Quick Highlights:

- Jamf sees a 10.5% boost in Q1 revenue, yet shares slip by 2%.

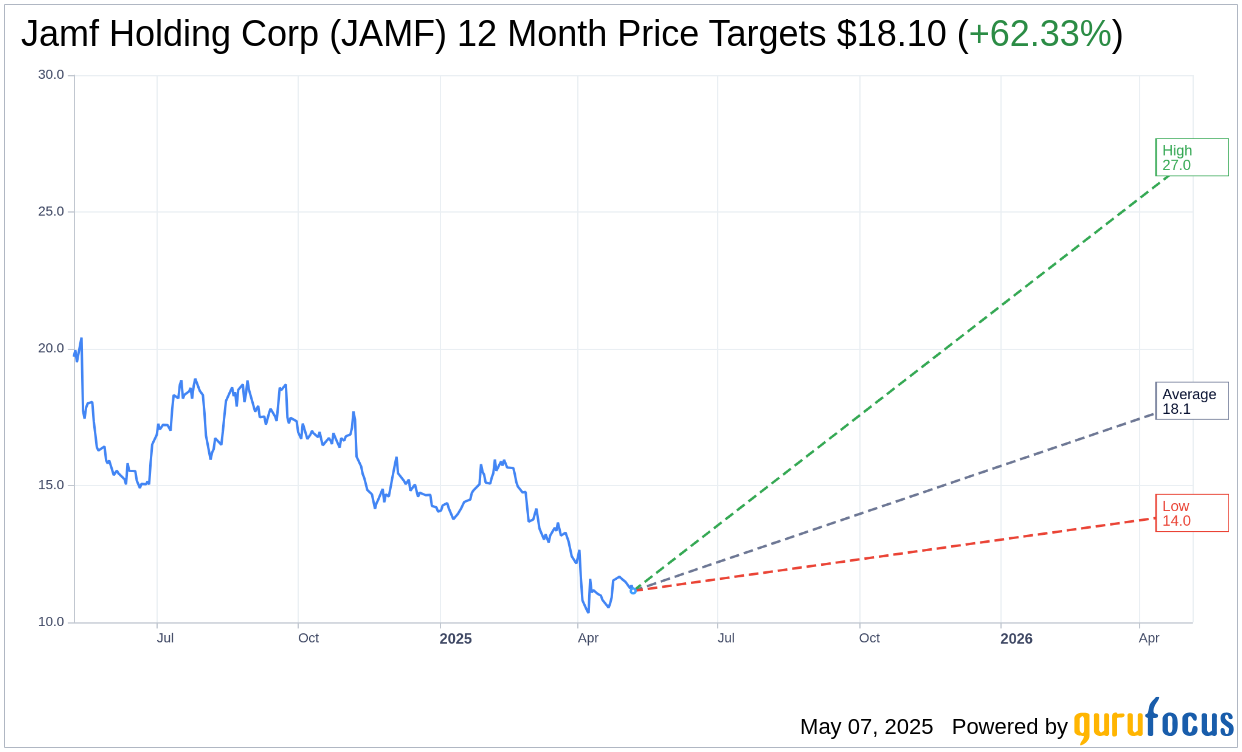

- Wall Street eyes a potential 62.33% upside for Jamf stock.

- Consensus rating indicates an "Outperform" status for JAMF.

Jamf Holding Corp (NASDAQ: JAMF) has impressed with a 10.5% increase in first-quarter revenue, amounting to $168 million. Despite this positive financial stride, the stock experienced a 2% drop after earlier gaining 5%. Jamf specializes in management and security solutions tailored for Apple platforms, with strategic plans for product growth slated for 2025.

Wall Street Analysts Forecast

Insight from 10 Wall Street analysts projects the average one-year price target for Jamf Holding Corp (JAMF, Financial) at $18.10. This includes a high forecast of $27.00 and a low of $14.00, suggesting a potential upside of 62.33% from the current share price of $11.15. For a deeper dive into these estimates, please visit the Jamf Holding Corp (JAMF) Forecast page.

Backing up this optimistic outlook, 12 brokerage firms have collectively rated Jamf Holding Corp (JAMF, Financial) with an average recommendation score of 2.2, signaling an "Outperform" stance. On the rating scale, 1 indicates a Strong Buy, while 5 denotes a Sell.

Understanding GF Value Projections

According to GuruFocus estimates, the anticipated GF Value of Jamf Holding Corp (JAMF, Financial) in one year stands at $23.90. This equates to an impressive forecasted upside of 114.35% from the current price of $11.15. The GF Value estimate is derived from historical trading multiples, previous business growth rates, and the company's expected future performance. For more comprehensive data, visit the Jamf Holding Corp (JAMF) Summary page.