In the first quarter of 2025, Palmer Square Capital BDC (PSBD, Financial) reported a net asset value (NAV) per share of $15.85, showcasing the effectiveness of its investment strategy. The company focuses on a mix of liquid credit opportunities and senior-secured private credit investments. Despite ongoing macroeconomic uncertainties, PSBD remains resilient, having been established during the aftermath of the Great Financial Crisis. Since then, Palmer Square Capital Management has expanded its operations to manage over $34 billion in assets.

PSBD emphasizes shareholder alignment through a unique fee structure and maintains transparency with monthly NAV and quarterly portfolio disclosures. Current market conditions, offering a discount to NAV, are perceived as a value opportunity by the company. The investment team at PSBD is actively identifying opportunities that aim to uphold the credit quality while delivering strong yields, thereby promising long-term value for shareholders.

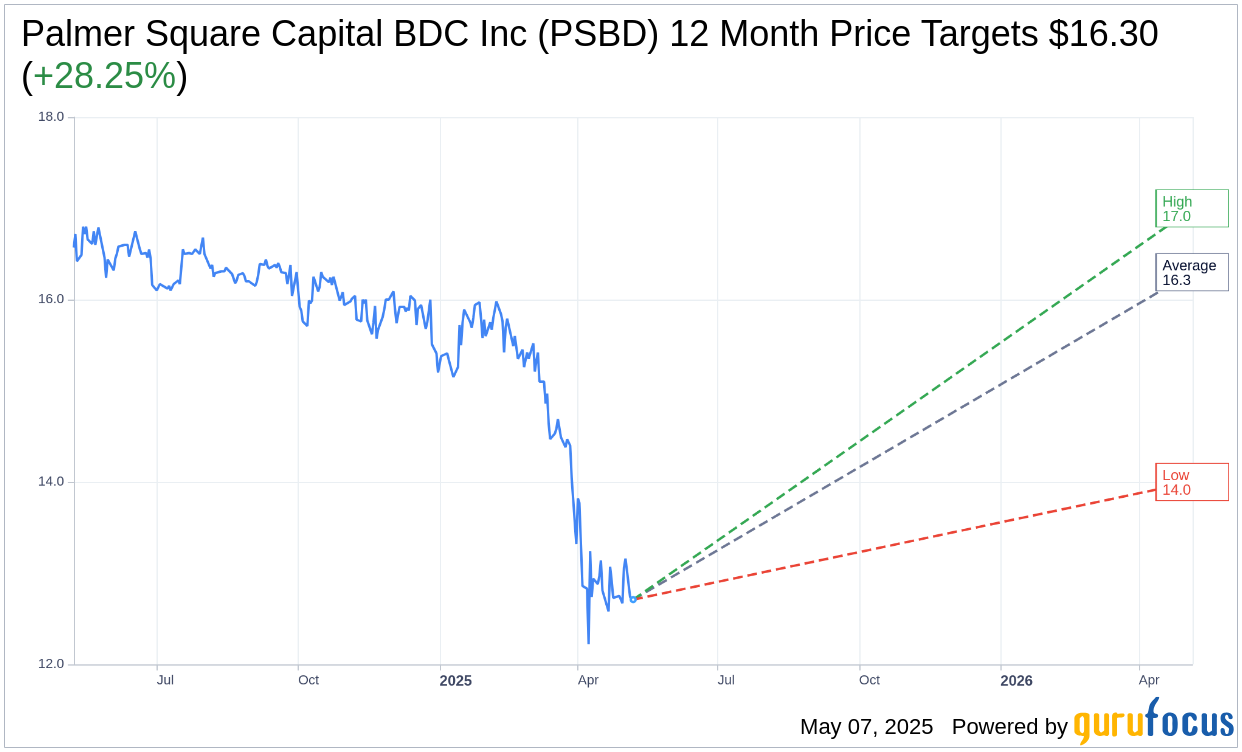

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Palmer Square Capital BDC Inc (PSBD, Financial) is $16.30 with a high estimate of $17.00 and a low estimate of $14.00. The average target implies an upside of 28.25% from the current price of $12.71. More detailed estimate data can be found on the Palmer Square Capital BDC Inc (PSBD) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Palmer Square Capital BDC Inc's (PSBD, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

PSBD Key Business Developments

Release Date: February 27, 2025

- Total Investment Income: $34.9 million for Q4 2024, up 16.9% from $29.8 million in the prior year period.

- Net Investment Income: $14.8 million or $0.45 per share for Q4 2024.

- Net Realized and Unrealized Losses: $2.9 million for Q4 2024.

- NAV per Share: $16.50 at the end of Q4 2024, compared to $16.61 at the end of Q3 2024.

- Dividend: $0.48 per share for Q4 2024, including a $0.06 supplemental distribution.

- Debt-to-Equity Ratio: 1.5 times at the end of Q4 2024.

- Available Liquidity: Approximately $200 million at the end of Q4 2024.

- Portfolio Fair Value: Approximately $1.41 billion as of December 31, 2024.

- Annualized Dividend Yield: 11.6% as of December 31, 2024.

- Weighted Average Total Yield to Maturity: 10.65% at fair value and 9.06% at amortized cost.

- PIK Income: Approximately 1.96% of total investment income.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Palmer Square Capital BDC Inc (PSBD, Financial) exhibited solid performance in the fourth quarter, with strong income generation across its high-quality portfolio.

- The company successfully IPOed in January 2024, becoming the only publicly traded BDC with a portfolio spanning both broadly syndicated public debt and large private credit investments.

- PSBD provides sector-leading transparency by disclosing monthly NAV, offering real-time visibility into the health and value of its portfolio.

- The company maintains a diversified high-quality portfolio, primarily composed of floating rate senior secured loans to large stable borrowers.

- PSBD's investment philosophy focuses on shareholder alignment, demonstrated by its industry-leading approach to fees and transparency, charging management fees only on net assets.

Negative Points

- The company experienced a total net realized and unrealized loss of $2.9 million in the fourth quarter of 2024.

- Net investment income per share decreased from $0.58 in the prior year period to $0.45 in the fourth quarter of 2024.

- The Board and management team decided to lower the base dividend to $0.36 beginning in the first quarter of 2025, reflecting rate cuts and a cautious outlook on capital deployment opportunities.

- There is ongoing uncertainty around the trajectory of interest rates, which could lead to volatility and impact the portfolio's total return opportunities.

- The company faces a challenging investment landscape with tightened spreads across credit markets, requiring a cautious approach to capital deployment.