MarketAxess (MKTX, Financial) reported its first-quarter revenue at $208.6 million, slightly below the expected $209.98 million. Despite this, the company experienced a notable increase in daily volumes across most product categories, achieving record levels in portfolio and block trading for both emerging markets and eurobonds.

The CEO of MarketAxess expressed optimism regarding the platform's performance amid the current credit market volatility. Open Trading activity also reached unprecedented levels during the first quarter, reflecting a robust increase in trading velocity. The company is optimistic that the recent enhancements to their trading solutions will enable them to capture more market share in the U.S. credit sector in the upcoming quarters.

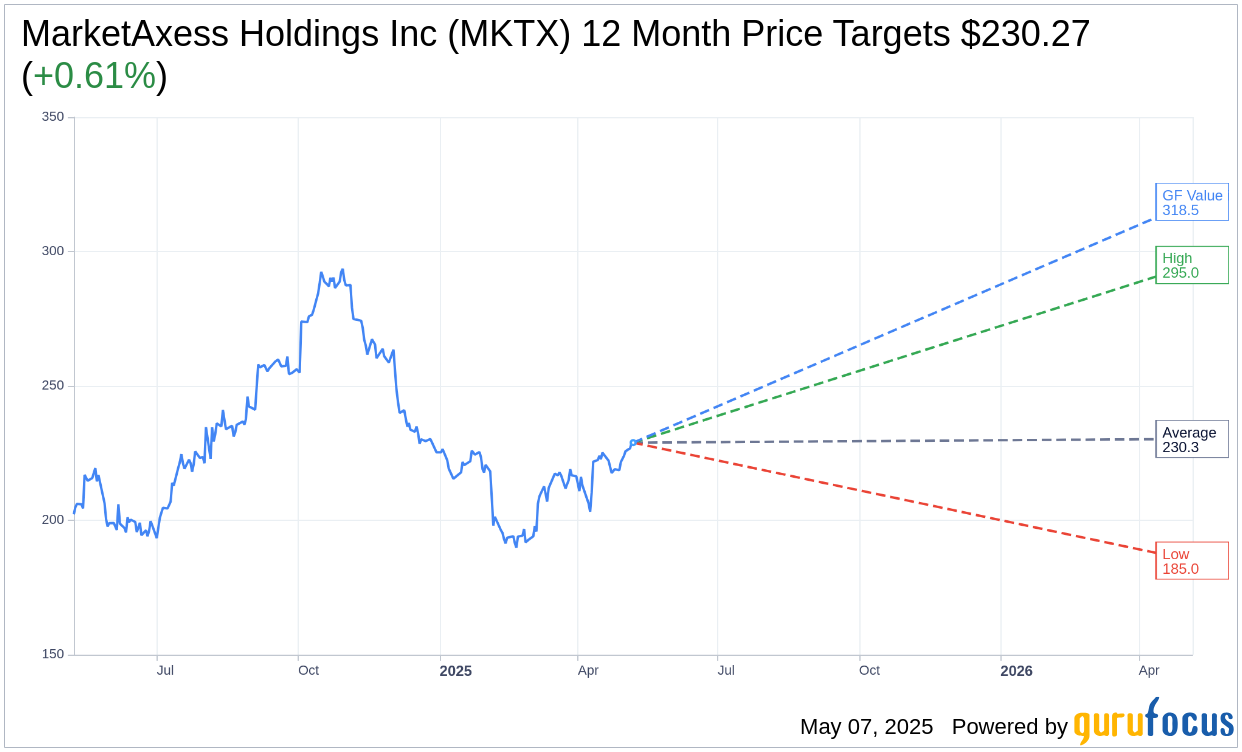

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for MarketAxess Holdings Inc (MKTX, Financial) is $230.27 with a high estimate of $295.00 and a low estimate of $185.00. The average target implies an upside of 0.61% from the current price of $228.88. More detailed estimate data can be found on the MarketAxess Holdings Inc (MKTX) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, MarketAxess Holdings Inc's (MKTX, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MarketAxess Holdings Inc (MKTX, Financial) in one year is $318.50, suggesting a upside of 39.16% from the current price of $228.88. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MarketAxess Holdings Inc (MKTX) Summary page.