Informatica (INFA, Financial) announced its first-quarter revenue for 2025 at $403.9 million, surpassing the consensus estimate of $391.79 million. The company noted robust execution of strategic plans, leading to impressive performance across various revenue and profitability metrics. Key drivers included a 30% year-over-year increase in Cloud Subscription Annual Recurring Revenue (ARR), fueled by new cloud applications, significant cloud expansion among existing customers, enhanced utilization of generative AI, and a swift transition from on-premises to cloud solutions.

Informatica's CEO, Amit Walia, highlighted the vital role of their cloud platform in data management, underscoring its importance. The company attributes its success to its leading product offerings, extensive partnership network, and the innovative delivery of data management and AI solutions via the IDMC platform, reinforcing their optimistic outlook in today's market conditions.

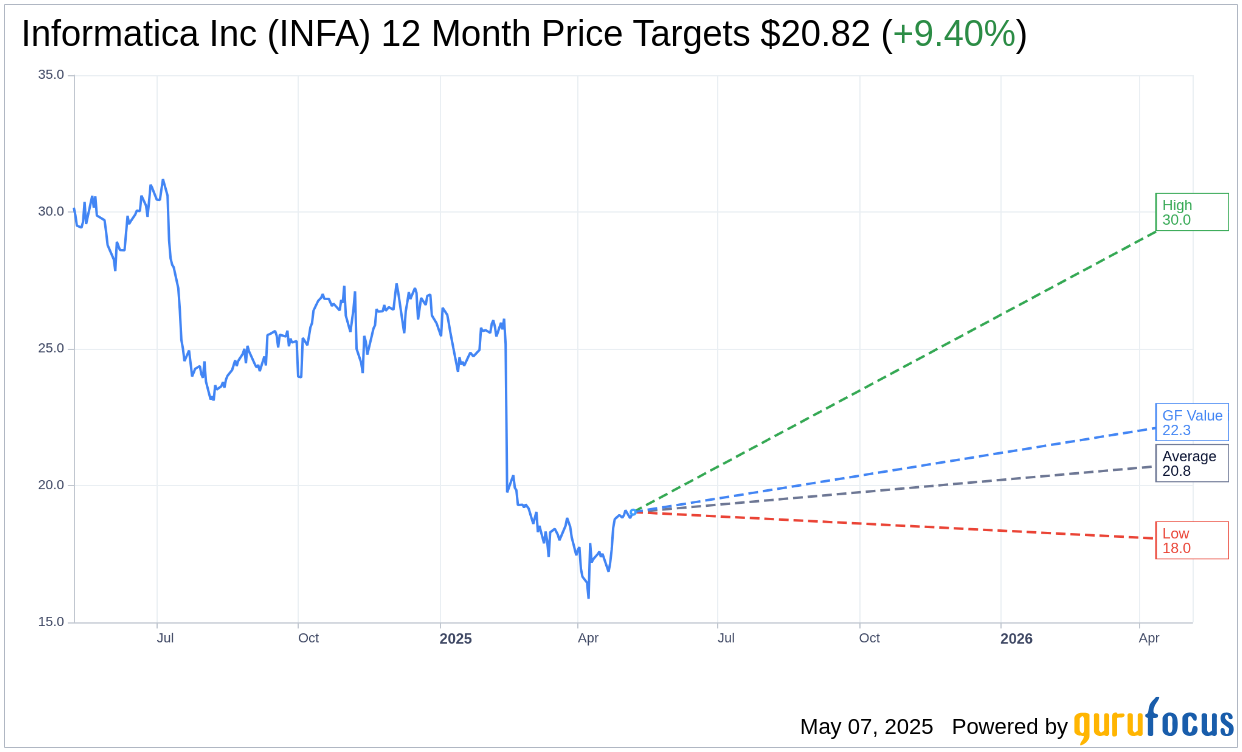

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Informatica Inc (INFA, Financial) is $20.82 with a high estimate of $30.00 and a low estimate of $18.00. The average target implies an upside of 9.40% from the current price of $19.03. More detailed estimate data can be found on the Informatica Inc (INFA) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Informatica Inc's (INFA, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Informatica Inc (INFA, Financial) in one year is $22.32, suggesting a upside of 17.29% from the current price of $19.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Informatica Inc (INFA) Summary page.

INFA Key Business Developments

Release Date: February 13, 2025

- Total ARR: $1.73 billion, a 6.1% increase year over year.

- Cloud Subscription ARR: $827 million, a 34% increase year over year, representing 48% of total ARR.

- GAAP Total Revenues: $428 million, a 3.8% decrease year over year.

- Cloud Subscription Revenue: $187 million, 44% of total revenues, growing 33% year over year.

- Operating Margin: 37.9%, a 150 basis point improvement from a year ago.

- Net Income: $129 million.

- Net Income Per Diluted Share: $0.41.

- Adjusted Unlevered Free Cash Flow After Tax: $180 million.

- Share Repurchase: $103 million spent to repurchase 3.8 million shares in Q4.

- Cash and Short-term Investments: $1.2 billion, an increase of $240 million year over year.

- Net Leverage Ratio: 1.1 times at the end of December.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Informatica Inc (INFA, Financial) achieved a 34% year-over-year growth in cloud subscription ARR, now representing nearly half of the total ARR.

- The company closed a record year for on-premises to cloud migrations, which grew 42% year over year.

- Cloud customer count grew by 8% for the year, with the number of cloud ARR customers spending more than $1 million increasing by 59% year over year.

- Informatica Inc (INFA) was named a leader in the 2025 Gartner Magic Quadrant for data and analytics governance platforms and the 2024 Gartner Magic Quadrant for data integration tools.

- The company expanded its AI capabilities, with 100 customers using GenAI capabilities on the IDMC platform, and extended CLAIRE GPT services at no additional cost throughout 2025.

Negative Points

- Renewal rates were lower than forecast, impacting overall financial performance.

- The reduction in renewal term length for self-managed subscription contracts negatively impacted GAAP revenue.

- Lower professional services revenue and foreign exchange headwinds contributed to outcomes that did not meet forecasts.

- The company experienced higher-than-expected roll-off of modernization-related self-managed subscription and maintenance ARR.

- GAAP total revenues for Q4 2024 decreased by 3.8% year over year, falling short of expectations.