Citi has revised its price target for Cytokinetics (CYTK, Financial), reducing it from $86 to $80 while maintaining a Buy rating on the stock. This adjustment follows the company's discussion of a recent regulatory hurdle during its first-quarter earnings report. Specifically, the U.S. Food and Drug Administration (FDA) has postponed the action date for aficamten by three months. The company had attempted to gain approval for the drug without a stringent Risk Evaluation and Mitigation Strategy (REMS) program. Despite the setback, Citi analysts suggest that the delay is the sole downside and will not affect the drug's commercial potential. They anticipate that aficamten will ultimately face less stringent REMS requirements compared to its rival, Camzyos.

Wall Street Analysts Forecast

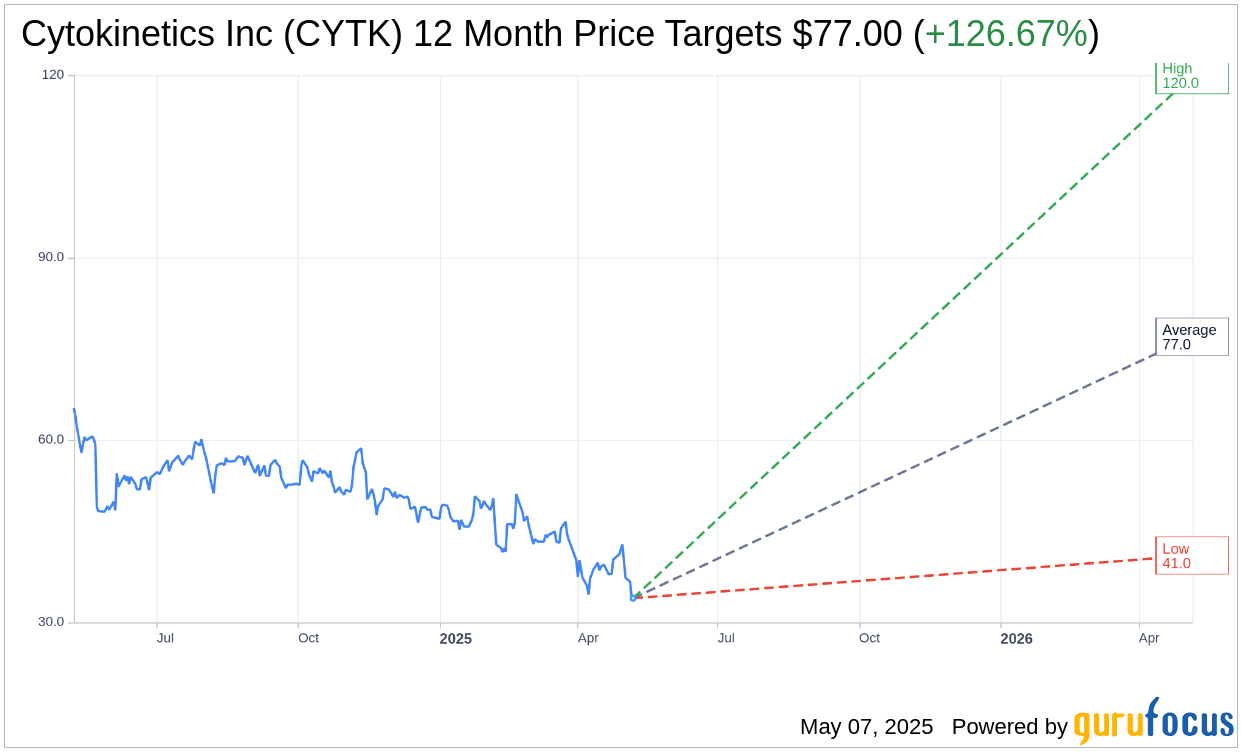

Based on the one-year price targets offered by 20 analysts, the average target price for Cytokinetics Inc (CYTK, Financial) is $77.00 with a high estimate of $120.00 and a low estimate of $41.00. The average target implies an upside of 126.67% from the current price of $33.97. More detailed estimate data can be found on the Cytokinetics Inc (CYTK) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Cytokinetics Inc's (CYTK, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cytokinetics Inc (CYTK, Financial) in one year is $242.02, suggesting a upside of 612.45% from the current price of $33.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cytokinetics Inc (CYTK) Summary page.

CYTK Key Business Developments

Release Date: May 06, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cytokinetics Inc (CYTK, Financial) reported a strong start to the year, laying a solid foundation for increased momentum towards potential commercialization.

- The company completed patient enrollment for the Acacia HCM trial months ahead of schedule, indicating strong interest and participation.

- Cytokinetics Inc (CYTK) has a robust cash position with approximately $1.1 billion in cash equivalents and investments, providing financial stability.

- The company is advancing regulatory activities outside the US, with potential approval by the EMA expected in the first half of 2026.

- Cytokinetics Inc (CYTK) is making significant progress in commercial readiness activities, including Salesforce recruiting and launch planning.

Negative Points

- The FDA extended the PDUFA date for the NDA for Aficaton, delaying potential approval to December 26, 2025.

- The submission of a REMS for Aficaton was required by the FDA, constituting a major amendment and causing a three-month extension.

- R&D expenses increased significantly, from $81.6 million in Q1 2024 to $99.8 million in Q1 2025, impacting financial results.

- The company reported a net loss of $161.4 million for Q1 2025, compared to a net loss of $135.6 million for the same period in 2024.

- There is uncertainty and investor concern regarding the REMS submission process and its impact on the approval timeline.