- Diebold Nixdorf exceeds EPS expectations but falls short on revenue.

- Analyst price targets suggest significant upside potential.

- Brokerage firms rate the stock as "Outperform."

Diebold Nixdorf (DBD, Financial) reported a successful first quarter in terms of earnings per share (EPS). The company achieved a Non-GAAP EPS of $0.37, which surpassed analyst forecasts by $0.01. Despite this positive EPS performance, the company's revenue painted a different picture. Diebold Nixdorf generated $841.1 million in revenue, which marks a 6.2% decrease compared to the same quarter last year, falling short of expectations by $3 million.

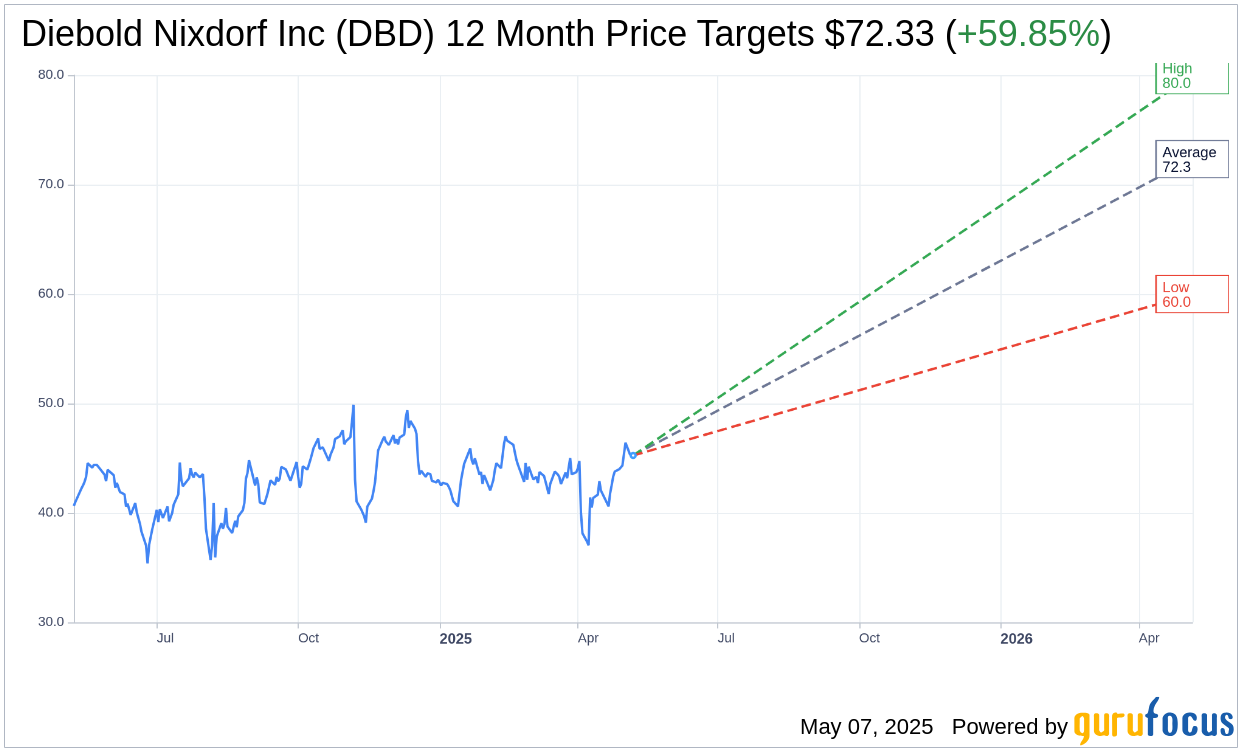

Wall Street Analysts Forecast

In evaluating Diebold Nixdorf's potential, Wall Street analysts have set one-year price targets for the stock. With estimates from three analysts, the average target price has been established at $72.33. This estimate includes a high target of $80.00 and a low target of $60.00. Should the stock reach this average target, it would represent an impressive upside of 59.85% from its current trading price of $45.25. For more in-depth analysis and detailed estimate data, investors can visit the Diebold Nixdorf Inc (DBD, Financial) Forecast page.

The consensus among three brokerage firms positions Diebold Nixdorf with an average recommendation of 1.7. This score suggests an "Outperform" status, aligning closely with a "Strong Buy" recommendation. The scale for this rating ranges from 1, indicating a Strong Buy, to 5, denoting a Sell.