PubMatic (PUBM, Financial) has introduced an enhanced suite of solutions for media buyers, leveraging generative AI to streamline the media buying process. This upgraded buyer platform enhances every phase, from discovering audiences and inventory forecasts to curation, activation, and optimizing performance. Unique in the market, it provides direct access to nearly the entire open internet, featuring over 1,900 premium publishers, privacy-compliant audience data from 190 data partners, and more than 821 billion ad impressions daily.

The platform integrates proprietary supply-side intelligence with AI-driven purchasing tools, delivering transparency in supply paths—a feature unavailable to demand-side platforms (DSPs). This innovation addresses the increasing need for media buyers to have better control and insight into their spending. Notably, this launch coincides with the two-year anniversary of PubMatic’s Activate product introduction, underscoring the company's evolution from a traditional supply-side platform (SSP) into an advanced, comprehensive technology entity shaping the future of programmatic advertising on the open internet.

By incorporating GenAI, PubMatic's buyer suite effectively tackles inefficiencies in supply paths, workflows, inventory discovery, audience strategies, and optimization, marking a significant milestone in its technological advancements.

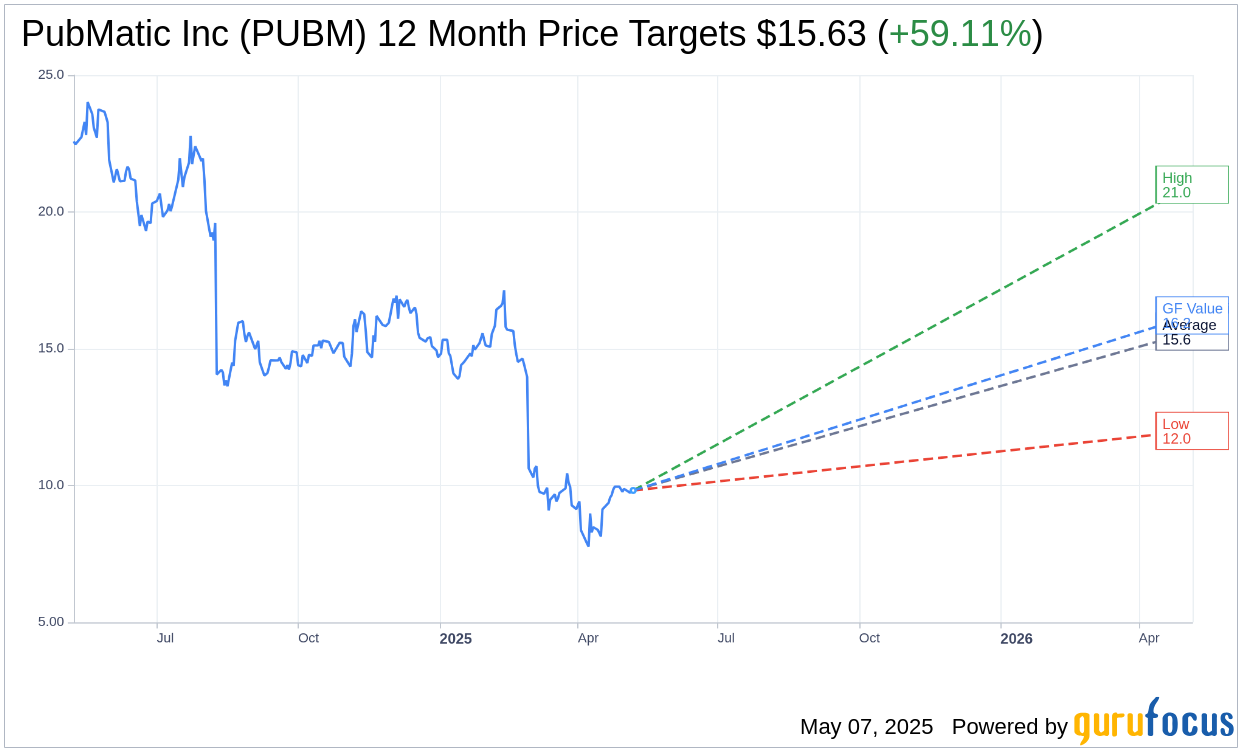

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for PubMatic Inc (PUBM, Financial) is $15.63 with a high estimate of $21.00 and a low estimate of $12.00. The average target implies an upside of 59.11% from the current price of $9.82. More detailed estimate data can be found on the PubMatic Inc (PUBM) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, PubMatic Inc's (PUBM, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for PubMatic Inc (PUBM, Financial) in one year is $16.22, suggesting a upside of 65.17% from the current price of $9.82. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the PubMatic Inc (PUBM) Summary page.

PUBM Key Business Developments

Release Date: February 27, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- PubMatic Inc (PUBM, Financial) achieved a 9% revenue growth in 2024, more than doubling the growth rate from 2023.

- CTV revenue more than doubled in 2024, reaching 20% of total revenue in Q4.

- The company expanded its adjusted EBITDA margins to 32%, marking its fourth year out of the last five exceeding the 'rule of 40' benchmark.

- PubMatic Inc (PUBM) increased its engineering productivity by over 15% through the adoption of generative AI technology.

- The company successfully executed a share repurchase program, reducing fully diluted shares outstanding by 8% in 2024.

Negative Points

- A significant headwind was experienced due to a change in bidding approach by a major DSP partner, affecting desktop display revenues.

- Total Q4 revenues were below expectations due to weak holiday spending by a large DSP buyer.

- The company anticipates a continuation of softer trends for the large DSP in 2025, impacting display revenues.

- PubMatic Inc (PUBM) expects its first half margins in 2025 to be slightly lower than historical levels due to the DSP impact.

- The company faces tough comparisons in 2025 due to the significant political ad spend in 2024, which contributed to 6% of total revenue.