Uber (UBER, Financial) started the year on a strong note, navigating complex global trade and economic conditions. The company's consumer base experienced a significant increase, expanding by 14% from the previous year, reaching 170 million monthly active users. Globally, Uber's retention rates have reached or are approaching historic highs, indicating strong customer loyalty.

Uber also emphasized that autonomous vehicle technology presents the most significant future opportunity for the company. In a notable advancement, Uber Freight achieved a milestone by collaborating with Aurora to complete a fully autonomous freight trip on public roads without a safety driver present.

Despite these developments, Uber's approach to capital allocation remains consistent. The company also reported positive trends in its European markets, suggesting an optimistic outlook for continued growth in the region. These updates were discussed during Uber's first-quarter earnings call.

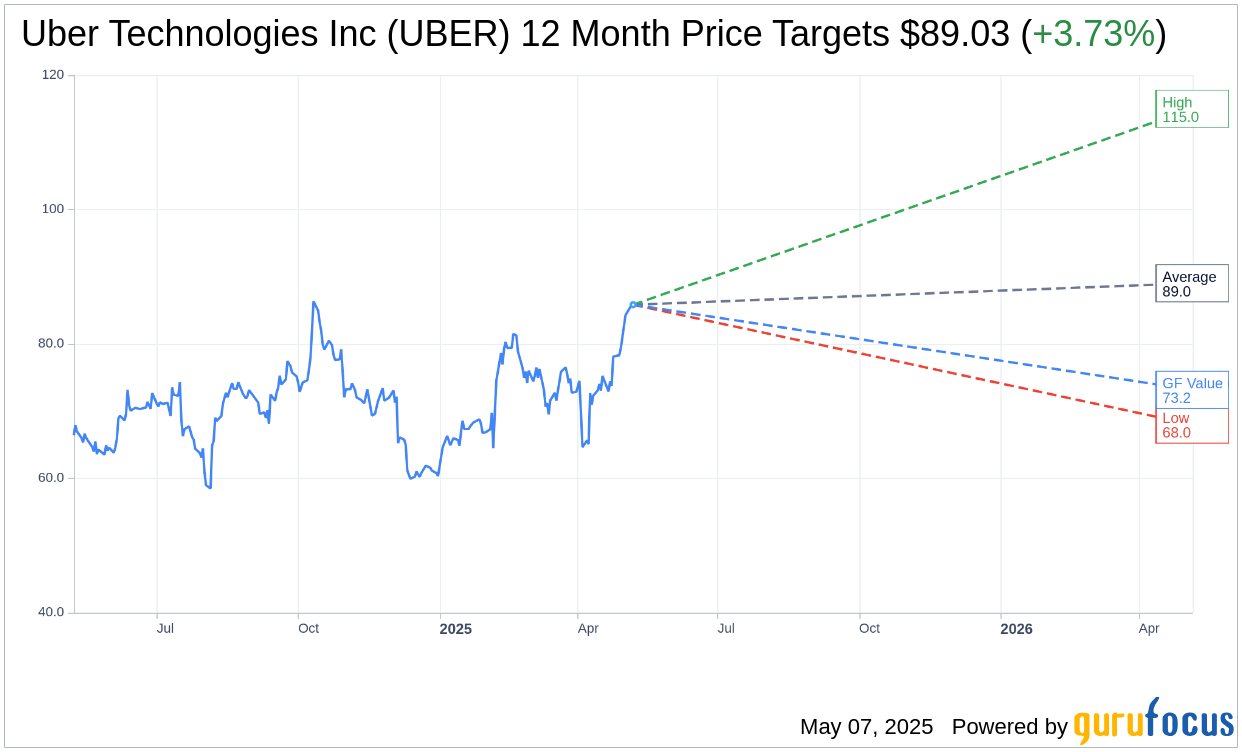

Wall Street Analysts Forecast

Based on the one-year price targets offered by 42 analysts, the average target price for Uber Technologies Inc (UBER, Financial) is $89.03 with a high estimate of $115.00 and a low estimate of $68.00. The average target implies an upside of 3.73% from the current price of $85.83. More detailed estimate data can be found on the Uber Technologies Inc (UBER) Forecast page.

Based on the consensus recommendation from 53 brokerage firms, Uber Technologies Inc's (UBER, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Uber Technologies Inc (UBER, Financial) in one year is $73.16, suggesting a downside of 14.76% from the current price of $85.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Uber Technologies Inc (UBER) Summary page.