Key Insights:

- Charles River Laboratories (CRL, Financial) secures a 21% premarket stock surge following robust Q1 2025 earnings.

- Shares exhibit a potential 5.15% upside based on average analyst price targets.

- GuruFocus estimates suggest a substantial 45.52% upside from current market levels.

Charles River Laboratories (CRL) has captured investor attention by delivering impressive Q1 2025 earnings that exceed expectations. Coupled with an improved full-year guidance, this performance has propelled its shares up by 21% in premarket trading. Although challenges persist in certain revenue segments, the company's enhanced earnings per share have fostered a more optimistic outlook for the year.

Wall Street Analysts Forecast

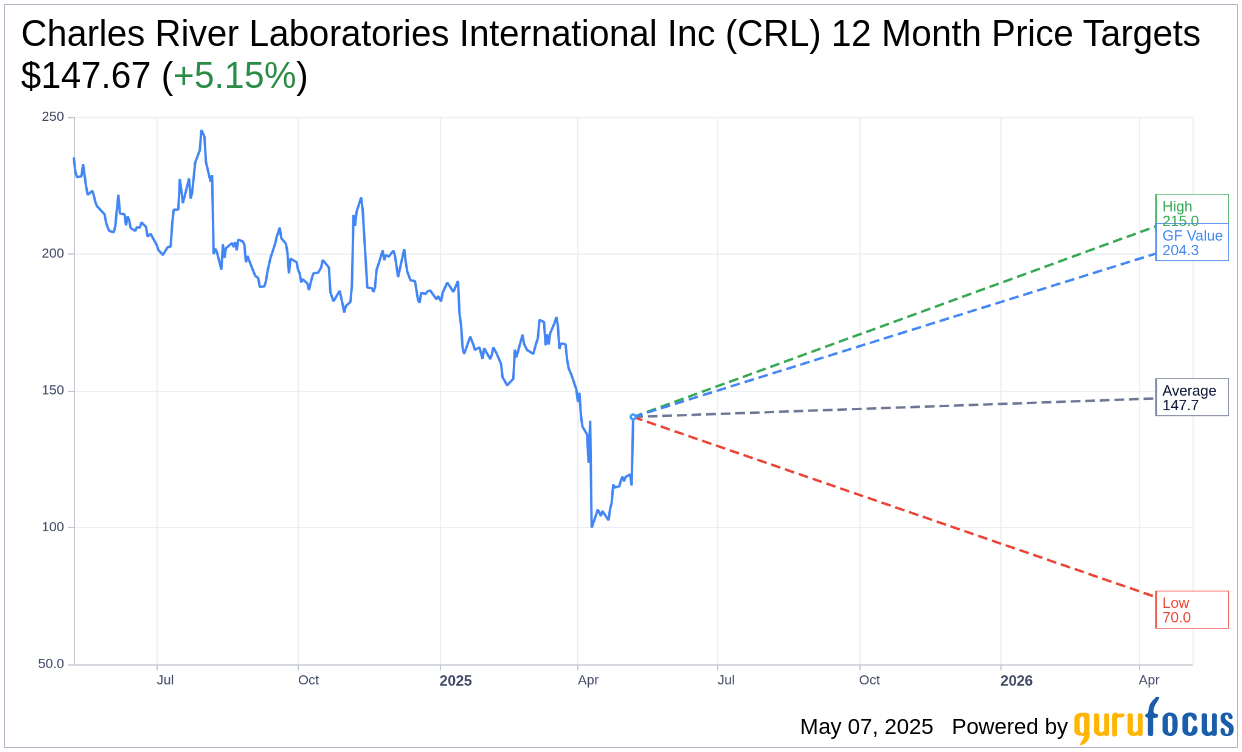

With insights from 15 analysts, the one-year price target for Charles River Laboratories International Inc (CRL, Financial) averages at $147.67. This includes an optimistic high of $215.00 and a cautious low of $70.00, translating to a potential upside of 5.15% from its present value of $140.43. For a more detailed breakdown of these estimates, visit the Charles River Laboratories International Inc (CRL) Forecast page.

Analyst consensus from 20 brokerage firms places Charles River Laboratories International Inc (CRL, Financial) at an "Hold" recommendation, averaging a 3.0 on a scale where 1 signifies Strong Buy and 5 denotes Sell. This reflects a cautious yet balanced market sentiment.

GuruFocus Valuation

According to GuruFocus estimates, the GF Value of Charles River Laboratories International Inc (CRL, Financial) in one year stands at $204.35. This suggests a compelling upside potential of 45.52% from the current market price of $140.43. The GF Value represents an estimation of the stock's fair trading value, calculated through historical trading multiples, past business growth, and projected future performance. For further insights and detailed metrics, visit the Charles River Laboratories International Inc (CRL) Summary page.