Sinclair Broadcast Group (SBGI, Financial) has forged a new collaboration with the ATP and WTA, along with several U.S.-based tennis tournaments. This strategic agreement introduces a cohesive solution for brands aiming to connect with tennis enthusiasts through various channels such as live events, broadcasts, and digital platforms.

For the first time, sponsors can access both the ATP Tour and Hologic WTA Tour events in the U.S. through a unified sponsorship package. This package also encompasses all of Sinclair's Tennis Channel platforms, including Tennis Channel, TennisChannel 2, its app and website, and other digital avenues. This partnership allows brands to maintain a consistent presence and narrative throughout the tennis season.

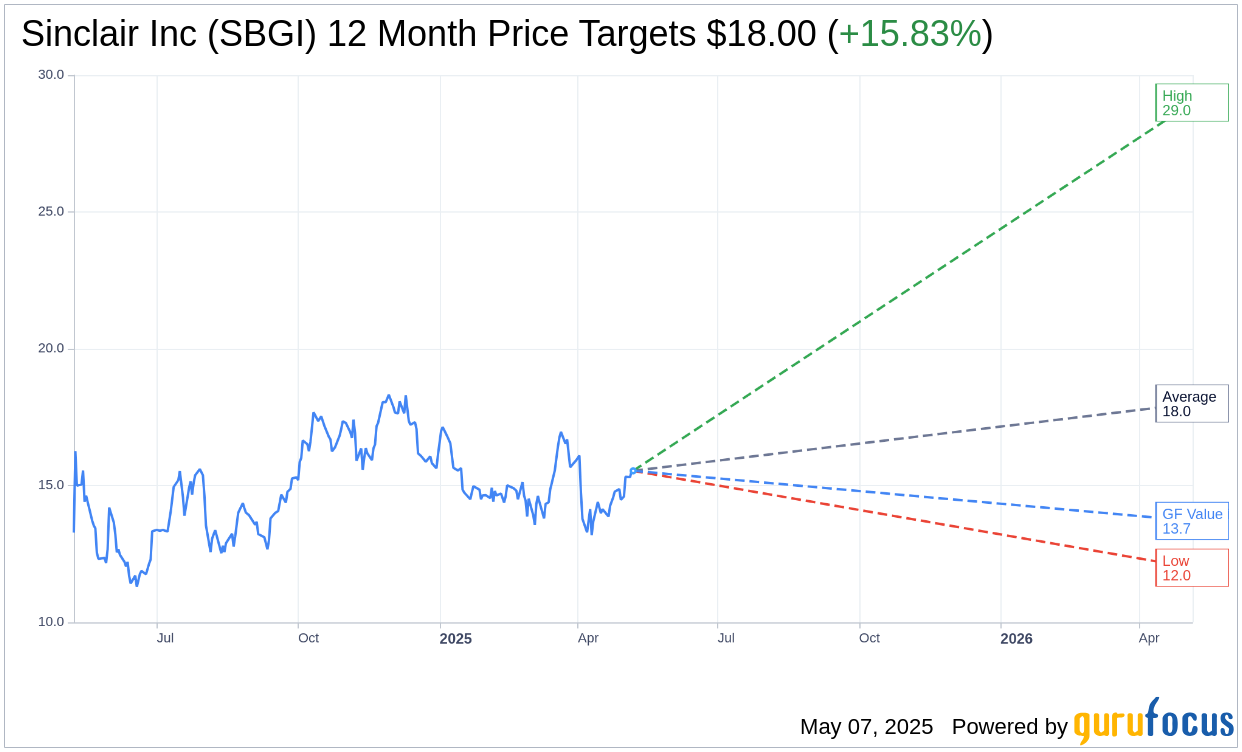

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Sinclair Inc (SBGI, Financial) is $18.00 with a high estimate of $29.00 and a low estimate of $12.00. The average target implies an upside of 15.83% from the current price of $15.54. More detailed estimate data can be found on the Sinclair Inc (SBGI) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Sinclair Inc's (SBGI, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sinclair Inc (SBGI, Financial) in one year is $13.71, suggesting a downside of 11.78% from the current price of $15.54. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sinclair Inc (SBGI) Summary page.

SBGI Key Business Developments

Release Date: February 26, 2025

- Political Advertising Revenue: $405 million, doubling the 2016 Presidential year results.

- Adjusted EBITDA: $330 million in Q4, $5 million above the high end of guidance.

- Distribution Revenue Growth: Over 5% net retransmission growth year-over-year in 2024.

- Cash Inflows from Ventures: $209 million in 2024, including $47 million in Q4.

- First-Out First Lien Note: $1.43 billion at 8.8% over eight years.

- First Lien Net Leverage: 4.2 times as of year-end 2024.

- Core Advertising Decline: 9% year-over-year in Q4 due to political crowd out.

- Tennis Channel Revenue Growth: 6% year-over-year, driven by digital advertising.

- Media Expenses: $38 million better than the midpoint of original full-year guidance.

- CapEx: $84 million for 2024, below the original midpoint guidance of $114 million.

- Q1 2025 Media Revenue Guidance: Expected to be 2% to 4% lower year-over-year.

- Q1 2025 Adjusted EBITDA Guidance: $90 million to $102 million.

- Net Cash Interest Expense: $143 million, including $75 million non-recurring refinancing fees.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sinclair Inc (SBGI, Financial) reported record-breaking political advertising revenues of $405 million in 2024, doubling the 2016 Presidential year results.

- The company completed a successful year of distribution and network affiliation agreements, achieving over 5% net retransmission growth year-over-year.

- Sinclair Inc (SBGI) launched several top-rated sports-related podcasts and a Tennis Channel DTC product, expanding its digital and streaming offerings.

- The company's Ventures side received $209 million in cash in 2024, as it continues to reposition its minority investment portfolio towards more majority-owned assets.

- Sinclair Inc (SBGI) substantially completed a comprehensive refinancing of its balance sheets, extending debt maturities and improving its financial position.

Negative Points

- Core advertising revenues came in slightly below expectations due to late-year macroeconomic pressures in several categories.

- The company anticipates a 2% to 4% decline in first-quarter 2025 media revenues year-over-year, primarily due to lower political revenues and softness in core advertising categories.

- Sinclair Inc (SBGI) faces ongoing negotiations with 20% of its MVPDs, which could impact future retransmission revenues.

- The company expects a modest 2% increase in media programming, production, and SG&A expenses year-over-year in 2025.

- Sinclair Inc (SBGI) is forecasting significant cash tax payments in 2025, largely driven by the emergence of Diamond from Chapter 11 protection.