The ODP Corp (ODP, Financial) released its 8-K filing on May 7, 2025, announcing its financial results for the first quarter ended March 29, 2025. The company reported a revenue of $1.7 billion, slightly above the analyst estimate of $1.667 billion. However, the adjusted earnings per share (EPS) of $1.06 exceeded the estimated EPS of $0.65, showcasing a stronger-than-expected bottom line performance.

Company Overview

The ODP Corp operates an integrated B2B distribution platform with several divisions. The ODP Business Solutions division serves companies of all sizes with office supplies, technology, furniture, and services. The Office Depot Division caters to retail consumers and small businesses through retail locations and eCommerce platforms. The Veyer Division specializes in supply chain, distribution, and procurement services, while the Varis Division offers a tech-enabled B2B indirect procurement marketplace. The Veyer division is a significant revenue contributor.

Performance and Challenges

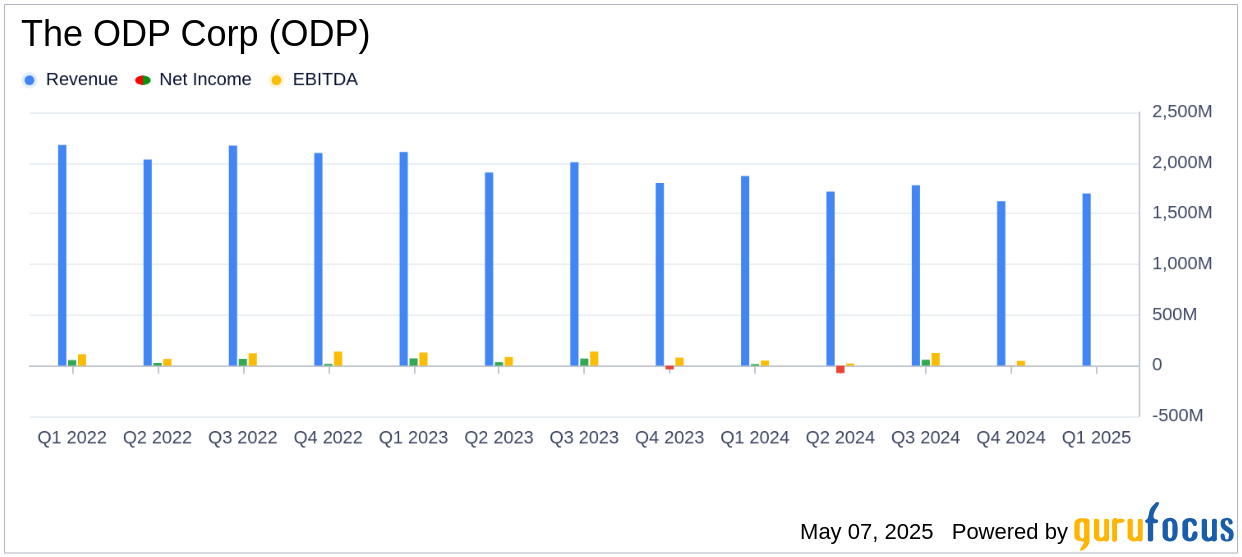

The ODP Corp faced a 9% decline in total sales compared to the previous year, primarily due to reduced sales in its Office Depot Division and ODP Business Solutions Division. The decrease was attributed to fewer retail locations, lower consumer traffic, and challenging macroeconomic conditions. Despite these challenges, the company managed to achieve an adjusted EBITDA of $76 million, although this was a decrease from $91 million in the prior year.

Financial Achievements

Despite reporting a GAAP operating loss of $32 million and a net loss of $29 million, The ODP Corp achieved significant financial milestones. The adjusted net income from continuing operations was $32 million, and the adjusted free cash flow increased to $45 million from $17 million in the previous year. These achievements highlight the company's operational discipline and focus on cash flow management, which are crucial in the Retail - Cyclical industry.

Key Financial Metrics

Important metrics from the financial statements include:

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Sales | $1,699 million | $1,869 million |

| Operating Income (Loss) | $(32) million | $41 million |

| Net Income (Loss) | $(29) million | $31 million |

| Adjusted EBITDA | $76 million | $91 million |

| Operating Cash Flow | $57 million | $44 million |

These metrics are vital for assessing the company's financial health and operational efficiency, especially in a competitive market.

Strategic Initiatives and Future Outlook

The ODP Corp is making strides in its B2B distribution business, securing significant new contracts and partnerships, particularly in the hospitality industry. The company is also progressing with its "Optimize for Growth" restructuring plan, aiming to enhance its B2B market presence while reducing retail exposure. This strategic focus is expected to drive future growth and profitability.

“We are off to a better start to the year, with our overall performance reflecting positive momentum and improving trends in the first quarter,” said Gerry Smith, Chief Executive Officer of The ODP Corporation.

Overall, while The ODP Corp faces challenges in the retail sector, its strategic initiatives and focus on B2B growth present a compelling value proposition for investors. The company's ability to adapt and capitalize on new opportunities will be crucial for its sustained success in the evolving market landscape.

Explore the complete 8-K earnings release (here) from The ODP Corp for further details.