- Kratos Defense & Security Solutions (KTOS, Financial) reports a promising book-to-bill ratio for Q1, surpassing revenue forecasts.

- Analysts offer a mixed outlook with a slightly bearish average price target.

- GF Value suggests potential overvaluation in the current market context.

Kratos Defense & Security Solutions (KTOS) delivered a strong performance in the first quarter, boasting an impressive book-to-bill ratio of 1.2:1. The company achieved $302.6 million in revenue, surpassing initial forecasts. Looking ahead, Kratos is optimistic about its growth trajectory, predicting a 10% organic revenue growth by 2025 and an ambitious 13%-15% growth in 2026, spurred by technological strides in hypersonic systems and tactical drones like the Valkyrie.

Wall Street Analysts Forecast

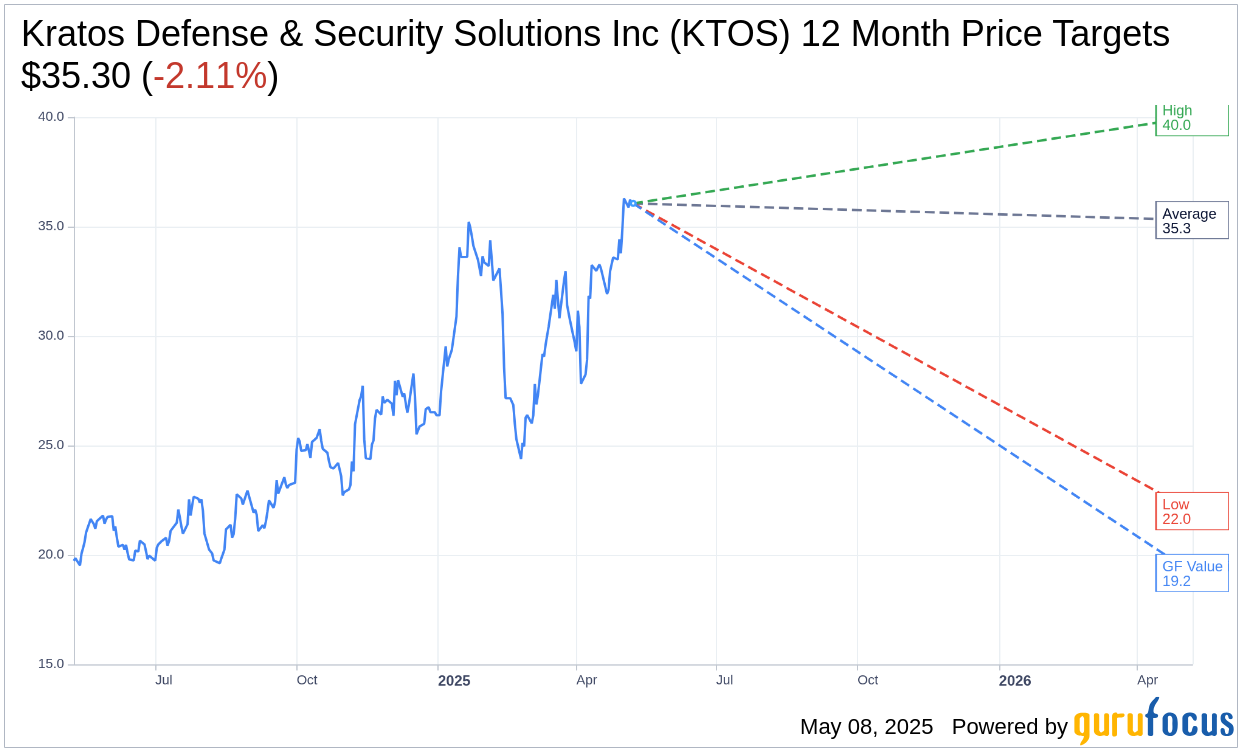

Wall Street's outlook for Kratos Defense & Security Solutions Inc (KTOS, Financial) presents a varied picture. Based on the one-year price targets put forth by 10 analysts, the average target price stands at $35.30, with estimates ranging from a high of $40.00 to a low of $22.00. This average target suggests a minor downside of 2.11% from its current market price of $36.06. For more detailed insight into these estimates, visit the Kratos Defense & Security Solutions Inc (KTOS) Forecast page.

The consensus recommendation from 12 brokerage firms positions Kratos with an average recommendation score of 2.2, categorizing it as "Outperform." This rating is on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 signifies Sell.

Understanding the GF Value Estimation

According to GuruFocus estimates, the GF Value for Kratos Defense & Security Solutions Inc (KTOS, Financial) in the upcoming year is projected to be $19.18. This estimation intimates a potential downside of 46.81% from the current price of $36.06, suggesting that the stock might be overvalued at present. The GF Value is a crucial metric by GuruFocus, calculated based on historical trading multiples, past business growth, and future performance projections. More extensive data is available on the Kratos Defense & Security Solutions Inc (KTOS) Summary page.