In recent stock market news, Cantor Fitzgerald has reiterated its position on Rivian Automotive (RIVN, Financial), maintaining a "Neutral" rating. This decision comes amidst ongoing analysis and evaluation of the company's market performance and future prospects.

Renowned analyst Andres Sheppard from Cantor Fitzgerald reaffirmed the price target for Rivian Automotive (RIVN, Financial) at $15.00 USD. This price target remains consistent with the previous assessment, indicating no change in the analyst's outlook for the company's stock valuation at this time.

The "Neutral" rating and the maintenance of the $15.00 price target suggest a balanced expectation for Rivian Automotive (RIVN, Financial), with neither a particularly bullish nor bearish outlook being projected by Cantor Fitzgerald as of May 7, 2025.

Investors and market watchers will continue to keep a close watch on any developments and updates regarding Rivian Automotive (RIVN, Financial) as they navigate the evolving market landscape.

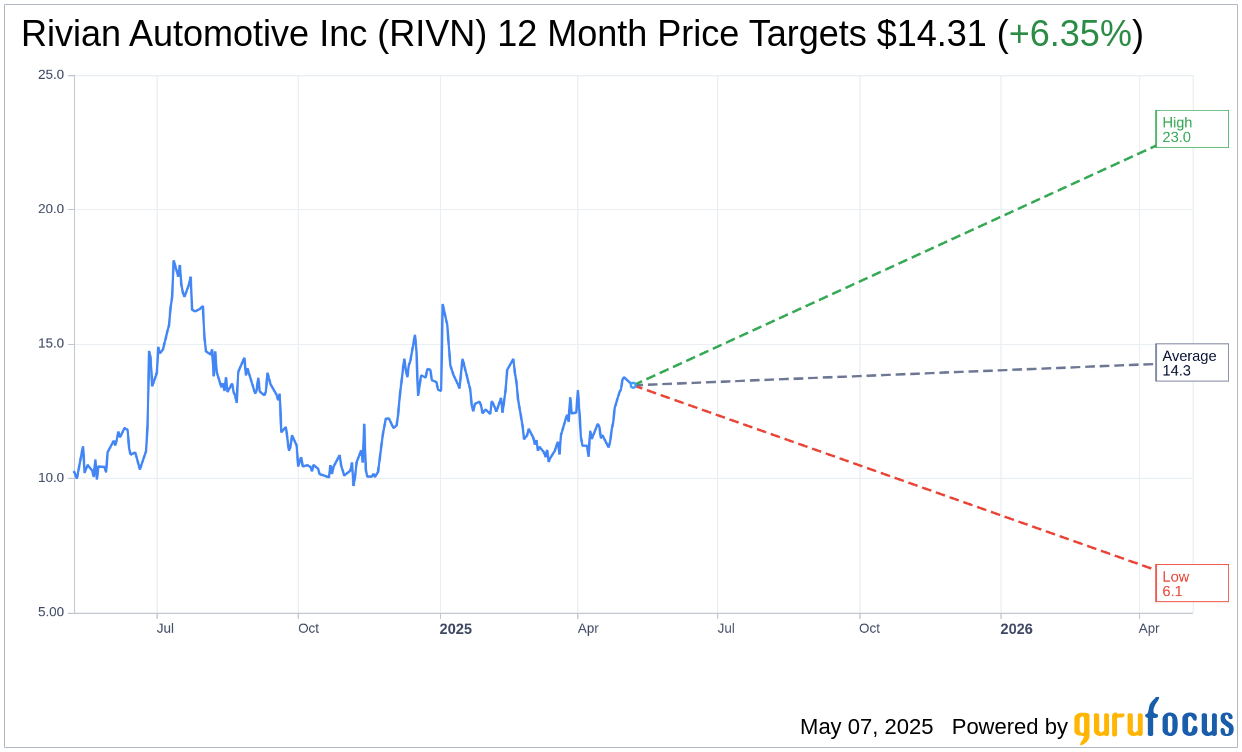

Wall Street Analysts Forecast

Based on the one-year price targets offered by 28 analysts, the average target price for Rivian Automotive Inc (RIVN, Financial) is $14.31 with a high estimate of $23.00 and a low estimate of $6.10. The average target implies an upside of 6.35% from the current price of $13.46. More detailed estimate data can be found on the Rivian Automotive Inc (RIVN) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, Rivian Automotive Inc's (RIVN, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rivian Automotive Inc (RIVN, Financial) in one year is $37.35, suggesting a upside of 177.59% from the current price of $13.455. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rivian Automotive Inc (RIVN) Summary page.