Vigil (VIGL, Financial) is making substantial headway in its TREM2 programs, particularly with its leading candidates, VG-3927 and iluzanebart. The biotech company shared positive Phase 1 results for VG-3927 this January, which support the commencement of a Phase 2 trial targeting Alzheimer's disease patients by the third quarter. These promising findings were also showcased at the AD/PD scientific conference, underlining VG-3927's potential as a next-generation treatment for Alzheimer's.

In parallel, Vigil is progressing with iluzanebart, which is currently in the late stages of a Phase 2 trial for adult-onset leukoencephalopathy with axonal spheroids and pigmented glia (ALSP). The full data for this stage is expected by the second quarter. With these developments, Vigil remains on track to achieve crucial clinical milestones in 2025, reinforcing its commitment to providing innovative therapies for patients and their families.

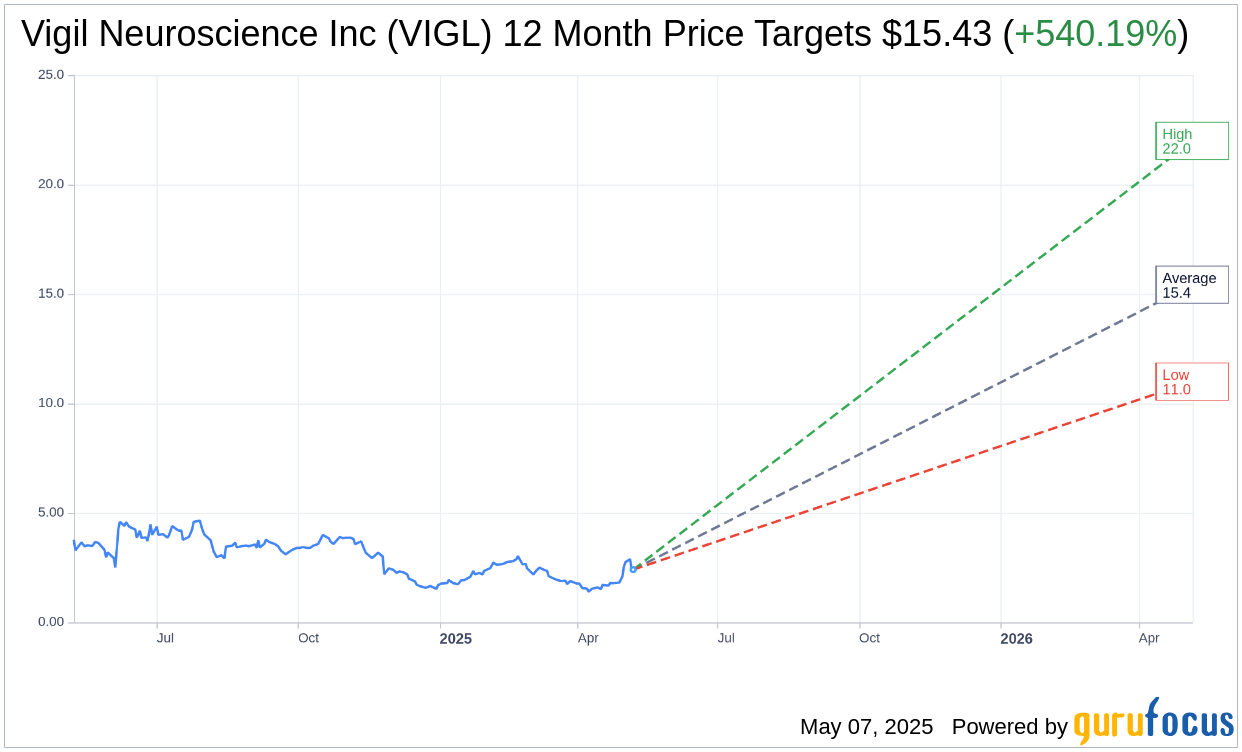

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Vigil Neuroscience Inc (VIGL, Financial) is $15.43 with a high estimate of $22.00 and a low estimate of $11.00. The average target implies an upside of 540.19% from the current price of $2.41. More detailed estimate data can be found on the Vigil Neuroscience Inc (VIGL) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Vigil Neuroscience Inc's (VIGL, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.