- Veolia Environnement (VEOEY, Financial) reports stability in revenues despite challenging market conditions, with a notable rise in profitability metrics.

- Analysts provide a mixed outlook with varied price targets, suggesting potential steady growth for Veolia Environnement SA.

- Current brokerage recommendations position the stock as an "Outperform," highlighting its promising prospects.

Veolia Environnement (VEOEY) has released its financial results for the first quarter, revealing a slight revenue contraction of 0.4% year-over-year, bringing the total to €11.51 billion. Despite this minor decline, the company demonstrated resilience with a 5.5% uplift in EBITDA, reaching €1,695 million, and a significant 8.4% increase in current EBIT, totaling €915 million.

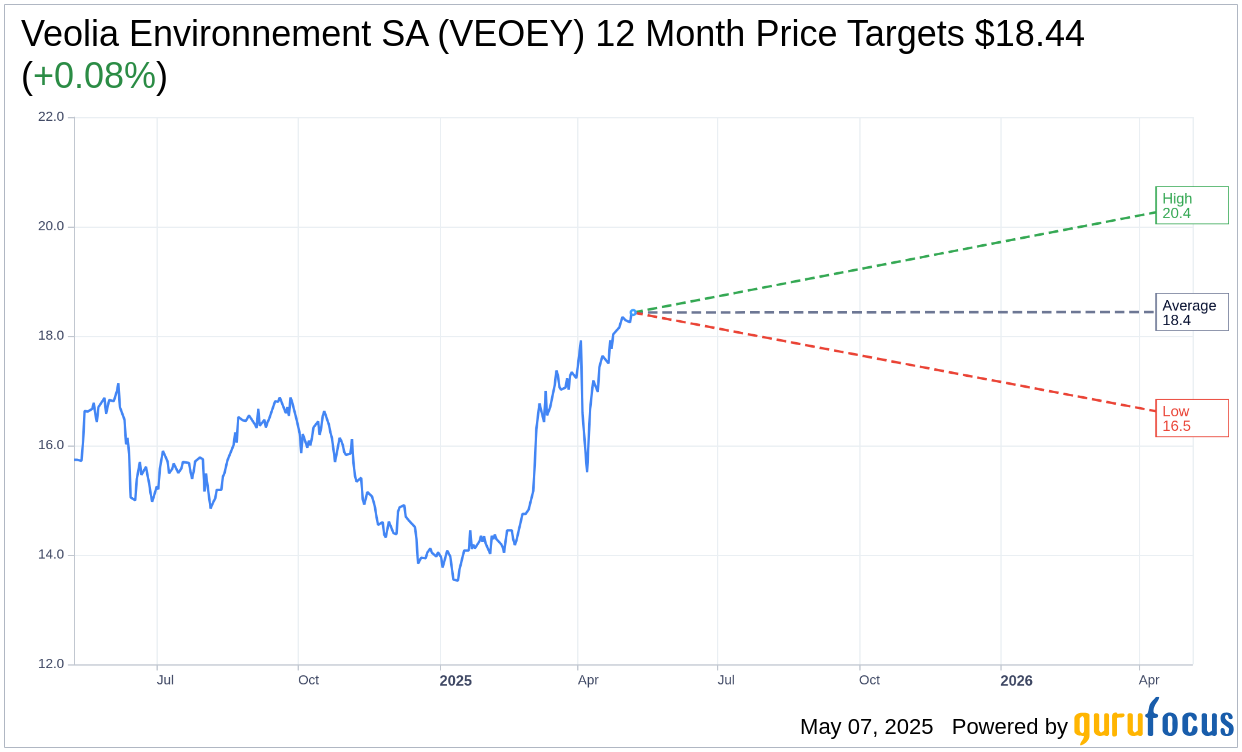

Wall Street Analysts Forecast

Veolia Environnement SA (VEOEY, Financial) has been under the scrutiny of analysts who have set one-year price targets that reflect cautious optimism. The average target price stands at $18.44, with projections ranging from a low of $16.50 to a high of $20.39. These estimates suggest a marginal upside of 0.08% from the current trading price of $18.43. For a more in-depth analysis, please visit the Veolia Environnement SA (VEOEY) Forecast page.

The brokerage community provides further insight into Veolia's market standing. With an average brokerage recommendation of 2.5, the consensus positions the stock as "Outperform." The recommendation scale is anchored at 1, indicating a Strong Buy, and extends to 5, representing a Sell. This rating underscores the potential for Veolia Environnement to deliver on its strategic objectives in the medium term.