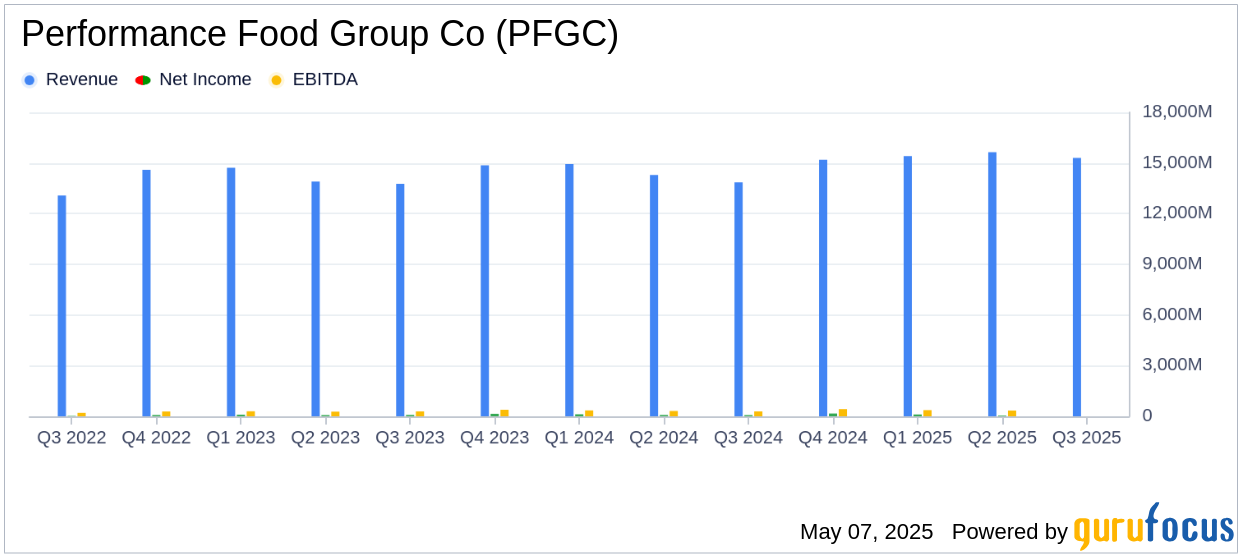

On May 7, 2025, Performance Food Group Co (PFGC, Financial) released its 8-K filing detailing its third-quarter and first-nine months fiscal 2025 results. The company, a leading distributor of food and food-related products, reported a 10.5% increase in net sales to $15.3 billion, driven by acquisitions and increased case volumes. However, net income fell 17.2% to $58.3 million, and diluted EPS decreased 17.8% to $0.37, missing the analyst estimate of $0.65 per share.

Company Overview

Performance Food Group Co (PFGC, Financial) markets and distributes national and company-branded food and food-related products. The company serves a wide range of customers, including vending distributors, box retailers, theaters, convenience stores, drug stores, grocery stores, travel providers, and hospitality providers. PFGC operates through three segments: Foodservice, Specialty (formerly Vistar), and Convenience.

Performance and Challenges

Despite strong sales momentum, PFGC faced challenges that impacted its profitability. The company's net income decreased due to higher operating expenses, primarily driven by recent acquisitions and increased personnel costs. The decline in net income and EPS highlights the pressure on margins in the Retail - Defensive industry, where cost management is crucial.

Financial Achievements

PFGC's financial achievements include a 16.2% increase in gross profit to $1.8 billion and a 20.1% rise in Adjusted EBITDA to $385.1 million. These metrics are vital for the company as they reflect operational efficiency and the ability to generate cash flow, which is essential for sustaining growth and managing debt.

Income Statement Highlights

| Metric | Q3 Fiscal 2025 | Q3 Fiscal 2024 |

|---|---|---|

| Net Sales | $15.3 billion | $13.9 billion |

| Gross Profit | $1.8 billion | $1.6 billion |

| Net Income | $58.3 million | $70.4 million |

| Diluted EPS | $0.37 | $0.45 |

Balance Sheet and Cash Flow

PFGC's balance sheet shows total assets of $17.1 billion, with significant increases in goodwill and intangible assets due to acquisitions. The company's cash flow from operating activities was $827.1 million, a decrease from the previous year, primarily due to changes in inventory purchasing strategies.

Segment Performance

The Foodservice segment reported a 19.2% increase in net sales to $8.4 billion, driven by acquisitions and case volume growth. The Specialty segment saw a slight decline in sales, while the Convenience segment experienced a 1.8% increase in net sales. Adjusted EBITDA for all segments improved, reflecting operational efficiencies.

Our organization rose to the challenges in the quarter and is on strong footing for the remainder of the year," said George Holm, PFG’s Chairman & Chief Executive Officer.

Analysis and Outlook

PFGC's strong sales growth is a positive indicator of market demand and effective acquisition strategies. However, the decline in net income and EPS underscores the importance of managing operational costs and integrating acquisitions efficiently. The company's updated full-year guidance reflects cautious optimism, with expectations for net sales between $63 billion and $63.5 billion.

Explore the complete 8-K earnings release (here) from Performance Food Group Co for further details.