Key Takeaways:

- Delek Logistics Partners (DKL, Financial) posts a record quarterly adjusted EBITDA of $117 million for early 2025.

- Analysts forecast an average price target of $44.75, reflecting a potential 14.16% upside.

- The company is rated "Outperform" based on a 2.3 average brokerage recommendation.

Delek Logistics Partners (DKL) has delivered a powerful start to 2025 with a record-setting quarterly adjusted EBITDA of $117 million. This performance underscores the company's robust strategic initiatives, including advancements in the Permian Basin and the expansion of the Libby plant. Furthermore, the quarterly distribution has been increased to $1.11 per unit, highlighting Delek's commitment to rewarding its investors.

Wall Street Analysts Forecast

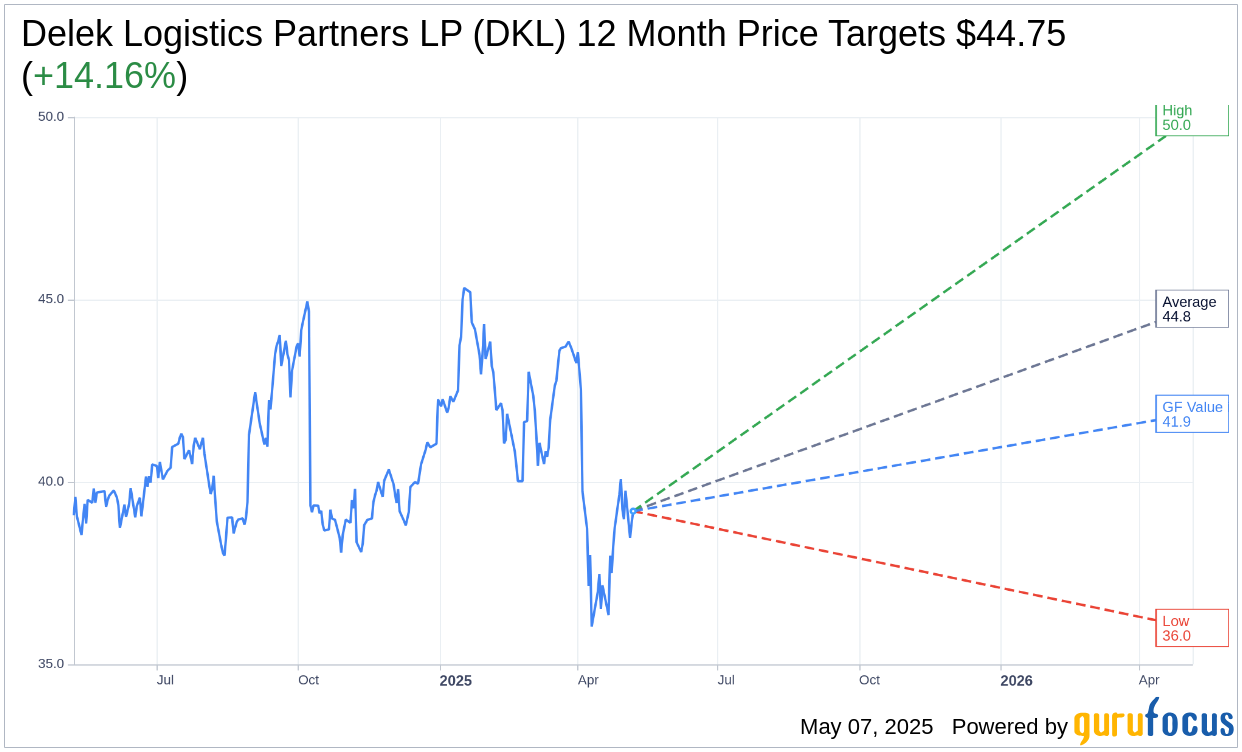

Delek Logistics Partners LP (DKL, Financial) has garnered significant attention from Wall Street analysts. Based on one-year price targets provided by four analysts, the average target price stands at $44.75. Notably, projections range from a high estimate of $50.00 to a low estimate of $36.00. With the current stock price at $39.20, this average target price translates into a potential upside of 14.16%. For a more detailed forecast, visit the Delek Logistics Partners LP (DKL) Forecast page.

In terms of brokerage recommendations, Delek Logistics Partners LP is currently rated at 2.3 on average by four brokerage firms. This rating signifies an "Outperform" status, within a scale ranging from 1 to 5, where 1 is Strong Buy and 5 is Sell.

According to GuruFocus estimates, the estimated GF Value of Delek Logistics Partners LP (DKL, Financial) over the next year is projected at $41.87. This suggests a 6.81% upside from its current market price of $39.20. The GF Value represents GuruFocus's estimate of the fair market value for the stock, derived from its historical trading multiples, past business growth, and future performance projections. For more comprehensive data, explore the Delek Logistics Partners LP (DKL) Summary page.