On May 7, 2025, Compass Minerals International Inc (CMP, Financial) released its 8-K filing detailing the fiscal 2025 second-quarter results. The company, known for its production of salt and specialty potash fertilizer, reported a revenue of $494.6 million, surpassing the analyst estimate of $413.67 million. However, the earnings per share (EPS) fell short of expectations, recording a net loss per diluted share of $0.77 compared to the estimated EPS of $0.38.

Company Overview

Compass Minerals International Inc (CMP, Financial) is a leading global provider of essential minerals, primarily producing salt and specialty potash fertilizer. The company's key assets include rock salt mines located in Ontario, Louisiana, and the United Kingdom, and a brine operation at the Great Salt Lake in Utah. The salt products are essential for deicing and are also used in various industrial and consumer markets, while the sulfate of potash is crucial for high-value crops sensitive to standard potash.

Performance and Strategic Challenges

The company's performance in the second quarter reflects its strategic focus on optimizing inventory and cost structures. Compass Minerals successfully reduced its North American highway deicing inventory value and volumes by 47% and 59%, respectively, year over year. This strategic inventory management allowed the company to release nearly $150 million in working capital, contributing to a reduction in net total debt by approximately $170 million, or 18%, during the quarter.

Compass Minerals continues to make progress on its back-to-basics strategy, a key tenet of which is optimization," said Edward C. Dowling Jr., president and CEO.

Financial Achievements and Industry Implications

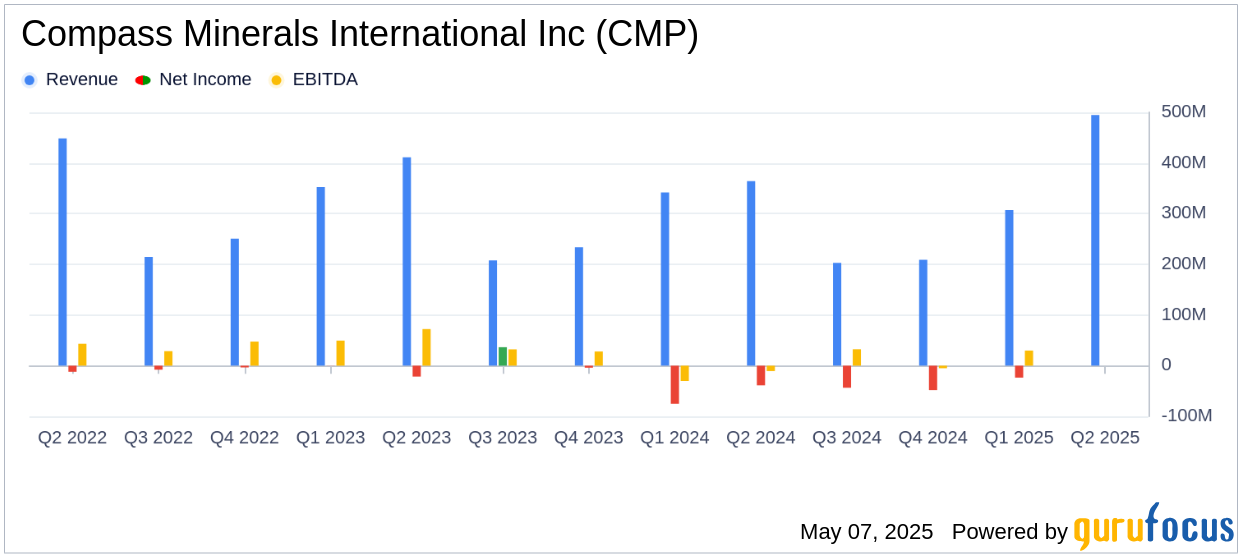

Despite the challenges, Compass Minerals achieved significant financial milestones. The company's revenue increased by 36% year over year, driven by a 47% increase in sales volume, although this was partially offset by a 5% decrease in average sales price. The salt segment, in particular, saw a 39% increase in revenue, highlighting the company's ability to capitalize on stronger winter weather conditions.

Key Financial Metrics

Compass Minerals reported an operating loss of $3.1 million, a significant improvement from the $39.3 million loss in the same quarter last year. Adjusted operating earnings were $54.8 million, down from $73.8 million in the previous year. Adjusted EBITDA stood at $84.1 million, compared to $95.7 million last year. These metrics are crucial for assessing the company's operational efficiency and profitability in the Metals & Mining industry.

| Financial Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Revenue | $494.6 million | $364.0 million |

| Operating Loss | $(3.1) million | $(39.3) million |

| Adjusted EBITDA | $84.1 million | $95.7 million |

| Net Loss per Diluted Share | $(0.77) | $(0.94) |

Analysis and Outlook

Compass Minerals' strategic focus on inventory management and cost optimization has positioned the company to better navigate market challenges. The reduction in inventory levels and debt highlights the company's commitment to improving its financial health. However, the decrease in average sales price and the shortfall in EPS indicate ongoing challenges in achieving profitability. As the company continues to optimize its operations, it remains well-positioned to leverage its unique assets and competitive advantages in the industry.

Explore the complete 8-K earnings release (here) from Compass Minerals International Inc for further details.