Summary:

- Appian (APPN, Financial) is set to reveal its first-quarter earnings on May 8, with an anticipated EPS surge of 112.5% year-over-year.

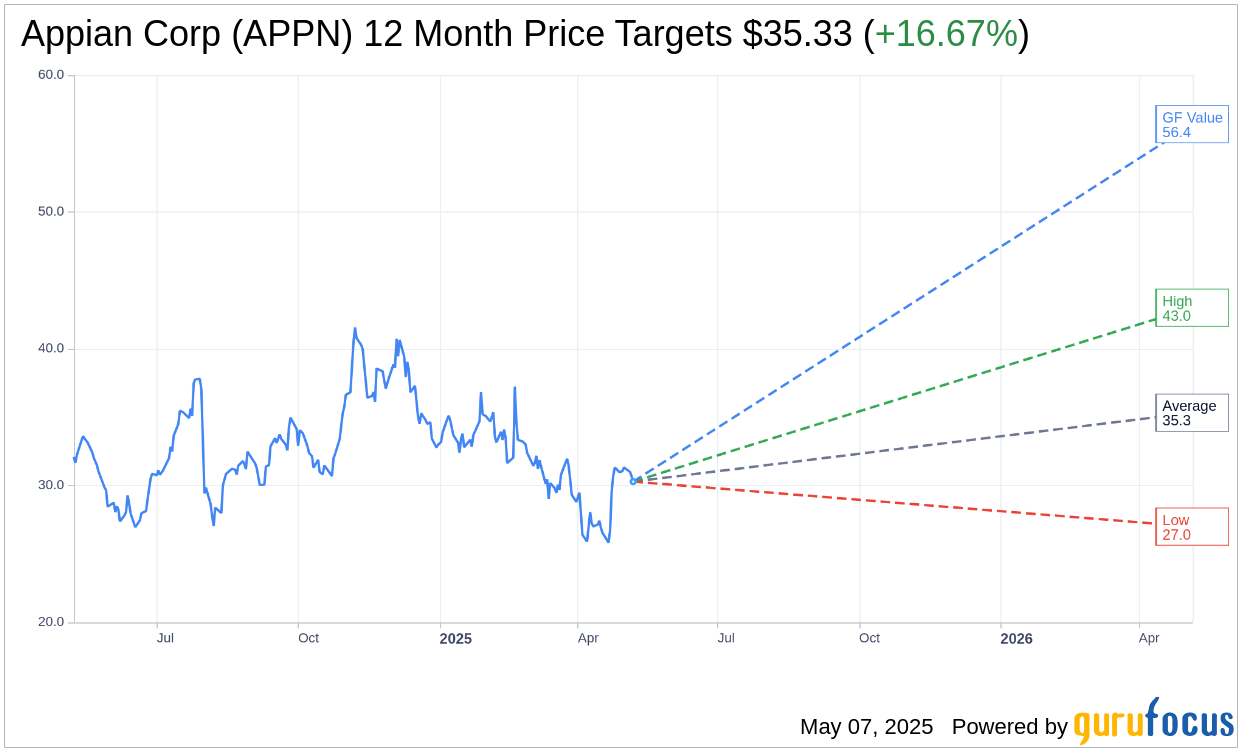

- Analysts project an average target price of $35.33 for APPN, suggesting a 16.67% upside from its current price.

- GuruFocus estimates indicate a significant potential upside of 86.3% based on GF Value calculations.

Appian's Financial Outlook for Q1

Appian Corp (APPN) is preparing to announce its first-quarter earnings on May 8. Analysts have forecasted an impressive rise in earnings per share (EPS) to $0.03, marking a substantial 112.5% increase compared to the same period last year. Revenue projections for the quarter stand at $163.3 million, representing a 9% uptick. Appian's track record shows that it has surpassed EPS expectations 75% of the time and has consistently outperformed revenue forecasts over the past two years. However, it's worth noting the recent trend: while EPS estimates have seen five upward revisions, revenue forecasts have been adjusted downward six times.

Wall Street Analysts' Price Targets

According to the latest insights from six analysts, the average one-year price target for Appian Corp (APPN, Financial) is $35.33. This average target suggests a 16.67% upside from the current stock price of $30.29. The analysts' forecasts range widely from a high estimate of $43.00 to a low of $27.00. For more comprehensive estimate data, investors can visit the Appian Corp (APPN) Forecast page.

Current Analyst Recommendations

The consensus recommendation from nine brokerage firms categorizes Appian Corp (APPN, Financial) with an average recommendation of 2.9, corresponding to a "Hold" status. It's important to keep in mind the rating scale, which spans from 1, indicating Strong Buy, to 5, signifying Sell.

Evaluating Appian's GF Value

Leveraging GuruFocus estimates, the projected GF Value for Appian Corp (APPN, Financial) is pegged at $56.42 in one year, which implies an impressive 86.3% upside from the current market price of $30.285. The GF Value metric represents GuruFocus’ assessment of the fair value at which the stock should trade, drawing from historical multiples, past business growth, and future performance forecasts. Detailed insights can be accessed on the Appian Corp (APPN) Summary page.