Summary:

- TriplePoint Venture Growth (TPVG, Financial) boasts a strong 14.4% portfolio yield and a $2.3 million gain from Revolut Ltd.

- The company secured $76.5 million in new debt commitments and concluded the period with a net asset value of $347 million.

- A distribution of $0.30 per share is planned for June 2025.

Strong Portfolio Performance and Financial Standing

TriplePoint Venture Growth (TPVG) demonstrated robust financial metrics in its Q1 report, underscored by a notable 14.4% portfolio yield. Additionally, the company achieved a $2.3 million gain from its investment in Revolut Ltd. Demonstrating its strategic growth efforts, TriplePoint closed a significant $76.5 million in new debt commitments. The firm's net asset value (NAV) stood impressively at $347 million. Investors were pleased to learn about the declared dividend of $0.30 per share slated for June 2025, reflecting the company's commitment to returning value to shareholders.

Wall Street Analysts Forecast

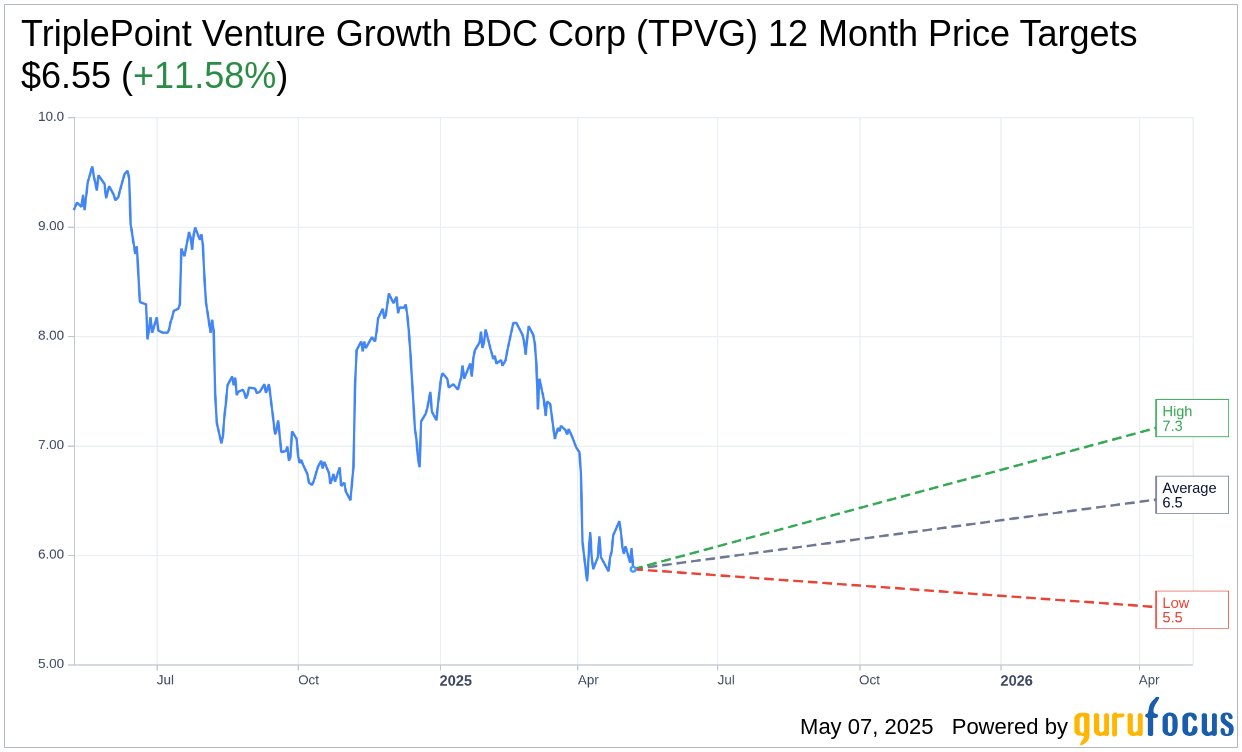

Analyst perspectives on TriplePoint Venture Growth BDC Corp (TPVG, Financial) remain optimistic. The projected one-year price target, as surveyed from 5 analysts, averages at $6.55. This forecast includes a high estimate of $7.25 and a low of $5.50, implying an 11.58% upside from the current trading price of $5.87. This potential growth makes TPVG an intriguing consideration for investors seeking capital appreciation. Further details on these projections can be accessed on the TriplePoint Venture Growth BDC Corp (TPVG) Forecast page.

Brokerage Recommendations

The consensus among Wall Street brokerage firms indicates a "Hold" recommendation for TriplePoint Venture Growth BDC Corp (TPVG, Financial), with an average rating of 3.1 from 8 firms. This rating is on a scale of 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell. Such a stance suggests that while there are growth opportunities, analysts advise a cautious approach, recommending investors evaluate further before making substantial changes to their positions.