Summary:

- Fluence Energy (FLNC, Financial) missed its GAAP EPS expectations by $0.02, yet exceeded revenue forecasts by $106.32 million.

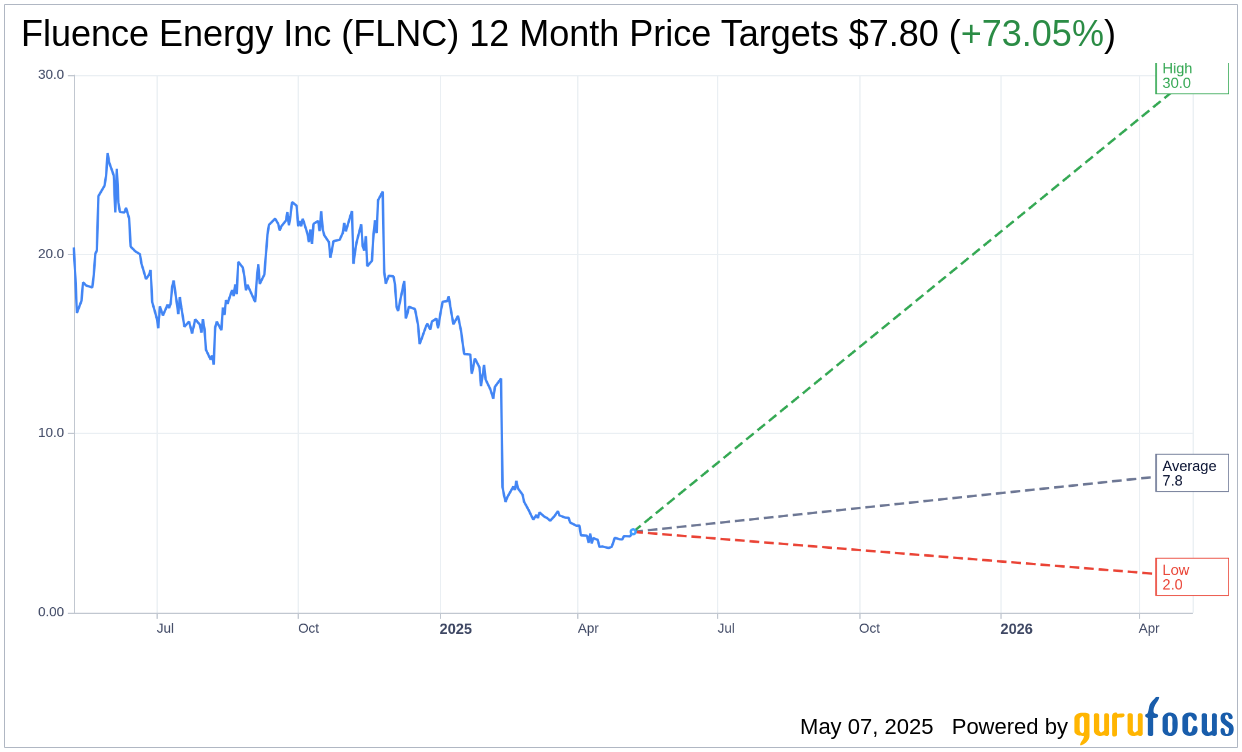

- Analysts project notable upside potential for the company's stock, suggesting a 73.05% increase.

- GuruFocus sees even more substantial growth potential, estimating a possible 523.06% upside in the stock's value.

Fluence Energy's Financial Performance

Fluence Energy (FLNC) recently announced its second-quarter earnings with a GAAP Earnings Per Share (EPS) of -$0.24, which fell short of analysts' expectations by $0.02. Despite this earnings shortfall, the company reported remarkable revenue figures, achieving $431.6 million. This figure not only surpassed market expectations by $106.32 million but also marks a 30.7% decline compared to the previous year.

Insights from Wall Street Analysts

In assessing Fluence Energy Inc (FLNC, Financial), 23 analysts have set a one-year average price target of $7.80. Current projections vary widely, with the highest estimate at $30.00 and the lowest at $2.00. These figures suggest a potential upside of 73.05% from the current stock price of $4.51. For more comprehensive estimates and projections, visit the Fluence Energy Inc (FLNC) Forecast page.

From a consensus perspective, 25 brokerage firms recommend a "Hold" for Fluence Energy Inc (FLNC, Financial) with an average recommendation rating of 2.7. This rating is based on a scale where 1 represents a Strong Buy and 5 indicates a Sell.

GuruFocus Value Estimation

According to GuruFocus metrics, the GF Value of Fluence Energy Inc (FLNC, Financial) is projected to reach $28.10 in the upcoming year. This suggests an extraordinary upside potential of 523.06% from the current price of $4.51. The GF Value is GuruFocus' proprietary estimate, calculated from the stock's historical trading multiples, past growth trends, and anticipated future performance. Explore these valuations in detail on the Fluence Energy Inc (FLNC) Summary page.