Charles River Laboratories (CRL, Financial) has adjusted its full-year revenue growth projections to fall between 3.5% and 5.5%, revising the earlier range of 4.5% to 7%. This positive adjustment is largely attributed to enhanced net bookings in the Discovery and Safety Assessment (DSA) segment observed in the first quarter. The company anticipates that these improvements will contribute additional DSA revenue throughout the year, with a significant impact expected in the first half. The consensus revenue forecast for the year stands at $9.31.

Wall Street Analysts Forecast

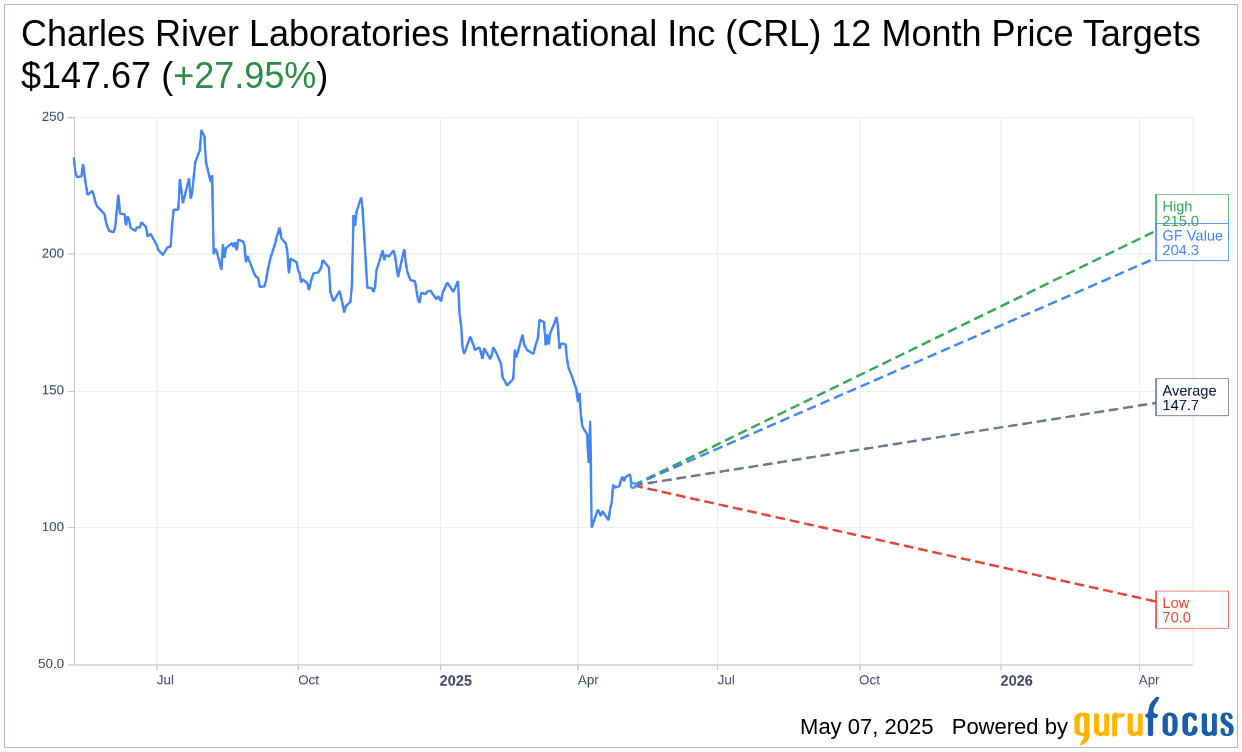

Based on the one-year price targets offered by 15 analysts, the average target price for Charles River Laboratories International Inc (CRL, Financial) is $147.67 with a high estimate of $215.00 and a low estimate of $70.00. The average target implies an upside of 27.95% from the current price of $115.41. More detailed estimate data can be found on the Charles River Laboratories International Inc (CRL) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Charles River Laboratories International Inc's (CRL, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Charles River Laboratories International Inc (CRL, Financial) in one year is $204.35, suggesting a upside of 77.06% from the current price of $115.41. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Charles River Laboratories International Inc (CRL) Summary page.

CRL Key Business Developments

Release Date: February 19, 2025

- Fourth Quarter Revenue: $1 billion, a 1.8% decline on an organic basis.

- Full-Year Revenue: $4.05 billion, a 2.8% organic decrease.

- Fourth Quarter Operating Margin: Increased by 80 basis points to 19.9%.

- Full-Year Operating Margin: Declined by 40 basis points to 19.9%.

- Fourth Quarter Earnings Per Share (EPS): $2.66, an increase of 8.1% from the previous year.

- Full-Year EPS: $10.32, a decline of 3.3%.

- DSA Fourth Quarter Revenue: $603.3 million, a 3.5% organic decrease.

- DSA Full-Year Revenue: Decreased 6.2% on an organic basis.

- RMS Fourth Quarter Revenue: $204.3 million, a 0.4% organic decrease.

- RMS Full-Year Revenue: Essentially flat with a 0.1% organic decline.

- Manufacturing Solutions Fourth Quarter Revenue: $194.9 million, a 2.1% organic growth.

- Manufacturing Solutions Full-Year Organic Growth: 6.8%.

- Free Cash Flow: $501.6 million in 2024.

- 2025 Revenue Guidance: Expected decline of 4.5% to 7% on a reported basis, 3.5% to 5.5% on an organic basis.

- 2025 EPS Guidance: $9.10 to $9.60.

- 2025 Free Cash Flow Guidance: $350 to $390 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Charles River Laboratories International Inc (CRL, Financial) ended the year with a fourth-quarter performance that was slightly better than expected, with annual revenue and non-GAAP earnings per share exceeding guidance.

- The company has implemented restructuring initiatives expected to yield annualized savings of approximately $225 million by 2026, with over $175 million realized in 2025.

- Operating margin increased by 80 basis points year over year to 19.9% in the fourth quarter, driven by lower unallocated corporate costs and margin expansion in the Manufacturing segment.

- The Microbial Solutions business reported a strong year-end performance with solid growth across all three testing platforms.

- Charles River Laboratories International Inc (CRL) plans to repurchase approximately $350 million in stock over the next month or two, exceeding their initial goal of $100 million last year to offset annual dilution from equity awards.

Negative Points

- Charles River Laboratories International Inc (CRL) expects a revenue decline of 3.5% to 5.5% on an organic basis in 2025, with a reported revenue decline of 4.5% to 7% including a foreign exchange headwind.

- The company anticipates a modestly lower consolidated operating margin in 2025 due to the inability to fully offset the revenue decline, particularly in the DSA segment.

- DSA revenue is expected to decline at a mid- to high-single-digit rate on an organic basis in 2025, with both lower pricing and steady volume impacting the decline.

- The Manufacturing Solutions segment is expected to have essentially flat revenue in 2025 on an organic basis, with lower revenue from two commercial CDMO clients reducing consolidated revenue by approximately 1%.

- Free cash flow is expected to decrease to a range of $350 to $390 million in 2025, down from $501.6 million in 2024, driven by lower earnings and higher working capital needs.