free cash flow sees a significant rise of 31.6% year-over-year.

Fiverr International Ltd. (FVRR) has kicked off 2025 on a high note, reporting impressive financial results. The company posted a non-GAAP earnings per share (EPS) of $0.64, surpassing analyst expectations by $0.05. Revenue grew by an impressive 14.7% year-over-year, reaching $107.2 million. Notably, Fiverr's free cash flow also experienced a substantial increase of 31.6% compared to the same quarter in the previous year.

Wall Street Analysts Forecast

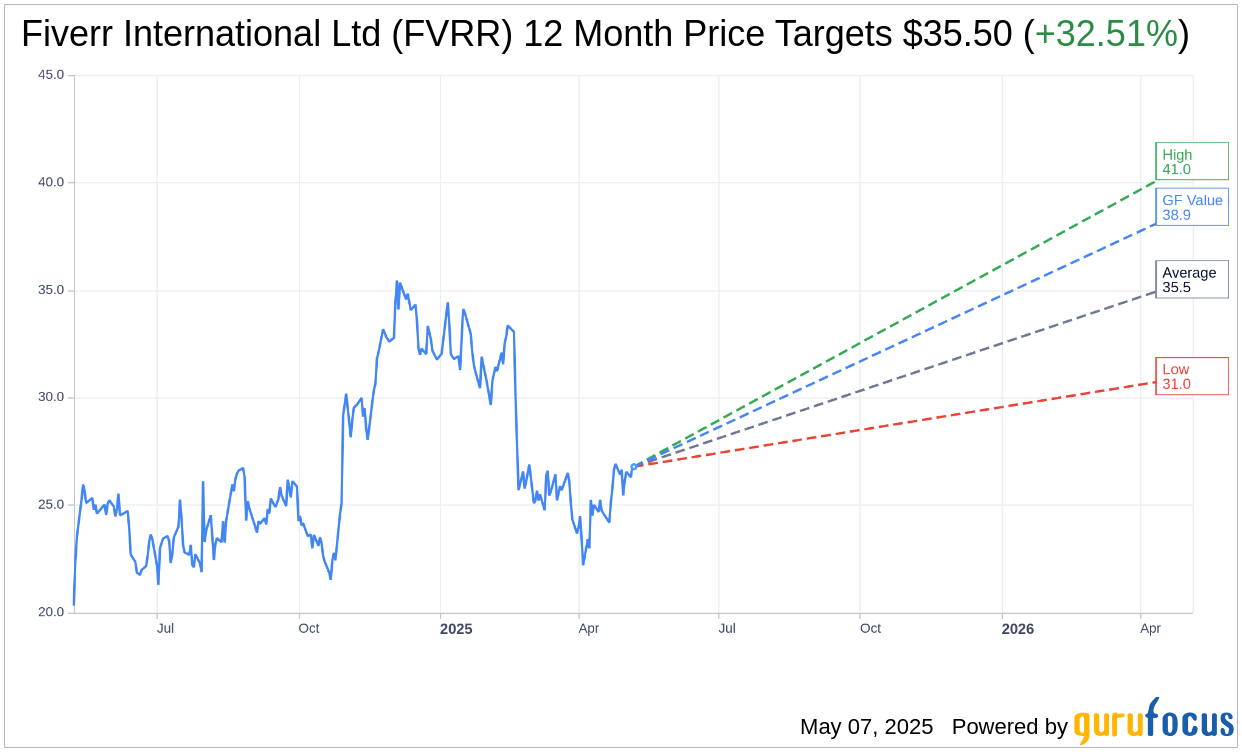

Wall Street analysts provide a positive outlook for Fiverr International Ltd. (FVRR, Financial), with one-year price targets based on insights from 8 analysts. The average target price stands at $35.50, with high and low estimates of $41.00 and $31.00, respectively. This average target price suggests a potential upside of 32.51% from the current market price of $26.79. For further details, visit the Fiverr International Ltd (FVRR) Forecast page.

Moreover, based on the consensus from 11 brokerage firms, Fiverr International Ltd.'s stock is rated as "Outperform" with an average brokerage recommendation of 2.3. This rating scale ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell.

GuruFocus has projected the estimated GF Value for Fiverr International Ltd (FVRR, Financial) at $38.88 in one year, which indicates an upside potential of 45.13% from its current trading price of $26.79. The GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance forecasts. For comprehensive insights, please refer to the Fiverr International Ltd (FVRR) Summary page.