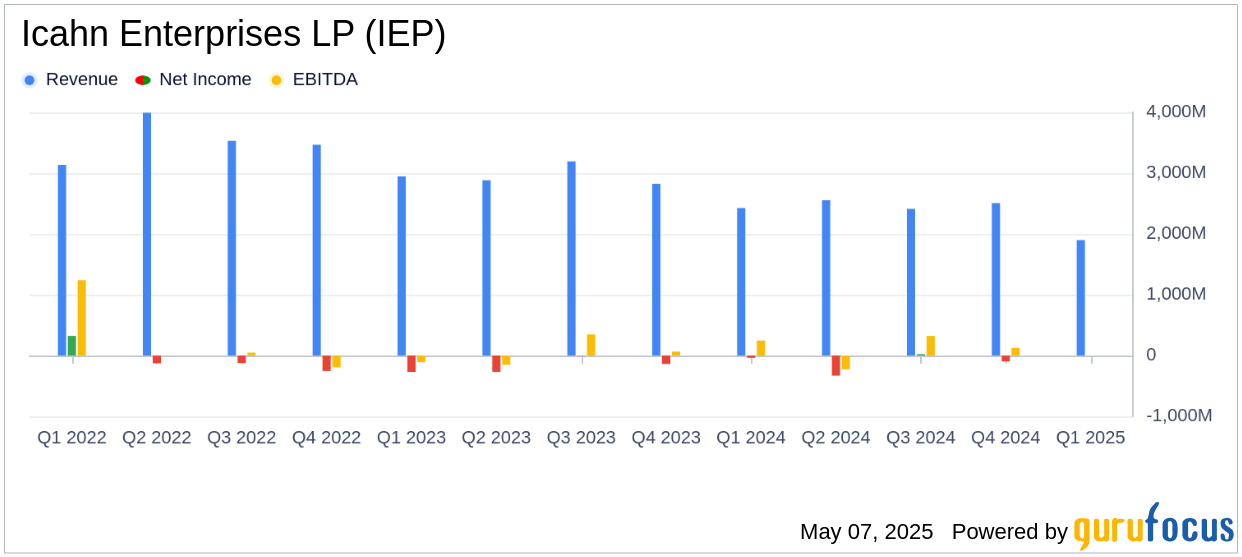

On May 7, 2025, Icahn Enterprises LP (IEP, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. The diversified holding company, which operates through segments such as Investment, Automotive, Energy, Food Packaging, Real Estate, Pharma, and Home Fashion, reported a net loss of $422 million, or $0.79 per depositary unit, significantly widening from a $38 million loss in the same period last year. The company's revenue for the quarter was $1.9 billion, falling short of the analyst estimate of $2,627.73 million.

Performance and Challenges

Icahn Enterprises LP's performance in Q1 2025 was marked by a substantial net loss and a decline in revenue compared to the previous year. The net loss attributable to the company increased to $422 million from $38 million in Q1 2024, while revenue decreased from $2.5 billion to $1.9 billion. This performance is critical as it reflects the company's struggles in managing its diversified operations, particularly in the Investment segment, which reported losses of $224 million primarily due to setbacks in the healthcare sector.

Financial Achievements and Industry Context

Despite the challenges, Icahn Enterprises LP declared a quarterly distribution of $0.50 per depositary unit, demonstrating its commitment to returning value to shareholders. This distribution is noteworthy in the context of the oil and gas industry, where maintaining shareholder returns amidst volatile market conditions is crucial. The Energy segment, which is the company's largest revenue generator, continues to play a pivotal role in its overall financial health.

Key Financial Metrics

The company's Adjusted EBITDA loss was $287 million for Q1 2025, compared to an Adjusted EBITDA of $134 million in Q1 2024. The indicative net asset value decreased by $336 million to approximately $3.0 billion as of March 31, 2025. These metrics are vital as they provide insights into the company's operational efficiency and asset valuation, which are critical for investors assessing the company's long-term viability.

The decreases were primarily due to losses in the Investment segment of $224 million, driven primarily by losses in the healthcare sector," the company stated in its filing.

Income Statement and Balance Sheet Highlights

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $1.9 billion | $2.5 billion |

| Net Loss | $422 million | $38 million |

| Adjusted EBITDA | ($287 million) | $134 million |

On the balance sheet, total assets decreased to $15.481 billion from $16.279 billion at the end of 2024. Cash and cash equivalents stood at $2.183 billion, down from $2.603 billion, reflecting the company's liquidity position. Total liabilities were $11.739 billion, slightly up from $11.658 billion, indicating a stable debt profile.

Analysis and Outlook

The financial results for Icahn Enterprises LP in Q1 2025 highlight significant challenges, particularly in its Investment segment. The widening net loss and declining revenue underscore the need for strategic adjustments to navigate the current economic landscape. The company's ability to maintain distributions is a positive sign, but the ongoing losses in key segments pose a risk to future performance. Investors will be closely monitoring the company's efforts to stabilize its operations and improve profitability in the coming quarters.

Explore the complete 8-K earnings release (here) from Icahn Enterprises LP for further details.