Highlights:

- Remitly (RELY, Financial) sees a robust 34% revenue surge in the first quarter of 2025.

- Solid adjusted EBITDA margins exceed 16%, with optimistic projections for the year.

- Analysts forecast a 27.98% potential upside for the stock, with a consensus "Outperform" rating.

As we step into 2025, Remitly (RELY) is making waves with a remarkable 34% increase in revenue along with adjusted EBITDA margins exceeding 16%, as highlighted by CEO Matt Oppenheimer. The company has set forth an optimistic financial forecast for the year. It anticipates revenue to range between $1.574 billion and $1.587 billion, while adjusted EBITDA is expected to land between $195 million and $210 million. The first quarter alone saw revenues of $361.6 million with send volume climbing 41% year-over-year to hit $16.2 billion.

Wall Street Analysts' Forecast

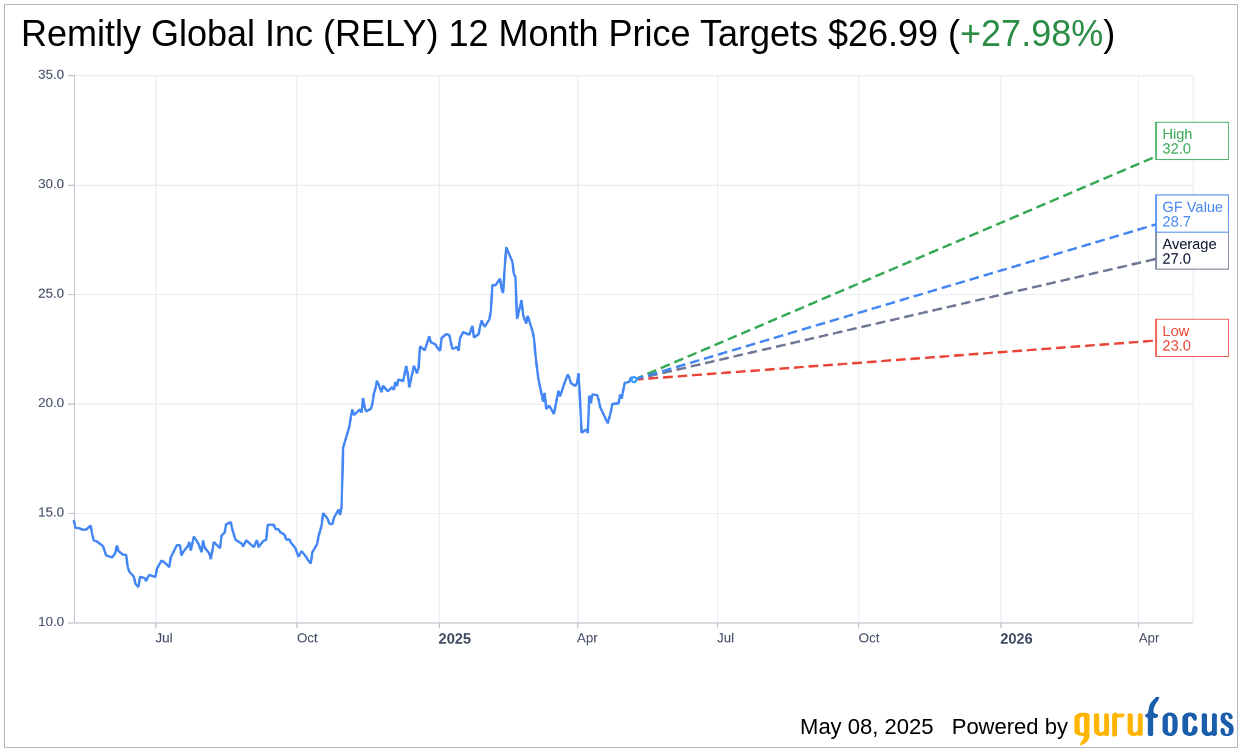

Nine analysts have provided their one-year price targets for Remitly Global Inc (RELY, Financial), with an average target of $26.99. The projections span from a high of $32.00 to a low of $23.00. From the current price of $21.09, this average target suggests a notable upside potential of 27.98%. For a more in-depth analysis, visit the Remitly Global Inc (RELY) Forecast page.

Further insights from 12 brokerage firms result in an average recommendation of 1.9 for Remitly Global Inc (RELY, Financial), which indicates an "Outperform" status. This rating is derived from a scale where 1 represents a Strong Buy and 5 equals a Sell.

According to GuruFocus data, the estimated GF Value for Remitly Global Inc (RELY, Financial) over the next year is $28.68. This valuation indicates a projected upside of 35.99% from the current price of $21.09. The GF Value represents GuruFocus' appraisal of the stock's fair trading value, calculated from historical trading multiples, past growth, and projected future performance. For comprehensive details, please refer to the Remitly Global Inc (RELY) Summary page.