- Pagaya Technologies (PGY, Financial) achieved a positive GAAP net income of $8 million in Q1 2025, underscoring its progress as a public entity.

- Revenue surged 18% year-over-year, reaching an annualized $1.2 billion, with adjusted EBITDA doubling to $320 million.

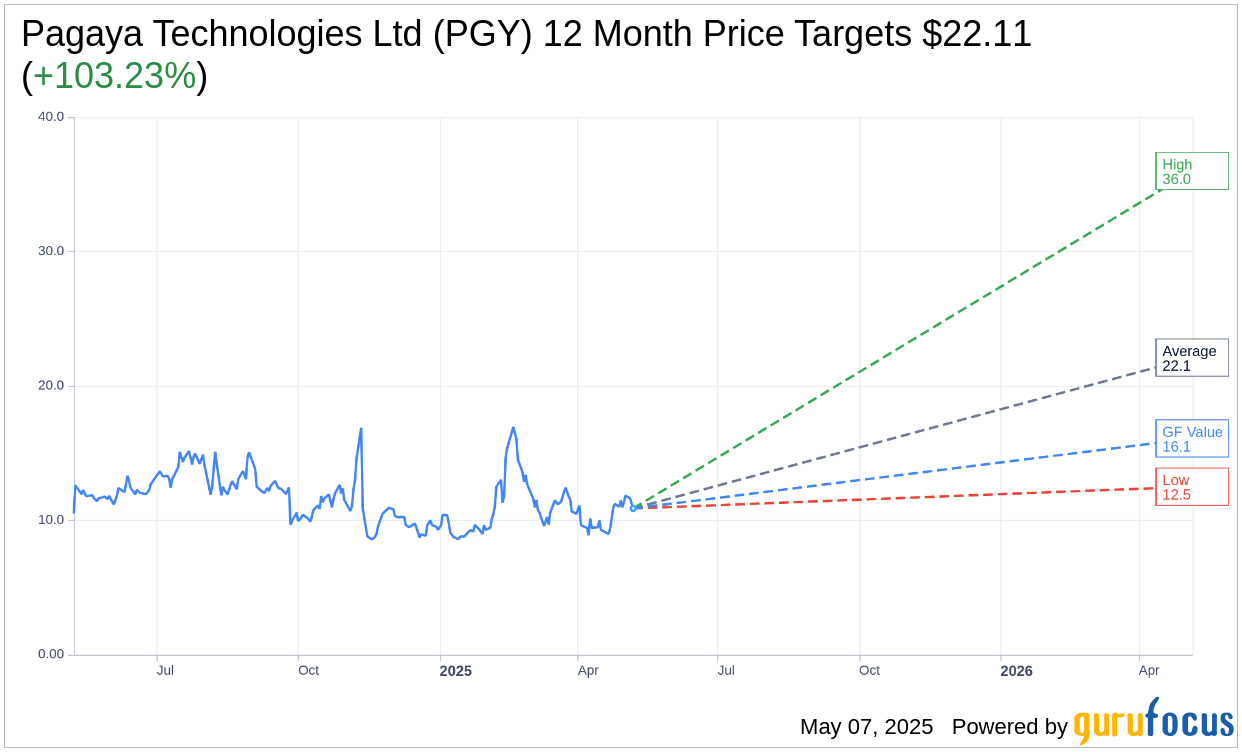

- Wall Street analysts project an impressive upside for PGY, with the average price target implying a 103.23% increase from current levels.

Pagaya Technologies Ltd (NYSE: PGY) made notable strides in the first quarter of 2025, delivering a landmark achievement with a positive GAAP net income of $8 million. This significant milestone reflects Pagaya's effective strategies and operational excellence as a public company.

Strong Financial Performance

The company's Q1 2025 financial results highlight an 18% year-over-year revenue increase, boosting its annualized revenue to $1.2 billion. Simultaneously, adjusted EBITDA witnessed a remarkable ascent, doubling to $320 million. These figures underscore robust financial health and an optimistic outlook for sustained growth in the subsequent quarters.

Future Growth Expectations

Pagaya Technologies actively projects substantial network volume and revenue expansion for the second quarter of 2025. This forward-looking perspective suggests confidence in the company's growth trajectory and its ability to capitalize on emerging opportunities in the market.

Wall Street Analysts Forecast

Market analysts have expressed favorable sentiment toward Pagaya Technologies Ltd, with nine analysts providing an average one-year price target of $22.11. Estimates range from a high of $36.00 to a low of $12.50, indicating a potential upside of 103.23% from the current stock price of $10.88. Investors can explore detailed forecasts on the Pagaya Technologies Ltd (PGY, Financial) Forecast page.

The collective assessment from eight brokerage firms rates the stock as "Outperform," with an average recommendation score of 1.6. This rating aligns with the scale where 1 suggests a Strong Buy and 5 suggests a Sell, reflecting investor confidence in Pagaya's potential.

Estimating Fair Value

According to GuruFocus estimates, the one-year GF Value for Pagaya Technologies Ltd is pegged at $16.09. This valuation suggests a 47.89% upside from the current trading price of $10.88. The GF Value is a proprietary measure indicating where the stock should be priced based on historical trading multiples, past business performance, and future growth projections. For more detailed insights, visit the Pagaya Technologies Ltd (PGY, Financial) Summary page.

For investors, these metrics and projections provide a comprehensive view of Pagaya's current market position and future potential, equipping them with essential information to make informed investment decisions.