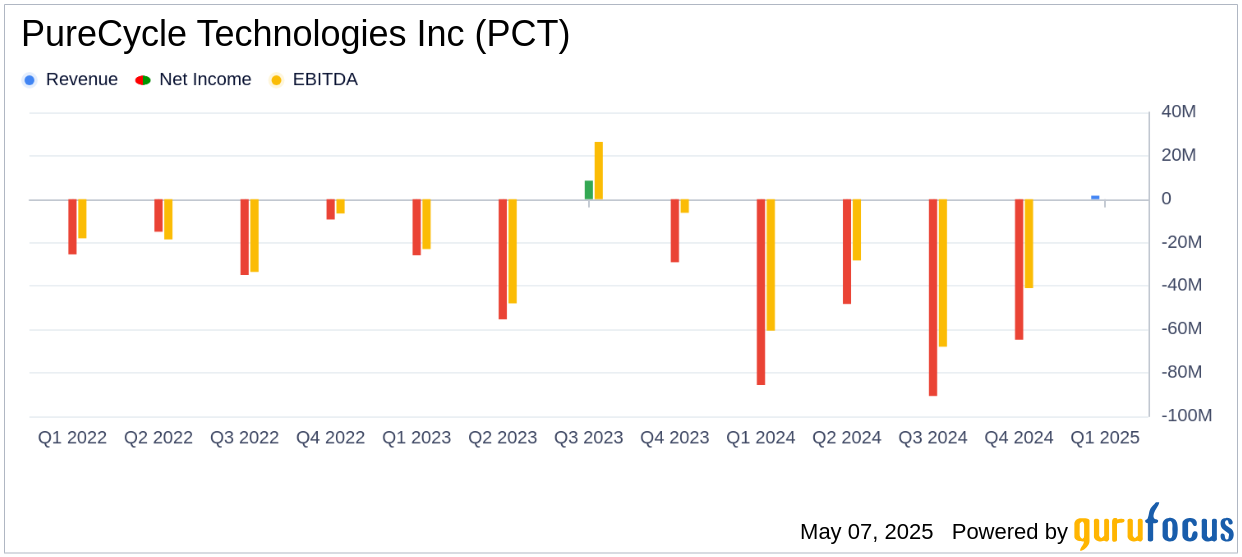

On May 7, 2025, PureCycle Technologies Inc (PCT, Financial) released its 8-K filing for the first quarter ending March 31, 2025. The company, which is pioneering a patented recycling process to transform waste polypropylene into high-quality resin, reported its first-ever revenue of approximately $1.6 million. However, this figure fell short of the analyst estimate of $3.60 million. The estimated earnings per share (EPS) was -0.23, indicating a net loss per share, which aligns with the company's ongoing investment in scaling operations.

Company Background

PureCycle Technologies Inc, based in Florida, is focused on commercializing a unique dissolution process originally developed by The Procter & Gamble Company. This technology separates polymers from contaminants in waste plastics, producing PureFive resin with near-virgin characteristics. The company operates a single segment dedicated to recycling polypropylene into resins, which are used in various applications similar to virgin polypropylene.

Performance and Challenges

The first quarter of 2025 marked a significant milestone for PureCycle Technologies Inc as it reported its inaugural revenue. CEO Dustin Olson highlighted the company's progress in commercial and operational fronts, noting increased confidence in ramping up operations. Despite these advancements, the company faces challenges in meeting revenue expectations, which could impact investor confidence and future funding opportunities.

Financial Achievements

PureCycle's financial achievements include the sale of $30.4 million in revenue bonds and raising approximately $33.0 million through a private placement of common stock. These financial maneuvers are crucial for supporting the company's growth initiatives and operational scaling in the industrial products sector.

Key Financial Metrics

During the first quarter, PureCycle recognized revenue of $1.6 million, marking its first reported revenue. The company also improved its operational metrics, with the Ironton Facility achieving nearly 90% onstream time in April. These metrics are vital as they reflect the company's ability to scale production and meet market demand.

Operational and Commercial Progress

PureCycle's operational improvements include increased production volume and reliability at the Ironton Facility. The company is also advancing its commercial efforts, with successful trials of PureFive resin in various applications, including biaxially oriented polypropylene (BOPP) film and fully drawn yarn (FDY). These developments are essential for establishing PureCycle's market presence and driving future sales.

Commentary and Industry Impact

Brückner CSO Markus Gschwandtner stated, “We have extensively studied recycled polypropylene over the past five years, and through the initial tests, PureCycle’s PureFive Choice™ resin has performed better than anything we’ve seen before. We believe this could be the breakthrough the industry needs to close the loop on BOPP film.”

This commentary underscores the potential impact of PureCycle's technology on the recycling industry, highlighting its capability to meet high industry standards and drive sustainability efforts.

Analysis and Outlook

While PureCycle Technologies Inc has made notable strides in its operational and commercial endeavors, the shortfall in revenue compared to analyst estimates indicates the challenges of scaling a novel technology. The company's ability to secure funding and improve operational efficiency will be critical in achieving its long-term objectives. As PureCycle continues to refine its processes and expand its market reach, its performance will be closely watched by investors and industry stakeholders.

Explore the complete 8-K earnings release (here) from PureCycle Technologies Inc for further details.