Quick Insights:

- Skyworks Solutions reports Q2 2025 revenue of $953 million, with an earnings per share of $1.24.

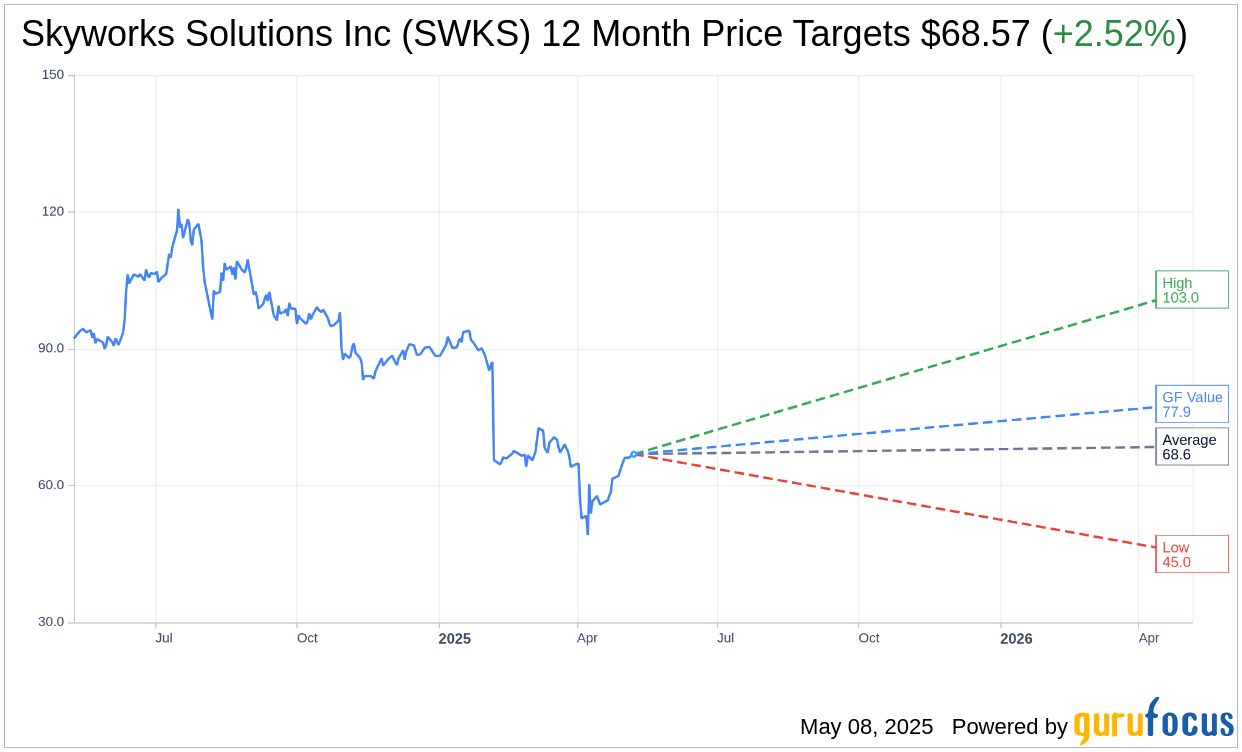

- Analysts set a one-year average price target of $68.57, suggesting a potential upside of 2.52%.

- Current brokerage recommendation stands at "Hold" with a GF Value estimate indicating a 16.52% potential upside.

Skyworks Solutions (SWKS, Financial) has reported their financial results for Q2 2025, showcasing a robust performance with revenue hitting $953 million. This was accompanied by an earnings per share (EPS) of $1.24, and the company generated an impressive free cash flow amounting to $371 million. Shareholders were rewarded with a return of $600 million, highlighting the company's commitment to delivering shareholder value. Notably, the company's gross margin was reported at 46.7%. Looking ahead, Skyworks Solutions has set their Q3 2025 revenue guidance in the range of $920 million to $960 million.

Wall Street Analysts Forecast

Analysts have provided a spectrum of price targets for Skyworks Solutions Inc (SWKS, Financial), with the average one-year target pegged at $68.57. This positions the stock for a potential upside of 2.52% from its current price of $66.88. The highest price target is set at $103.00, while the most conservative estimate stands at $45.00. These figures provide a comprehensive perspective on the stock's potential trajectory. For more detailed forecast data, investors can visit the Skyworks Solutions Inc (SWKS) Forecast page.

The consensus from 28 brokerage firms categorizes Skyworks Solutions Inc's (SWKS, Financial) average brokerage recommendation as 3.1, which indicates a "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell. This balanced perspective suggests that analysts see the stock as fairly valued at its current level.

Furthermore, according to GuruFocus estimates, the projected GF Value for Skyworks Solutions Inc (SWKS, Financial) over the next year is $77.93. This indicates a potential upside of 16.52% from its current trading price of $66.88. The GF Value is calculated using the historical multiples at which the stock has previously traded, combined with past business growth and anticipated future performance. For more comprehensive data, investors are encouraged to consult the Skyworks Solutions Inc (SWKS) Summary page.