Commercial Vehicle Group (CVGI, Financial) has seen its price target adjusted by Barrington analyst Gary Prestopino. The target range is now set at $3 to $5, down from the previous $5 to $7. Despite the reduction, the analyst maintains an Outperform rating on the stock. This decision comes after CVGI announced first-quarter results that exceeded expectations. However, the analyst notes that the company's main markets continue to face challenges.

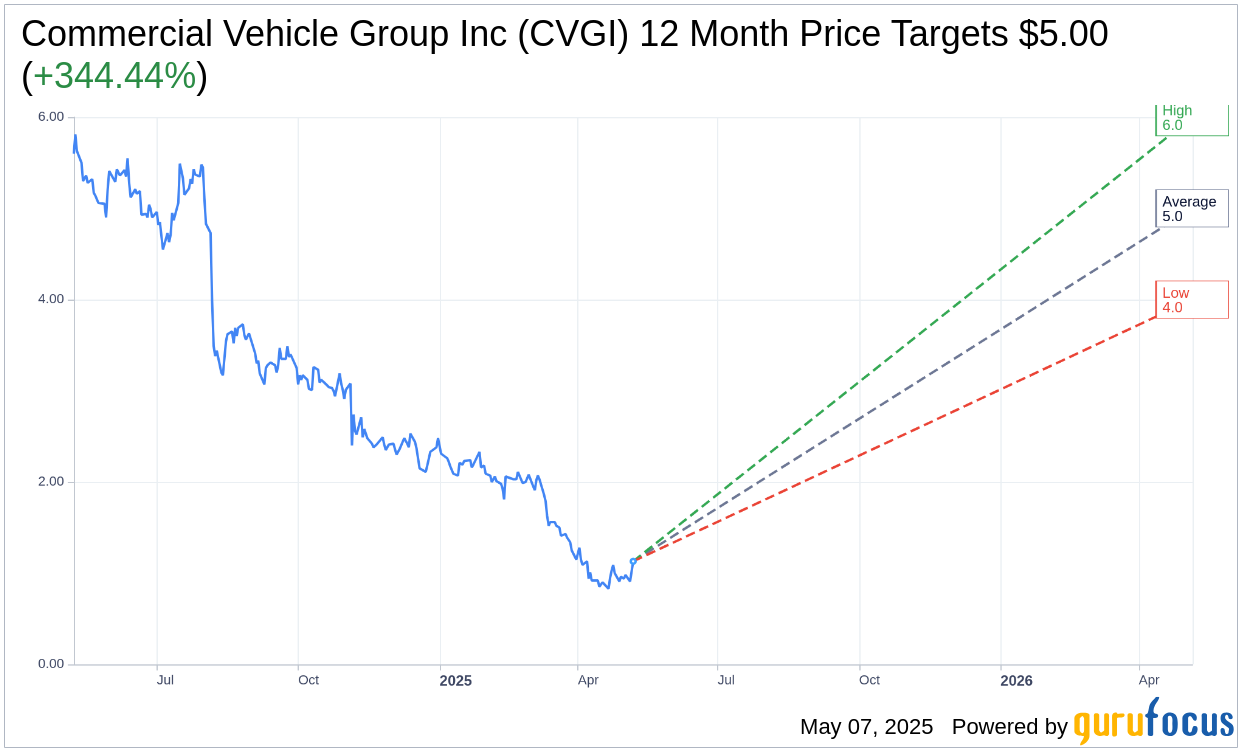

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Commercial Vehicle Group Inc (CVGI, Financial) is $5.00 with a high estimate of $6.00 and a low estimate of $4.00. The average target implies an upside of 344.44% from the current price of $1.13. More detailed estimate data can be found on the Commercial Vehicle Group Inc (CVGI) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Commercial Vehicle Group Inc's (CVGI, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Commercial Vehicle Group Inc (CVGI, Financial) in one year is $4.85, suggesting a upside of 331.11% from the current price of $1.125. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Commercial Vehicle Group Inc (CVGI) Summary page.

CVGI Key Business Developments

Release Date: March 11, 2025

- Revenue: $163.3 million for Q4 2024, down from $193.7 million in the prior year period.

- Adjusted EBITDA: $0.9 million for Q4 2024, compared to $8.3 million in the prior year.

- Adjusted EBITDA Margin: 0.6% for Q4 2024, down from 4.3% in Q4 2023.

- Net Loss: $35 million for Q4 2024, or a loss of $1.04 per diluted share.

- Adjusted Net Loss: $5.1 million for Q4 2024, or a loss of $0.15 per diluted share.

- Free Cash Flow: $0.8 million for Q4 2024, compared to $4.3 million in the prior year.

- Full Year Revenue: $723.4 million for 2024, down from $835.5 million in 2023.

- Full Year Adjusted EBITDA: $23.2 million for 2024, compared to $54.6 million in 2023.

- Net Leverage Ratio: 4.7 times trailing 12 months adjusted EBITDA from continuing operations at year-end 2024.

- Electrical Systems Revenue: $40.3 million for Q4 2024, a decrease of 28% year-over-year.

- Vehicle Solutions Revenue: $91.4 million for Q4 2024, a decrease of 15% year-over-year.

- Aftermarket Revenue: $31.6 million for Q4 2024, an increase of 4% year-over-year.

- 2025 Revenue Guidance: Expected to be in the range of $670 million to $710 million.

- 2025 Adjusted EBITDA Guidance: Expected to be in the range of $25 million to $30 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Commercial Vehicle Group Inc (CVGI, Financial) has taken decisive actions to improve its cost structure by divesting non-core businesses and reducing headcount by approximately 17%.

- The company secured approximately $97 million in new business wins in 2024, primarily in the electrical systems segment, which is expected to drive future growth.

- CVGI opened new low-cost facilities in Mexico and Morocco, which are anticipated to enhance operational efficiency and leverage as markets recover.

- The company has initiated a new organizational structure with three operating segments to better align with customer needs and market demands.

- CVGI expects to achieve $15 million to $20 million in cost savings in 2025, contributing to margin expansion and improved financial performance.

Negative Points

- CVGI's fourth quarter 2024 revenue decreased to $163.3 million from $193.7 million in the prior year, primarily due to lower sales in vehicle solutions and electrical system segments.

- Adjusted EBITDA for the fourth quarter was significantly lower at $0.9 million compared to $8.3 million in the prior year, reflecting operational inefficiencies and lower volumes.

- The company reported a net loss of $35 million for the quarter, including a non-cash tax valuation allowance, compared to a net income of $22.6 million in the prior year.

- Free cash flow from continuing operations was only $0.8 million for the quarter, down from $4.3 million in the prior year, indicating cash flow challenges.

- CVGI's net leverage ratio increased to 4.7 times trailing 12 months adjusted EBITDA, raising concerns about financial stability and the need for potential covenant relief.