On May 7, 2025, Chardan Capital, led by analyst Rudy Li, initiated coverage on Praxis Precision Medicine (PRAX, Financial), recommending a "Buy" rating. This marks a significant move for the company, as it garners attention from the investment community.

Praxis Precision Medicine (PRAX, Financial), focused on advancing precision medicine, has been assigned a price target of USD 80.00 by Chardan Capital. This new price target indicates a positive outlook for the company's future performance in the stock market.

The announcement from Chardan Capital did not include any prior price target or rating changes for PRAX, as this is an initiation of coverage. The current price target stands at USD 80.00, with no percent change in the price target since there is no prior data available for comparison.

Investors and stakeholders in Praxis Precision Medicine (PRAX, Financial) will be closely monitoring the stock following this coverage initiation by Chardan Capital. The "Buy" rating and the USD 80.00 price target suggest potential opportunities for growth and value creation for the company.

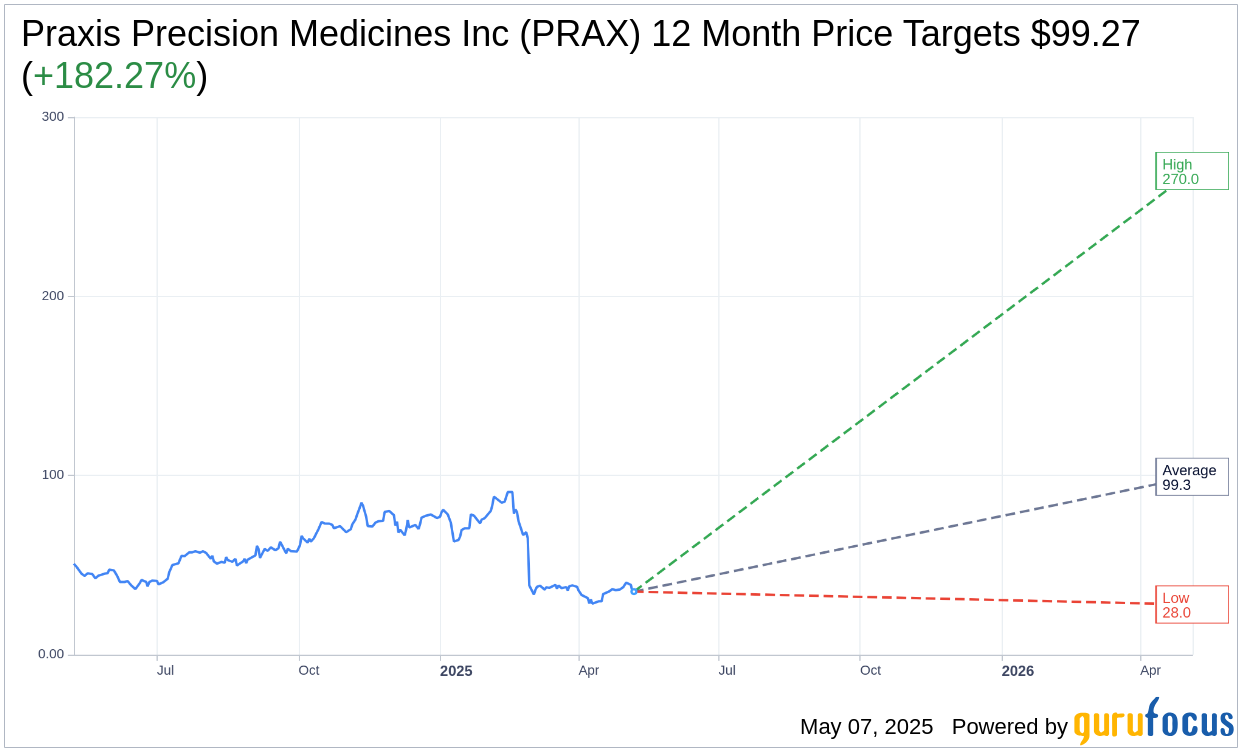

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Praxis Precision Medicines Inc (PRAX, Financial) is $99.27 with a high estimate of $270.00 and a low estimate of $28.00. The average target implies an upside of 182.27% from the current price of $35.17. More detailed estimate data can be found on the Praxis Precision Medicines Inc (PRAX) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Praxis Precision Medicines Inc's (PRAX, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.