Key Highlights:

- Beyond Meat's Q1 2025 net revenues decreased by 9.1%, reaching $68.7 million.

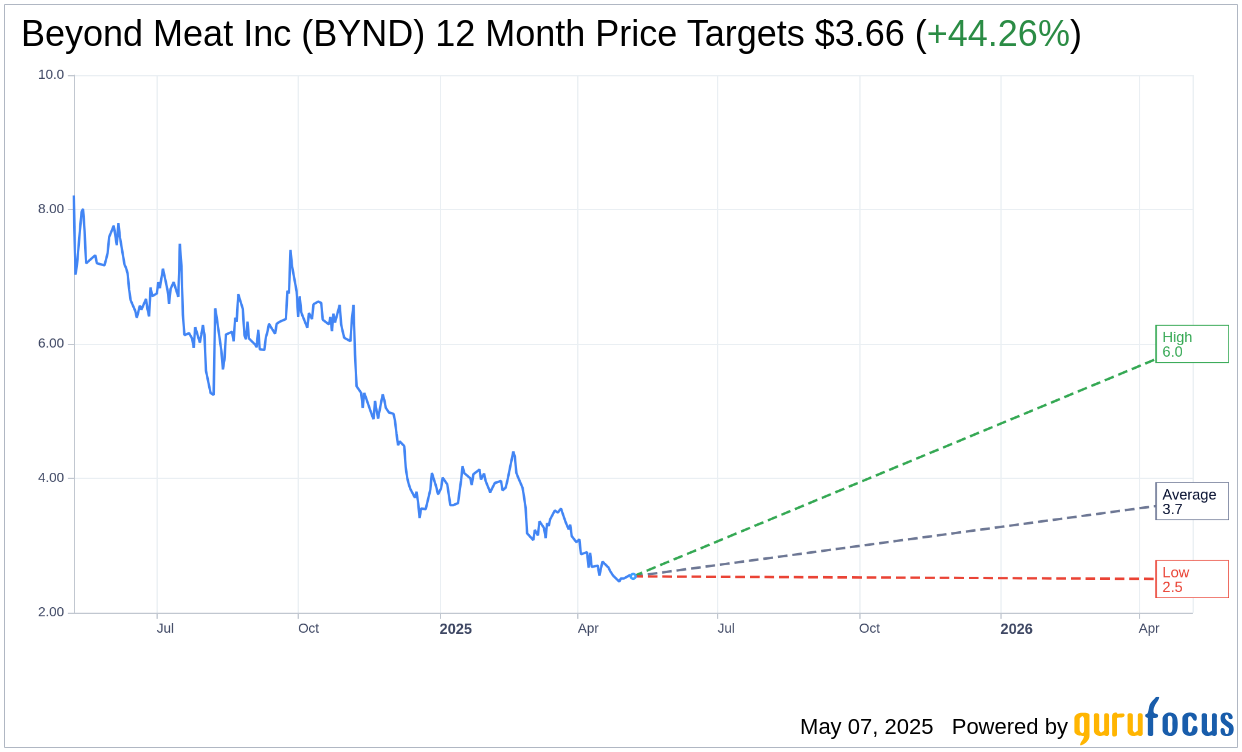

- Analysts predict a potential upside of 44.26% based on the average price target.

- The GF Value suggests a significant upside potential of 245.28%.

Beyond Meat's Revenue Decline and Strategic Measures

Beyond Meat (BYND, Financial) has reported a notable decline in its Q1 2025 net revenues, which fell to $68.7 million—a 9.1% decrease compared to the previous year. This drop is primarily due to challenges in retail distribution and a strategic shift in product placement by key U.S. retailers. In response, Beyond Meat is actively implementing cost-reduction strategies and has secured a $100 million financing facility to reinforce its financial position.

Analyst Price Targets and Predictions

According to price targets set by seven analysts, Beyond Meat Inc (BYND, Financial) has an average target price of $3.66. This figure includes a high estimate of $6.00 and a low estimate of $2.50. The average target suggests a potential upside of 44.26% from its current price of $2.54. For further insights, you can explore more detailed estimate data on the Beyond Meat Inc (BYND) Forecast page.

Brokerage Recommendations

Beyond Meat Inc (BYND, Financial) holds an average brokerage recommendation score of 3.5, signaling a "Hold" status. This score is derived from the consensus of 11 brokerage firms, using a scale where 1 represents a Strong Buy, and 5 indicates a Sell.

GuruFocus GF Value Insights

According to GuruFocus estimates, the anticipated GF Value for Beyond Meat Inc (BYND, Financial) one year from now is projected to be $8.77. This estimate suggests an impressive upside potential of 245.28% based on its current price of $2.54. The GF Value represents GuruFocus' fair value estimate, calculated through historical trading multiples and projections of business performance. For more comprehensive data, visit the Beyond Meat Inc (BYND) Summary page.