On May 7, 2025, Unity Software Inc (U, Financial) released its 8-K filing for the first quarter of 2025, showcasing a notable performance that surpassed analyst expectations in terms of revenue and Adjusted EBITDA. Unity Software Inc, a leading provider of a software platform for creating and operating interactive, real-time 3D content, reported a revenue of $435 million, exceeding the estimated $416.92 million. The company, which serves various industries including gaming, retail, and automotive, continues to demonstrate its robust capabilities in supporting developers across the full lifecycle of game development.

Performance and Challenges

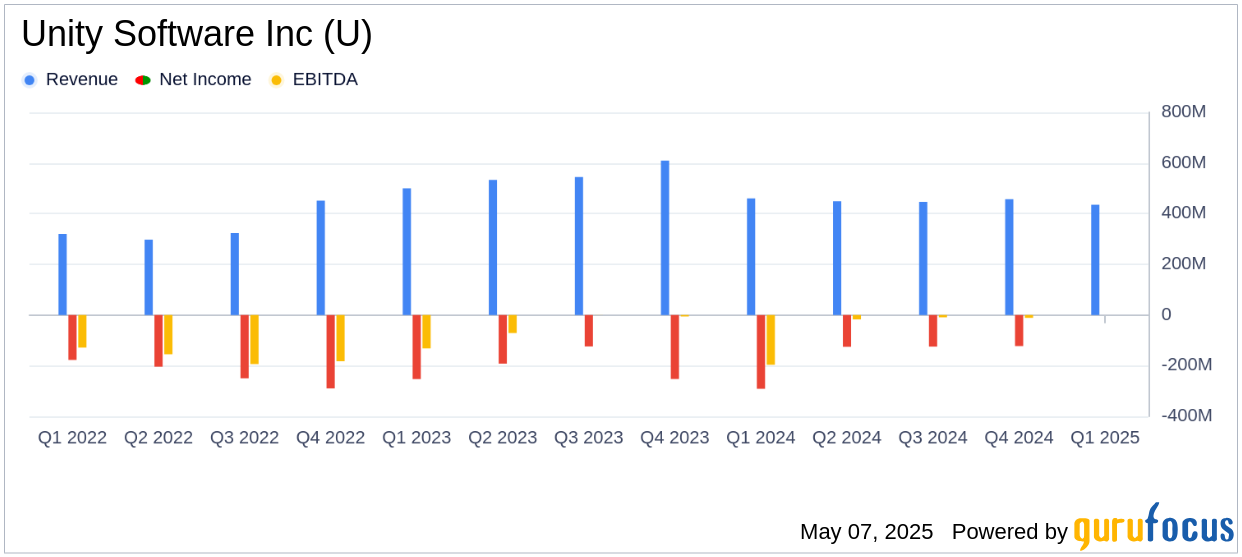

Unity Software Inc (U, Financial) reported a revenue of $435 million for the first quarter of 2025, which, although down 6% year-over-year from $460 million in the same period of 2024, exceeded the analyst estimate of $416.92 million. This decline was attributed to a portfolio reset that impacted the Create Solutions and Grow Solutions segments. Create Solutions revenue fell by 8% to $150 million, while Grow Solutions revenue decreased by 4% to $285 million. Despite these challenges, the company's strategic initiatives, such as the rollout of Unity Vector, have shown early success and contributed positively to the financial results.

Financial Achievements

Unity Software Inc (U, Financial) achieved an Adjusted EBITDA of $84 million, with a margin of 19%, surpassing the previous year's $79 million and a margin of 17%. This improvement highlights the company's effective cost control measures and higher-than-expected revenue. The Adjusted EPS was reported at $0.24, which is a significant achievement compared to the estimated EPS of -0.35. These financial achievements underscore Unity's ability to maintain operational efficiency and profitability in a competitive software industry.

Key Financial Metrics

Unity Software Inc (U, Financial) reported a GAAP net loss of $78 million, with a margin of (18)%, a substantial improvement from the $291 million net loss in the first quarter of 2024. The basic and diluted net loss per share was $0.19, compared to $0.75 in the previous year. The company's net cash provided by operating activities was $13 million, a positive shift from the $7 million used in the same period last year. Free cash flow also improved to $7 million from a negative $15 million in the first quarter of 2024.

Balance Sheet Overview

As of March 31, 2025, Unity Software Inc (U, Financial) reported total assets of $6.65 billion, with cash and cash equivalents amounting to $1.54 billion. The company's total liabilities stood at $3.22 billion, reflecting a decrease from $3.31 billion at the end of 2024. The stockholders' equity was reported at $3.19 billion, indicating a stable financial position.

Analysis and Outlook

Unity Software Inc (U, Financial) has demonstrated resilience in the face of revenue challenges, with its strategic initiatives and cost management contributing to a stronger financial performance. The company's focus on enhancing its platform and expanding its product offerings, such as Unity Vector, positions it well for future growth. However, the ongoing portfolio reset and market competition remain challenges that Unity must navigate to sustain its momentum.

Unity's guidance for the second quarter of 2025 includes expected revenue between $415 million and $425 million, with Adjusted EBITDA projected to be between $70 million and $75 million. These projections reflect the company's cautious optimism and commitment to maintaining its leadership in the software industry.

Explore the complete 8-K earnings release (here) from Unity Software Inc for further details.