On May 7, 2025, Matrix Service Co (MTRX, Financial) released its 8-K filing detailing the financial results for the third quarter of fiscal 2025, which ended on March 31, 2025. Matrix Service Co is a prominent engineering and construction provider for large industrial projects, primarily serving the oil and gas, power, petrochemical, industrial, mining, and minerals markets. The company operates across three segments: Utility and Power Infrastructure; Process and Industrial Facilities; and Storage and Terminal Solutions.

Performance and Challenges

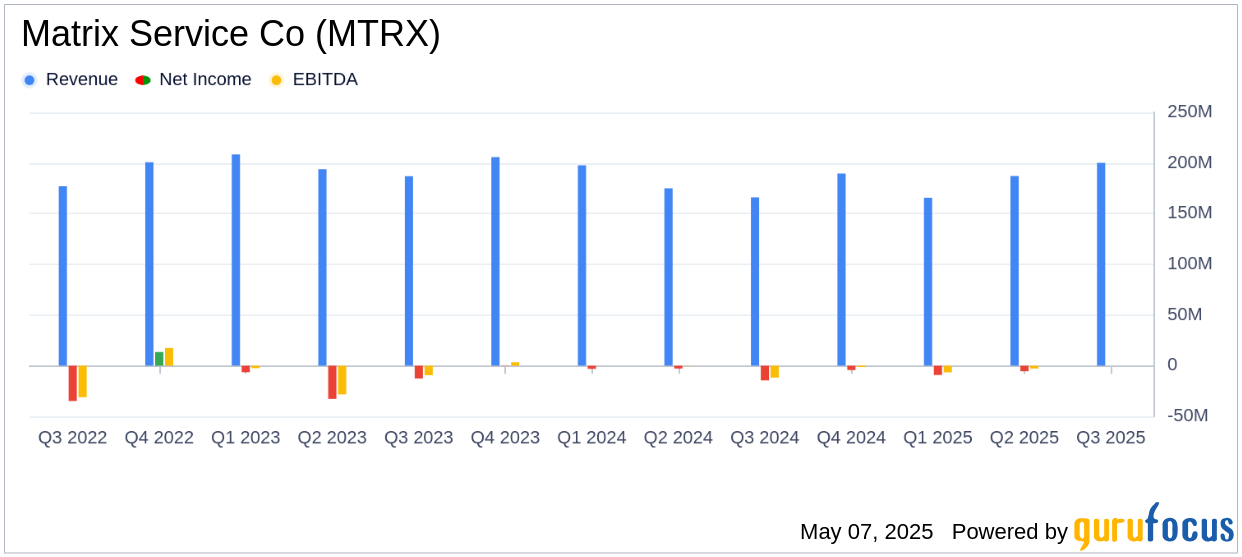

Matrix Service Co reported a revenue of $200.2 million for the third quarter, which is a 21% increase from the previous year but fell short of the analyst estimate of $215.06 million. The net loss per share was $(0.12), which is worse than the estimated loss of $(0.05) per share but a significant improvement from the $(0.53) loss per share reported in the same quarter last year. The company's backlog increased by 7.7% from the previous quarter to $1.4 billion, indicating strong future project commitments.

Financial Achievements

The company achieved a break-even Adjusted EBITDA, a notable improvement from the $(10.0) million reported in the same quarter of the previous year. Cash flow from operations was $31.2 million, and the company maintained a strong liquidity position with $247.1 million and no outstanding debt. These achievements are crucial for a construction company like Matrix Service Co, as they indicate financial stability and the ability to fund ongoing and future projects.

Income Statement Highlights

Matrix Service Co's gross margin improved to $12.9 million, or 6.4%, compared to $5.6 million, or 3.4%, in the previous year. Selling, general, and administrative expenses decreased to $17.7 million from $19.9 million, primarily due to reduced cash-settled stock-based compensation. The company reported a net loss of $(3.4) million, a significant improvement from the $(14.6) million loss in the prior year.

Segment Performance

The Storage and Terminal Solutions segment saw a 77% increase in revenue to $96.1 million, driven by specialty vessel and LNG storage projects. However, the gross margin decreased slightly due to lower labor productivity on a crude terminal project. The Utility and Power Infrastructure segment's revenue increased by 27% to $58.7 million, with a gross margin improvement to 9.4% due to strong project execution. Conversely, the Process and Industrial Facilities segment experienced a revenue decline to $45.4 million, attributed to the completion of a large renewable diesel project, but saw an increase in gross margin to 8.3%.

Backlog and Financial Position

The company's backlog stood at $1.4 billion, with project awards totaling $301.2 million in the quarter, resulting in a book-to-bill ratio of 1.5x. The table below summarizes the backlog by segment:

| Segment | Awards ($) | Book-to-Bill | Backlog ($) |

|---|---|---|---|

| Storage and Terminal Solutions | 204,839 | 2.1x | 847,771 |

| Utility and Power Infrastructure | 37,686 | 0.6x | 297,526 |

| Process and Industrial Facilities | 58,667 | 1.3x | 266,868 |

| Total | 301,192 | 1.5x | 1,412,165 |

Analysis and Commentary

Matrix Service Co's third-quarter results reflect a positive trajectory towards profitability, supported by a growing backlog and improved revenue in key segments. However, the company faces challenges from macroeconomic uncertainties and project timing, which have led to a reduction in fiscal year revenue guidance by 10%. Despite these challenges, the company's strong liquidity position and strategic focus on core segments provide a solid foundation for future growth.

“Our third quarter results reflect accelerating revenue, supported by backlog growth which advances our return to profitability and enhances our visibility into future earnings,” said John Hewitt, President and Chief Executive Officer of Matrix Service Company.

Explore the complete 8-K earnings release (here) from Matrix Service Co for further details.