Summary:

- Select Water Solutions (WTTR, Financial) reports a robust 7% rise in Q1 2025 revenues, with strong performance in chemical technologies and water services.

- Planned EBITDA growth for Q2 2025 projected at 6%-12%, highlighting optimistic investor sentiment.

- Analysts anticipate notable upside potential, with an average price target of $17.00, offering a significant 131.14% increase from the current stock price.

Select Water Solutions' Impressive Q1 2025 Performance

Select Water Solutions (WTTR) has reported a promising 7% increase in Q1 2025 revenues, demonstrating significant growth within strategic areas. The company's adjusted EBITDA climbed by an impressive 14%, signaling effective cost management and operational efficiency. In particular, chemical technologies experienced a robust 21% rise, while the water services sector saw an 8% increase. This growth trajectory is further underscored by the company's strategic 11-year contract in the Northern Delaware Basin, expanding its operational footprint to over 1 million acres.

Strategic Financial Moves

Chris George, the CFO, announced a new credit facility, effectively adding $300 million in revolver commitments to bolster the company's financial flexibility. Investors should note the projected 6%-12% Q2 EBITDA growth, attributed to a strong performance in the water infrastructure segment. This positive outlook reflects the company’s proactive approach to leverage its strengths in water solutions.

Wall Street Analysts' Forecast

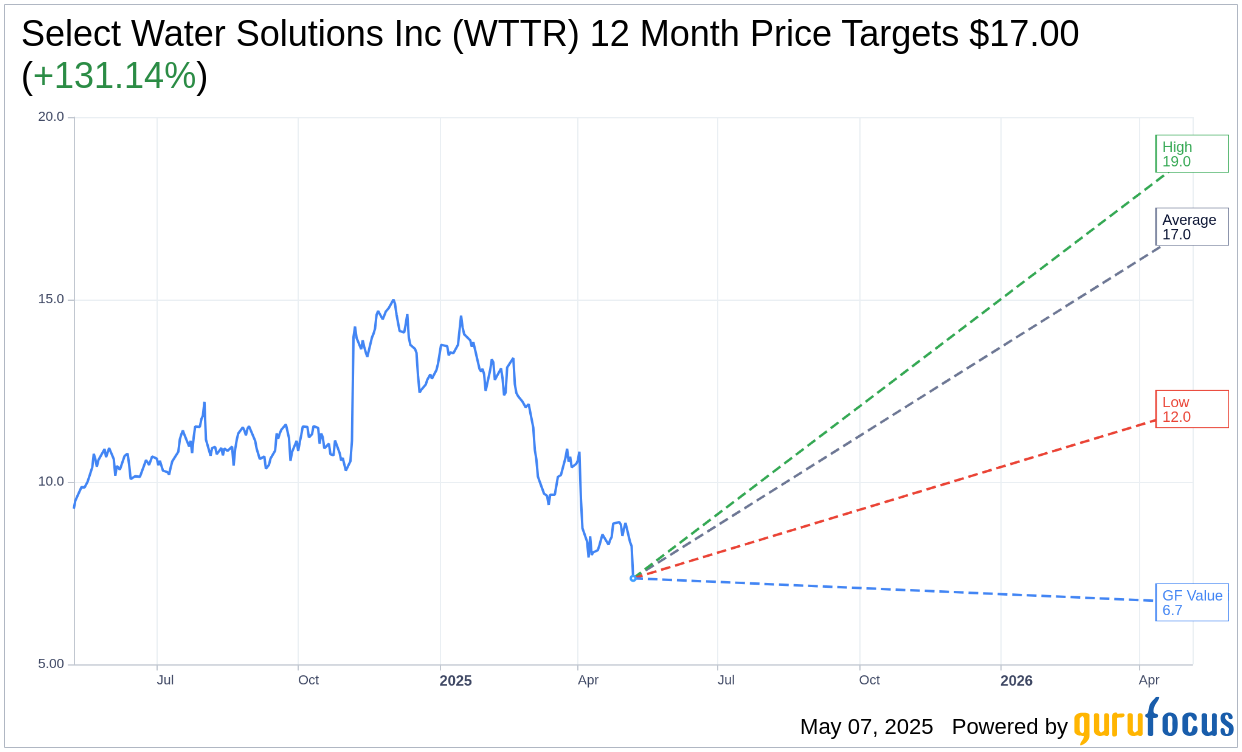

According to one-year price targets from five analysts, the average target price for Select Water Solutions Inc (WTTR, Financial) is $17.00, with estimates ranging between a high of $19.00 and a low of $12.00. This average target implies a substantial upside potential of 131.14% from the current price of $7.36. Investors can find further details and more nuanced estimate data on the Select Water Solutions Inc (WTTR) Forecast page.

Brokerage Recommendations: An Outperforming Stock

The consensus amongst five brokerage firms rates Select Water Solutions Inc (WTTR, Financial) at an average of 1.6, placing it firmly in the "Outperform" category. This rating is calculated on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Sell. Such a rating highlights the favorable sentiment surrounding WTTR’s market potential.

GF Value Assessment

According to GuruFocus estimates, the one-year GF Value for Select Water Solutions Inc (WTTR, Financial) is $6.70, suggesting a potential downside of 8.91% from its current trading price of $7.35. The GF Value is calculated by evaluating the stock's historical trading multiples, past business growth, and future performance projections. For more comprehensive insights, refer to the Select Water Solutions Inc (WTTR) Summary page.