InflaRx (IFRX, Financial) is eagerly anticipating several important developments in its drug pipeline. The company is preparing for an interim analysis of the Phase 3 trial for vilobelimab, a treatment targeting pyoderma gangrenosum. Additionally, InflaRx expects to reveal topline Phase 2a data for its therapeutic candidate, INF904. These upcoming milestones have the potential to reduce risks associated with the company's projects significantly. Successfully achieving these goals could enhance the value of InflaRx's offerings, pushing the company closer to providing new treatment options for individuals dealing with chronic inflammatory diseases.

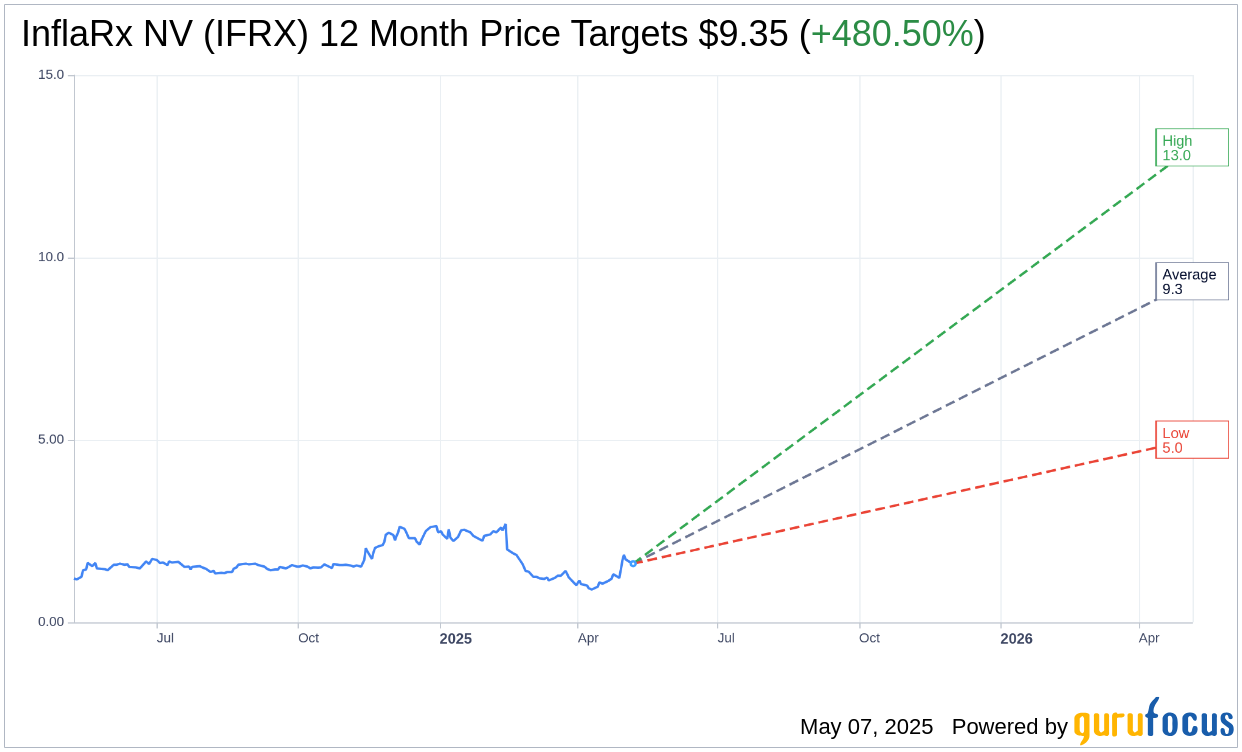

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for InflaRx NV (IFRX, Financial) is $9.35 with a high estimate of $13.02 and a low estimate of $5.01. The average target implies an upside of 480.50% from the current price of $1.61. More detailed estimate data can be found on the InflaRx NV (IFRX) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, InflaRx NV's (IFRX, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.