Highlights:

- Instacart's new app, Fizz, enhances competition in the delivery service sector.

- Analyst predictions suggest a promising upside potential of approximately 12.88% for Maplebear Inc. (CART, Financial).

- Current brokerage recommendations highlight an "Outperform" status for CART, reflecting strong market confidence.

Instacart (CART) has recently launched Fizz, an innovative app specifically designed to cater to party planners. This application offers a seamless delivery of drinks and snacks, introducing features such as a flat rate delivery option and convenient payment splitting. The new app is set to heighten competition with major players like DoorDash and Uber Eats, as it aims to capture a larger market share in the delivery sector. In response to this strategic move, CART shares observed a modest rise of 0.6% in premarket trading.

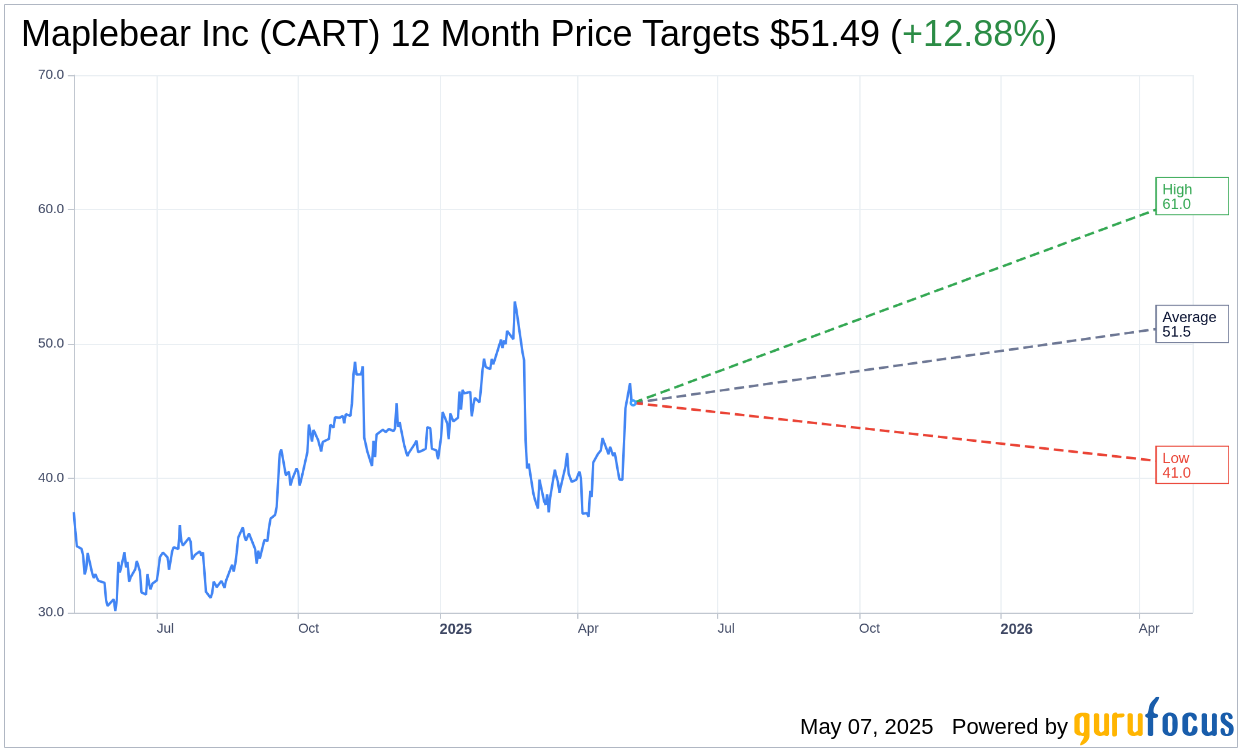

Wall Street Analysts Forecast

Analyst projections over the next year paint a promising picture for Maplebear Inc (CART, Financial). With insights from 27 analysts, the average target price is set at $51.49, with forecasts ranging from a high of $61.00 to a low of $41.00. This average target suggests a potential upside of 12.88% from the current trading price of $45.61. Investors seeking more granular data and analyses can explore further on the Maplebear Inc (CART) Forecast page.

Expert opinions from 34 brokerage firms have culminated in an average recommendation rating of 2.2 for Maplebear Inc (CART, Financial), signifying an "Outperform" status. This evaluation is based on a standard rating scale from 1 to 5, where 1 denotes a "Strong Buy" and 5 signifies "Sell". Such a rating underscores a generally positive outlook, hinting at CART's potential to exceed market expectations.