In the second quarter, Emerson (EMR, Financial) reported revenue of $4.38 billion, aligning with market forecasts. The company witnessed robust underlying orders, contributing to margin expansion and adjusted earnings that surpassed expectations. Emerson's President and CEO, Lal Karsanbhai, highlighted record performances in gross profit and adjusted segment EBITA margins, emphasizing the contributions of the Emerson Management System. The successful first half of the year and adept handling of the tariff environment have led the company to revise its outlook for 2025 with increased confidence.

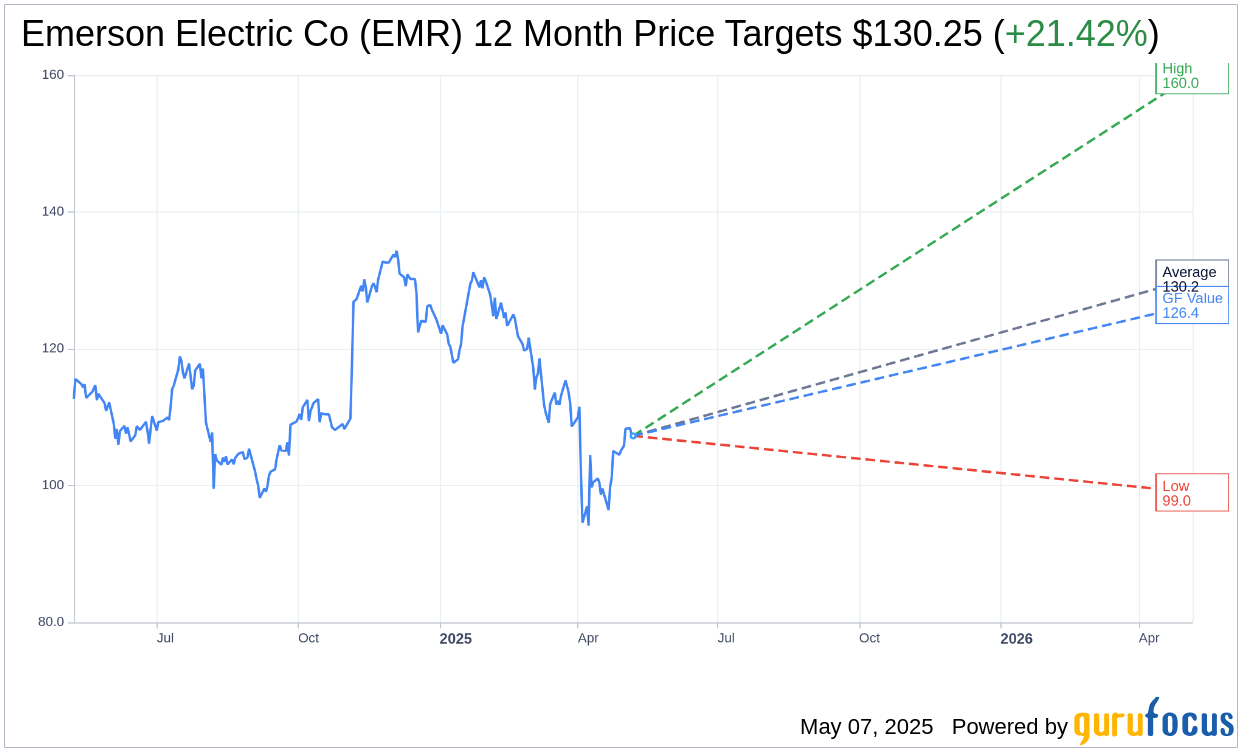

Wall Street Analysts Forecast

Based on the one-year price targets offered by 26 analysts, the average target price for Emerson Electric Co (EMR, Financial) is $130.25 with a high estimate of $160.00 and a low estimate of $99.00. The average target implies an upside of 21.42% from the current price of $107.27. More detailed estimate data can be found on the Emerson Electric Co (EMR) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Emerson Electric Co's (EMR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Emerson Electric Co (EMR, Financial) in one year is $126.40, suggesting a upside of 17.83% from the current price of $107.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Emerson Electric Co (EMR) Summary page.