On May 7, 2025, AerSale Corp (ASLE, Financial) released its 8-K filing for the first quarter of 2025. AerSale Corp, a leader in aviation aftermarket products and services, reported a revenue of $65.8 million, falling short of the analyst estimate of $89.53 million. The company specializes in the sale, lease, and exchange of used aircraft, engines, and components, and provides a range of maintenance, repair, and overhaul services.

Performance and Challenges

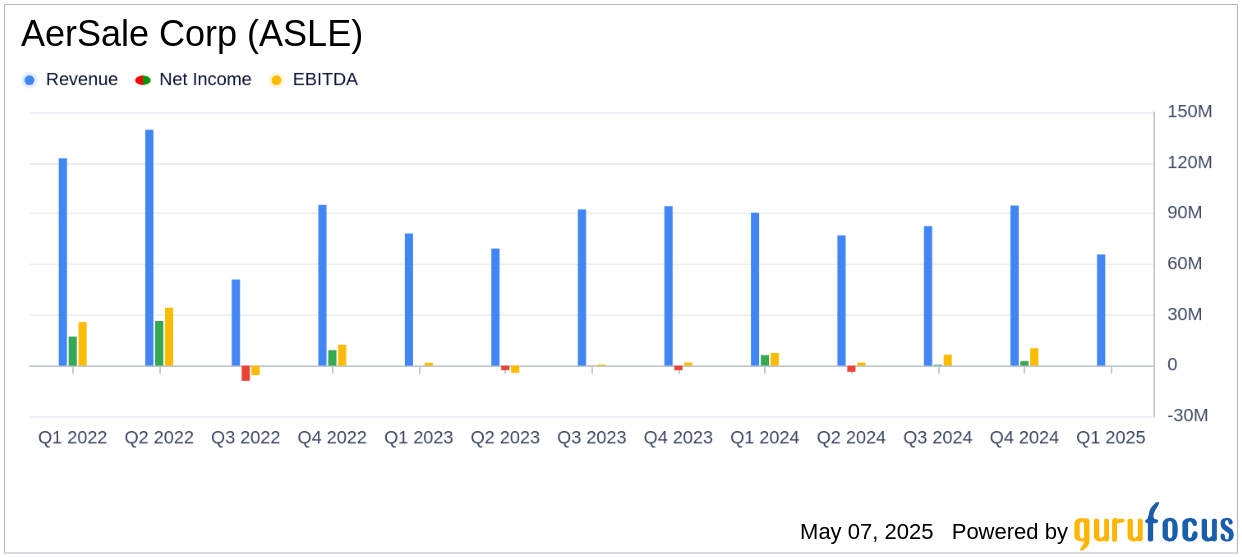

AerSale Corp's revenue for the first quarter of 2025 decreased by 27.4% compared to the previous year, primarily due to fewer whole asset sales. The company sold only one engine in the current period, compared to one aircraft and four engines in the prior year. Despite this, excluding flight equipment sales, revenue increased by 23.4% to $64.0 million, driven by strong demand for Used Serviceable Material (USM) and AerSafe™ products.

Financial Achievements and Industry Importance

The company's core business demonstrated resilience with a 23.4% revenue growth excluding flight equipment sales. This growth is significant in the transportation industry, highlighting the robust demand for AerSale's USM parts, MRO services, and expanding lease pool. CEO Nick Finazzo expressed confidence in the company's strategic initiatives, stating,

We remain focused on executing our strategic initiatives which we expect will drive higher operating results as the year progresses."

Key Financial Metrics

AerSale Corp reported a GAAP net loss of $5.3 million, contrasting with a net income of $6.3 million in the prior year. The adjusted net loss was $2.7 million, compared to an adjusted net income of $5.5 million in the previous year. The company's adjusted EBITDA was $3.2 million, down from $9.0 million, reflecting the lower volume of whole asset sales.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $65.8 million | $90.5 million |

| GAAP Net Income (Loss) | $(5.3) million | $6.3 million |

| Adjusted Net Income (Loss) | $(2.7) million | $5.5 million |

| Adjusted EBITDA | $3.2 million | $9.0 million |

Analysis of Performance

The decline in AerSale Corp's revenue and net income highlights the volatility associated with whole asset sales. However, the company's strong performance in its core business areas, such as USM and MRO services, underscores its ability to adapt and thrive amidst challenges. The strategic focus on monetizing feedstock investments and expanding MRO capabilities positions AerSale Corp well for future growth.

Despite the current challenges, AerSale Corp's strategic initiatives and strong market position provide a solid foundation for potential recovery and growth in the coming quarters. Investors should monitor the company's progress in executing its strategic plans and the impact of market dynamics on its financial performance.

Explore the complete 8-K earnings release (here) from AerSale Corp for further details.