Barclays has revised its price target for Devon Energy, changing it from $38 to $40, while maintaining an Equal Weight rating on the stock (DVN, Financial). This adjustment follows Devon Energy's impressive first-quarter results, which slightly surpassed expectations, as noted by an analyst. Additionally, the firm has increased its cash flow projections for the years 2025 and 2026, reflecting optimism in the company's financial prospects.

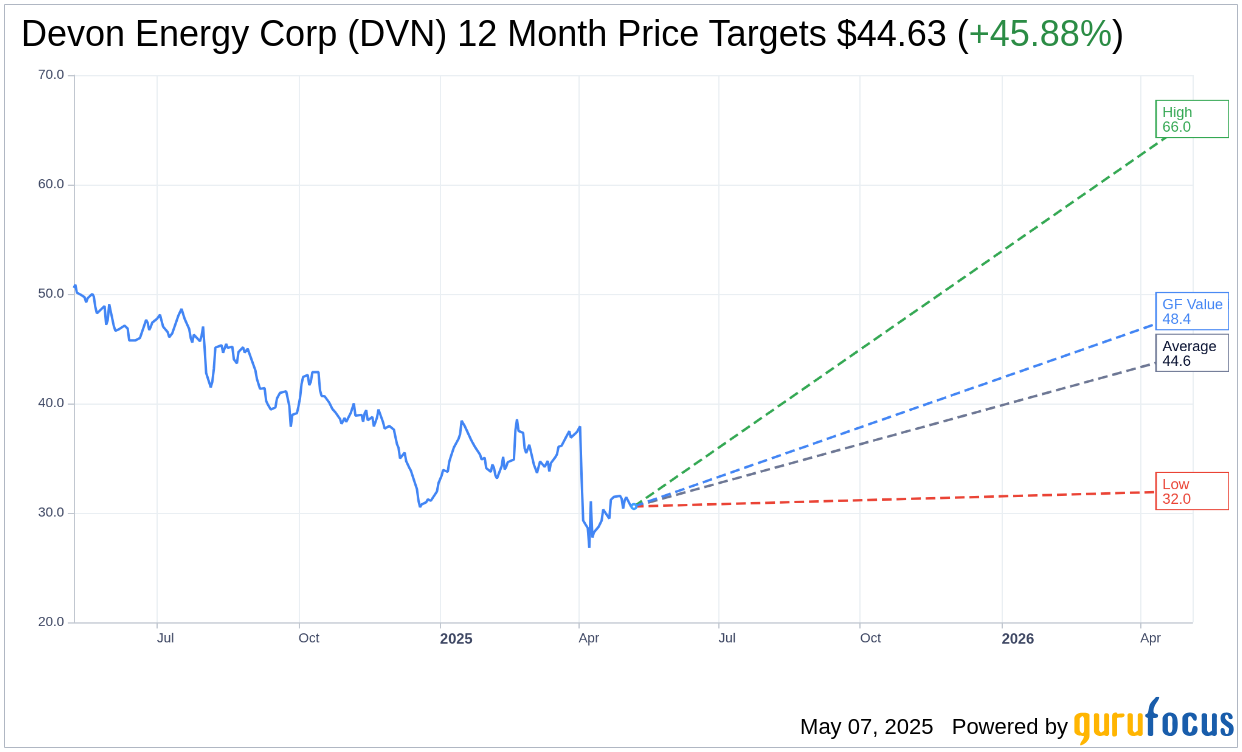

Wall Street Analysts Forecast

Based on the one-year price targets offered by 28 analysts, the average target price for Devon Energy Corp (DVN, Financial) is $44.66 with a high estimate of $66.00 and a low estimate of $32.00. The average target implies an upside of 46.00% from the current price of $30.59. More detailed estimate data can be found on the Devon Energy Corp (DVN) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Devon Energy Corp's (DVN, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Devon Energy Corp (DVN, Financial) in one year is $48.44, suggesting a upside of 58.35% from the current price of $30.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Devon Energy Corp (DVN) Summary page.

DVN Key Business Developments

Release Date: February 19, 2025

- Free Cash Flow: Generated $3 billion for the year, with $738 million in the fourth quarter.

- Shareholder Returns: Returned $2 billion for the year, including $444 million in the fourth quarter via dividends and share repurchases.

- Dividend Increase: Quarterly dividend increased to $0.24 per share, a 9% improvement over 2024.

- Oil Production: Reached an all-time high of 398,000 barrels per day in the fourth quarter.

- Cash Position: Increased to $850 million, up 25% from the previous quarter.

- Capital Investment: Expected to be $3.9 billion for 2025, $200 million lower than previous guidance.

- Production Outlook for 2025: Expected to deliver 815,000 BOE per day, including 383,000 barrels of oil per day.

- Natural Gas Production: More than 1.3 billion cubic feet per day, with revenue expected to more than double year-over-year.

- Net Debt-to-EBITDA Ratio Target: Aiming to drive below 1 times.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Devon Energy Corp (DVN, Financial) reported exceptionally strong results for the fourth quarter of 2024, with record oil production reaching 398,000 barrels per day.

- The company generated $3 billion of free cash flow, returning $2 billion to shareholders, and increased its quarterly dividend by 9% to $0.24 per share.

- The successful integration of the Grayson Mill assets and the Williston Basin acquisition contributed significantly to the company's performance.

- Devon Energy Corp (DVN) has maintained financial strength with ample liquidity and low leverage, positioning itself well for future growth.

- The company has identified $50 million in capital and expense savings from the Grayson Mill asset, exceeding its synergy target.

Negative Points

- Despite strong performance, there is caution against extrapolating the fourth quarter's production run rate as it may not be sustainable every quarter.

- The dissolution of the joint venture with BPX in the Eagle Ford may present operational challenges as Devon Energy Corp (DVN) takes full control.

- The company faces potential impacts from tariffs on materials used in wells, although currently estimated to be less than a 2% impact on the capital program.

- Devon Energy Corp (DVN) has a significant portion of its capital structure as debt, which could amplify equity volatility depending on commodity prices.

- The company has a limited inventory depth of 10 years at current production rates, raising concerns about long-term sustainability without further acquisitions or discoveries.