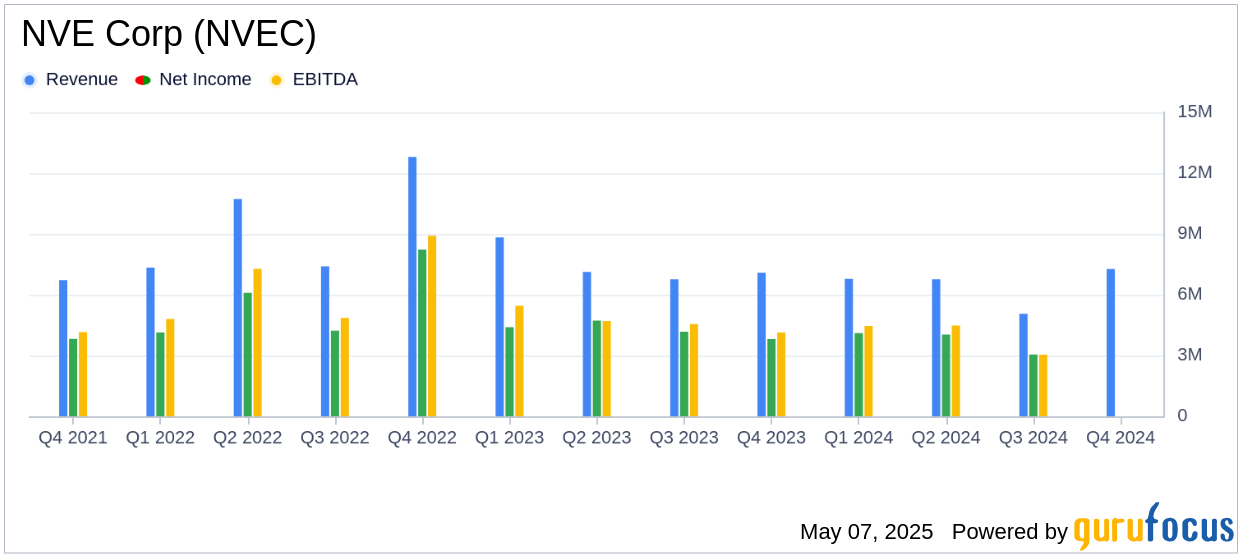

NVE Corp (NVEC, Financial) released its 8-K filing on May 7, 2025, detailing its financial performance for the fourth quarter and fiscal year ended March 31, 2025. The company, known for its high-performance spintronic products, reported a 3% increase in fourth-quarter revenue to $7.27 million, driven by a significant rise in contract research and development revenue. However, fiscal year 2025 revenue declined by 13% to $25.9 million, primarily due to a decrease in product sales.

Company Overview

NVE Corp specializes in the development and sale of devices utilizing spintronics, a nanotechnology that leverages electron spin for data acquisition, storage, and transmission. The company's product portfolio includes various sensors and couplers, such as digital, medical, and rotation sensors, as well as isolators and transceivers, all based on giant magnetoresistance (GMR) and tunneling magnetoresistance (TMR) technologies.

Performance and Challenges

Despite a 2% increase in net income for the fourth quarter to $3.89 million, or $0.80 per diluted share, NVE Corp faced a 12% decline in net income for the fiscal year, totaling $15.1 million, or $3.11 per diluted share. The fiscal year revenue drop was attributed to a 16% decrease in product sales, which overshadowed the 112% increase in contract research and development revenue. This performance highlights the challenges NVE Corp faces in maintaining product sales momentum amid industry fluctuations.

Financial Achievements

In the semiconductor industry, where innovation and adaptation are crucial, NVE Corp's ability to increase contract research and development revenue by 558% in the fourth quarter is noteworthy. This achievement underscores the company's potential to diversify its revenue streams and leverage its expertise in spintronics to explore new market opportunities.

Key Financial Metrics

The income statement reveals a gross profit of $21.64 million for fiscal 2025, down from $23.03 million in the previous year. Total expenses increased to $5.64 million from $4.51 million, driven by higher research and development costs. The balance sheet shows total assets of $64.28 million, with cash and cash equivalents at $8.04 million, down from $10.28 million the previous year. Shareholders' equity decreased to $62.27 million from $65.57 million, reflecting the impact of reduced retained earnings.

| Metric | 2025 | 2024 |

|---|---|---|

| Total Revenue | $25.9 million | $29.8 million |

| Net Income | $15.1 million | $17.1 million |

| Net Income per Share (Diluted) | $3.11 | $3.54 |

Analysis and Commentary

Despite the challenges in product sales, NVE Corp's strategic focus on contract research and development has yielded positive results, as evidenced by the substantial revenue increase in this segment. The company's announcement of a quarterly cash dividend of $1.00 per share reflects its commitment to returning value to shareholders. However, the decline in overall revenue and net income for the fiscal year indicates the need for continued innovation and market adaptation.

“We’re pleased to report year-over-year and sequential revenue and earnings growth for the quarter,” said NVE President and Chief Executive Officer Daniel A. Baker, Ph.D.

As NVE Corp navigates the complexities of the semiconductor industry, its ability to capitalize on spintronics technology and expand its research capabilities will be crucial in overcoming current challenges and driving future growth.

Explore the complete 8-K earnings release (here) from NVE Corp for further details.