Guggenheim has revised its price target for Teradata (TDC, Financial), reducing it from $37 to $35. Despite the adjustment, the firm continues to hold a Buy rating for the company's shares. According to analysts, Teradata had a promising beginning for the year after recalibrating its performance outlook in the previous quarter. The company's guidance for the second quarter aligns with expectations, although it reflects some expected earnings per share seasonality. The firm also notes that Teradata has upheld nearly all of its key forecasts for the full year, which are considered to be set at appropriate levels. This assessment comes following the release of the company's earnings report.

Wall Street Analysts Forecast

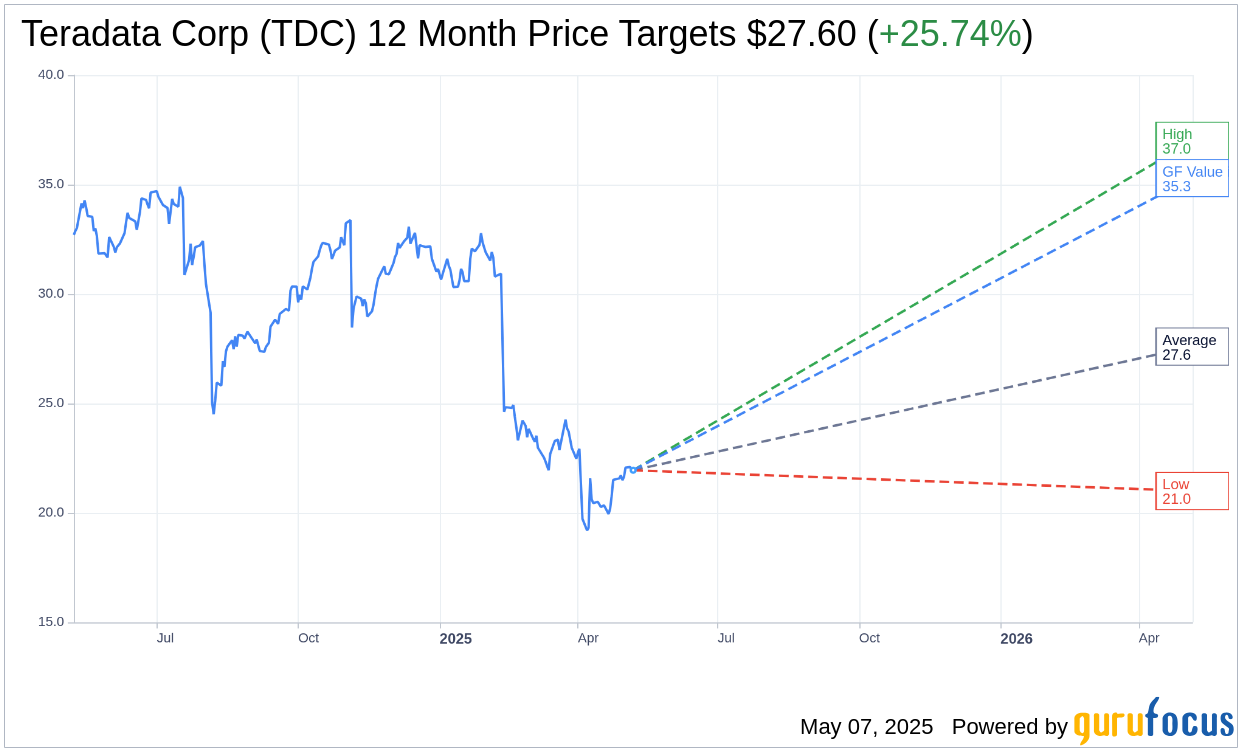

Based on the one-year price targets offered by 10 analysts, the average target price for Teradata Corp (TDC, Financial) is $27.60 with a high estimate of $37.00 and a low estimate of $21.00. The average target implies an upside of 25.74% from the current price of $21.95. More detailed estimate data can be found on the Teradata Corp (TDC) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Teradata Corp's (TDC, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teradata Corp (TDC, Financial) in one year is $35.30, suggesting a upside of 60.82% from the current price of $21.95. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teradata Corp (TDC) Summary page.

TDC Key Business Developments

Release Date: May 06, 2025

- Public Cloud ARR: $606 million, a 16% year-on-year increase in constant currency.

- Total ARR: $1.44 billion, in line with expectations on a constant currency basis.

- Free Cash Flow: $7 million generated in the quarter.

- Non-GAAP EPS: $0.66, an increase of 16% year-on-year.

- Cloud Net Expansion Rate: 115%.

- Recurring Revenue: $358 million, down 8% year-over-year as reported and down 6% in constant currency.

- Total Revenue: $418 million, down 10% year-over-year as reported and 8% in constant currency.

- Total Gross Margin: 60.3%, down 190 basis points year-over-year.

- Operating Margin: 21.8%, up 270 basis points year-over-year.

- Stock Repurchase: Approximately $44 million or 1.6 million shares repurchased.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Teradata Corp (TDC, Financial) reported a 16% year-on-year increase in public cloud ARR, reaching $606 million.

- The company achieved a non-GAAP EPS of $0.66, marking a 16% increase year-on-year.

- Teradata Corp (TDC) maintained a strong focus on execution, benefiting from actions initiated in the previous year.

- The company introduced Teradata Enterprise Vector Store, enhancing its capabilities in AI and analytics.

- Teradata Corp (TDC) was recognized as a leader in the Forrester Wave on data management for analytics platforms.

Negative Points

- Total ARR declined by 2% year-over-year on a constant currency basis.

- First quarter recurring revenue was down 8% year-over-year as reported.

- Total revenue for the first quarter was down 10% year-over-year as reported.

- The services business continues to be impacted by lower bookings in the second half of 2024.

- The company anticipates a significant sequential decline in non-GAAP EPS for the second quarter.