DA Davidson has revised its price target for Boise Cascade (BCC, Financial), reducing it from $125 to $115 while maintaining a Buy rating. This adjustment reflects a more cautious outlook on engineered wood products (EWP) pricing through the remainder of the year, as well as moderated assumptions regarding new starts. However, the company's recent commentary suggests that volume and activity levels are not as concerning as initially anticipated. Additionally, the firm anticipates that the second half of the year will see positive impacts as previous capital project challenges diminish.

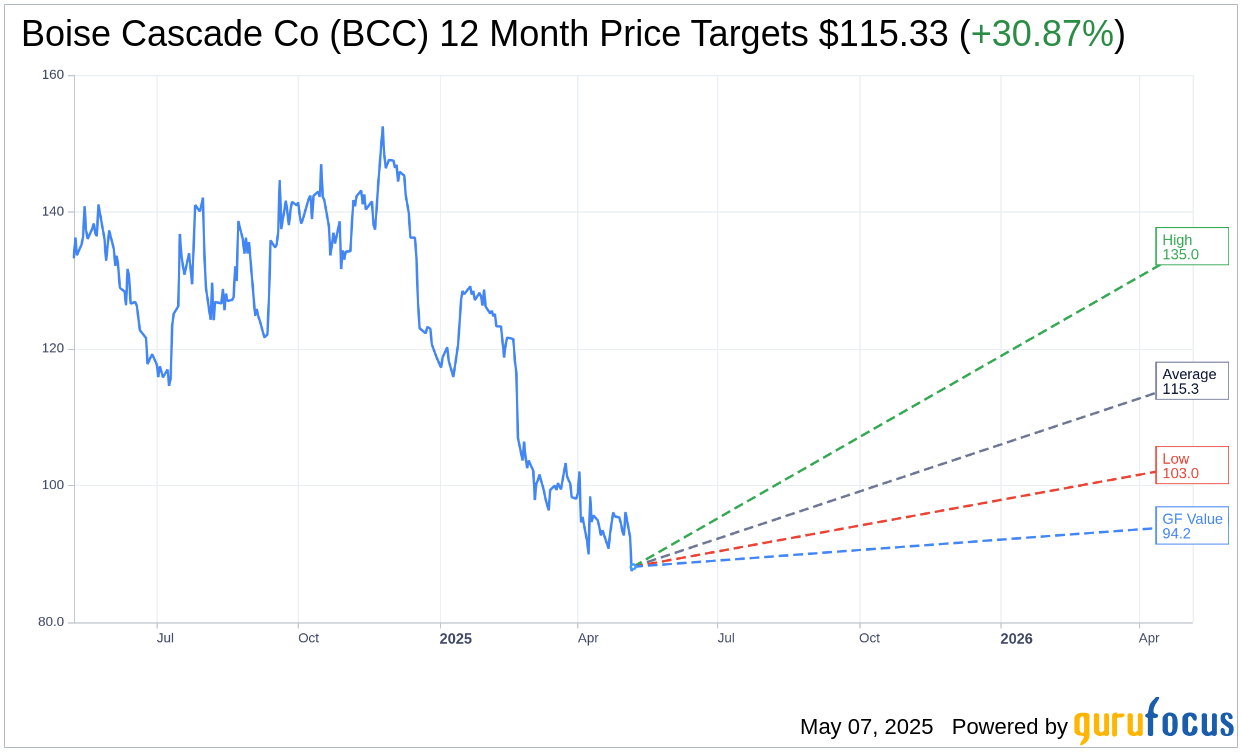

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Boise Cascade Co (BCC, Financial) is $115.33 with a high estimate of $135.00 and a low estimate of $103.00. The average target implies an upside of 30.87% from the current price of $88.13. More detailed estimate data can be found on the Boise Cascade Co (BCC) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Boise Cascade Co's (BCC, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Boise Cascade Co (BCC, Financial) in one year is $94.17, suggesting a upside of 6.85% from the current price of $88.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Boise Cascade Co (BCC) Summary page.

BCC Key Business Developments

Release Date: May 06, 2025

- Consolidated Sales: $1.5 billion, down 7% from Q1 2024.

- Net Income: $40.3 million or $1.06 per share, compared to $104.1 million or $2.61 per share in Q1 2024.

- Wood Products Sales: $415.8 million, down 11% from Q1 2024.

- Wood Products Segment EBITDA: $40.2 million, compared to $95.6 million in Q1 2024.

- BMD Sales: $1.4 billion, down 7% from Q1 2024.

- BMD Segment EBITDA: $62.8 million, compared to $83.6 million in Q1 2024.

- BMD Gross Margin: 14.7%, down 40 basis points year-over-year.

- Plywood Sales Volume: 363 million feet, compared to 372 million feet in Q1 2024.

- Average Plywood Net Sales Price: $341 per 1,000, down 10% year-over-year.

- Capital Expenditures: $53 million in Q1, with $31 million in Wood Products and $22 million in BMD.

- Dividends Paid: $10 million in regular dividends during the quarter.

- Share Repurchases: $71 million of common stock repurchased through the first four months of 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Boise Cascade Co (BCC, Financial) maintained a strong balance sheet, which supports strategic investments and capital returns to shareholders.

- The company experienced improved sales velocity in March, leading to EBITDA margins similar to recent quarters.

- Boise Cascade Co (BCC) is making significant progress on modernization projects, such as the Oakdale facility, which is expected to enhance EWP production capabilities.

- The company has a robust capital allocation strategy, including share repurchases and dividends, demonstrating a commitment to shareholder returns.

- Boise Cascade Co (BCC) benefits from a strong distribution network, allowing it to shift volumes to areas of strength and maintain high service levels across the country.

Negative Points

- First-quarter sales and net income declined compared to the previous year, with sales down 7% and net income significantly lower.

- The company faced challenges from constrained demand, uncertain trade policies, and difficult weather conditions, impacting financial performance.

- A planned outage at the Oakdale facility negatively impacted first-quarter results, with an $8 million impact on EBITDA.

- Economic uncertainty and elevated mortgage rates have dampened consumer and homebuilder confidence, affecting demand.

- Boise Cascade Co (BCC) experienced pricing pressure in the EWP segment due to constrained demand and competition for market share.