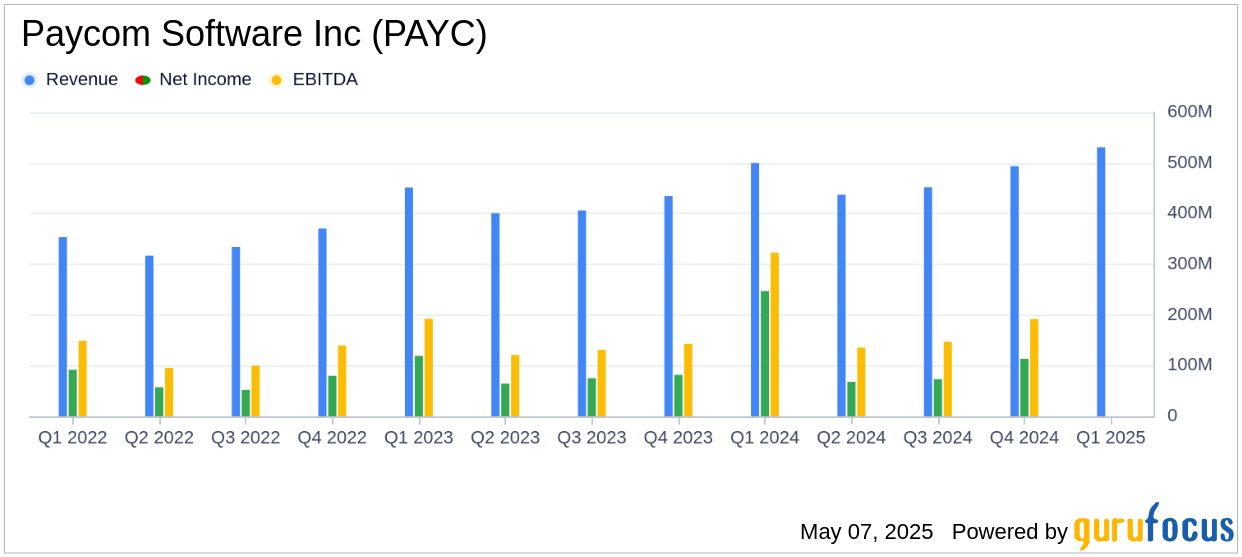

On May 7, 2025, Paycom Software Inc (PAYC, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. Paycom, a leading provider of payroll and human capital management software, reported revenues of $531 million, marking a 6% increase year-over-year and surpassing the analyst estimate of $524.95 million. The company's GAAP net income was $139 million, or $2.48 per diluted share, while the non-GAAP net income reached $158 million, or $2.80 per diluted share.

Company Overview

Founded in 1998, Paycom Software Inc (PAYC, Financial) is a fast-growing provider of payroll and human capital management software, primarily targeting clients with 50-10,000 employees in the United States. As of 2023, Paycom services approximately 19,500 clients. The company offers a comprehensive suite of HCM add-on modules, including time and attendance, talent management, and benefits administration.

Performance and Challenges

Paycom's performance in the first quarter of 2025 highlights its strong sales execution and operational efficiency. The company's revenue growth of 6.1% year-over-year is a testament to its successful automation strategies and client ROI achievements. However, the GAAP net income of $139.4 million, or $2.48 per diluted share, represents a decline from the previous year's $247.2 million, or $4.37 per diluted share. This decrease is attributed to the absence of a one-time benefit from the forfeiture of the 2020 CEO performance award in the prior year.

Financial Achievements

Paycom's financial achievements are significant in the software industry, where recurring revenue and operational efficiency are critical. The company's recurring and other revenues increased by 7.3% from the previous year, constituting 94.2% of total revenues. This growth underscores Paycom's ability to maintain a stable revenue stream, which is crucial for long-term sustainability in the competitive software market.

Key Financial Metrics

Paycom's adjusted EBITDA for the first quarter was $253.2 million, representing 48% of total revenues, compared to $229.5 million in the same period last year. The company's cash and cash equivalents increased to $520.8 million as of March 31, 2025, from $402.0 million at the end of 2024. Notably, Paycom maintained a total debt of $0, highlighting its strong financial position.

We delivered strong results in the first quarter, led by our differentiated approach to automation, strong sales execution and operational efficiency gains," said Paycom founder, CEO and chairman, Chad Richison.

Income Statement Highlights

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Revenues | $530.5 million | $499.9 million |

| GAAP Net Income | $139.4 million | $247.2 million |

| Non-GAAP Net Income | $157.7 million | $146.6 million |

| Adjusted EBITDA | $253.2 million | $229.5 million |

Analysis and Outlook

Paycom's ability to exceed revenue estimates and maintain strong operational efficiency positions it well for future growth. The company's focus on automation and client ROI continues to drive its success. Despite the decline in GAAP net income due to the absence of a one-time benefit, Paycom's non-GAAP net income and adjusted EBITDA demonstrate its robust financial health. The company's guidance for 2025 anticipates total revenue growth of approximately 8% year-over-year, with recurring and other revenue growth of about 9%.

Explore the complete 8-K earnings release (here) from Paycom Software Inc for further details.