The New York Times Company (NYT, Financial) achieved a first-quarter revenue of $635 million, aligning with market expectations. The period saw the addition of 250,000 net new digital-only subscribers, raising its total subscriber base to 11.66 million. This growth contributed to an average revenue per user (ARPU) for digital-only services increasing by 3.6% from the previous year, reaching $9.54. This rise was fueled by subscribers moving from promotional rates to standard pricing and adjustments in pricing for longstanding non-bundled subscribers.

The company reported a significant 14.4% year-over-year climb in digital subscription revenues. Additionally, digital advertising revenues saw a boost of 12.4%, driven by high demand from advertisers and the introduction of new advertising opportunities.

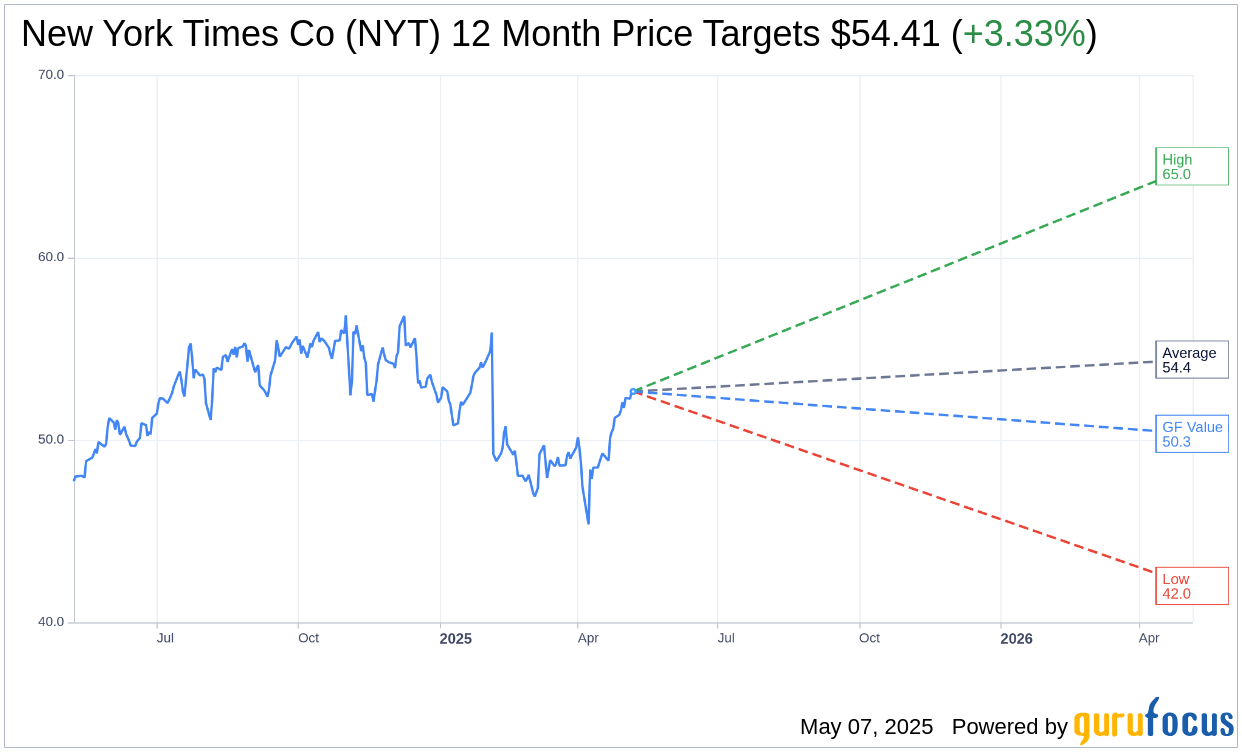

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for New York Times Co (NYT, Financial) is $54.41 with a high estimate of $65.00 and a low estimate of $42.00. The average target implies an upside of 3.33% from the current price of $52.66. More detailed estimate data can be found on the New York Times Co (NYT) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, New York Times Co's (NYT, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for New York Times Co (NYT, Financial) in one year is $50.34, suggesting a downside of 4.41% from the current price of $52.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the New York Times Co (NYT) Summary page.