On March 31, 2025, Jeremy Grantham (Trades, Portfolio) executed a significant reduction in holdings of GrafTech International Ltd (EAF, Financial). The transaction involved a decrease of 6,667,836 shares, representing a -37.19% change in the position. This strategic move by Grantham, a renowned investor known for his expertise in identifying market bubbles, reflects a cautious approach towards GrafTech's current market standing. The reduction in shares had a -0.02 impact on Grantham's portfolio, leaving the firm with 11,261,040 shares, which now represent 0.03% of the portfolio.

Jeremy Grantham (Trades, Portfolio): A Profile of Investment Acumen

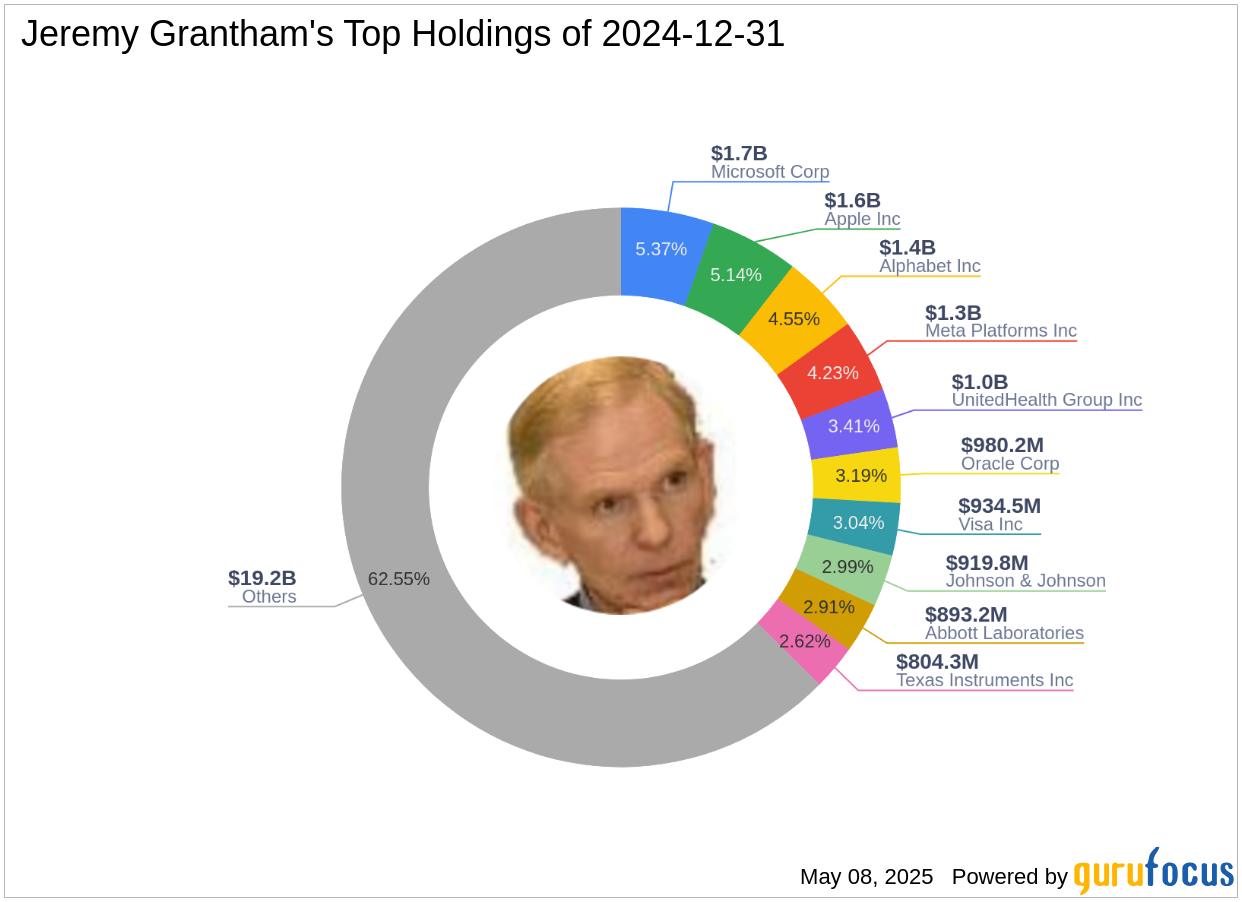

Jeremy Grantham (Trades, Portfolio) is the Chairman of Grantham Mayo van Otterloo (GMO) LLC, a Boston-based asset management firm. Grantham is highly regarded for his ability to identify speculative market bubbles and steer clear of overvalued markets. His investment philosophy is centered around avoiding speculative bubbles, a strategy that has proven successful over his long career. Grantham's top holdings include major companies such as Apple Inc (AAPL, Financial), Meta Platforms Inc (META, Financial), and Alphabet Inc (GOOGL, Financial), with a total equity of $30.74 billion. The firm's focus is primarily on the technology and healthcare sectors.

Understanding GrafTech International Ltd

GrafTech International Ltd, based in the USA, is a manufacturer of high-quality graphite electrode products essential for the production of EAF steel and other metals. Operating within the Industrial Materials segment, GrafTech has a market capitalization of $187.519 million. The company's product offerings include graphite electrodes and petroleum needle coke products, the latter being a key raw material in electrode production. Despite its critical role in the steel industry, GrafTech's current stock price is $0.7265, with a GF Value of 1.76, indicating a possible value trap.

Financial Metrics and Valuation Concerns

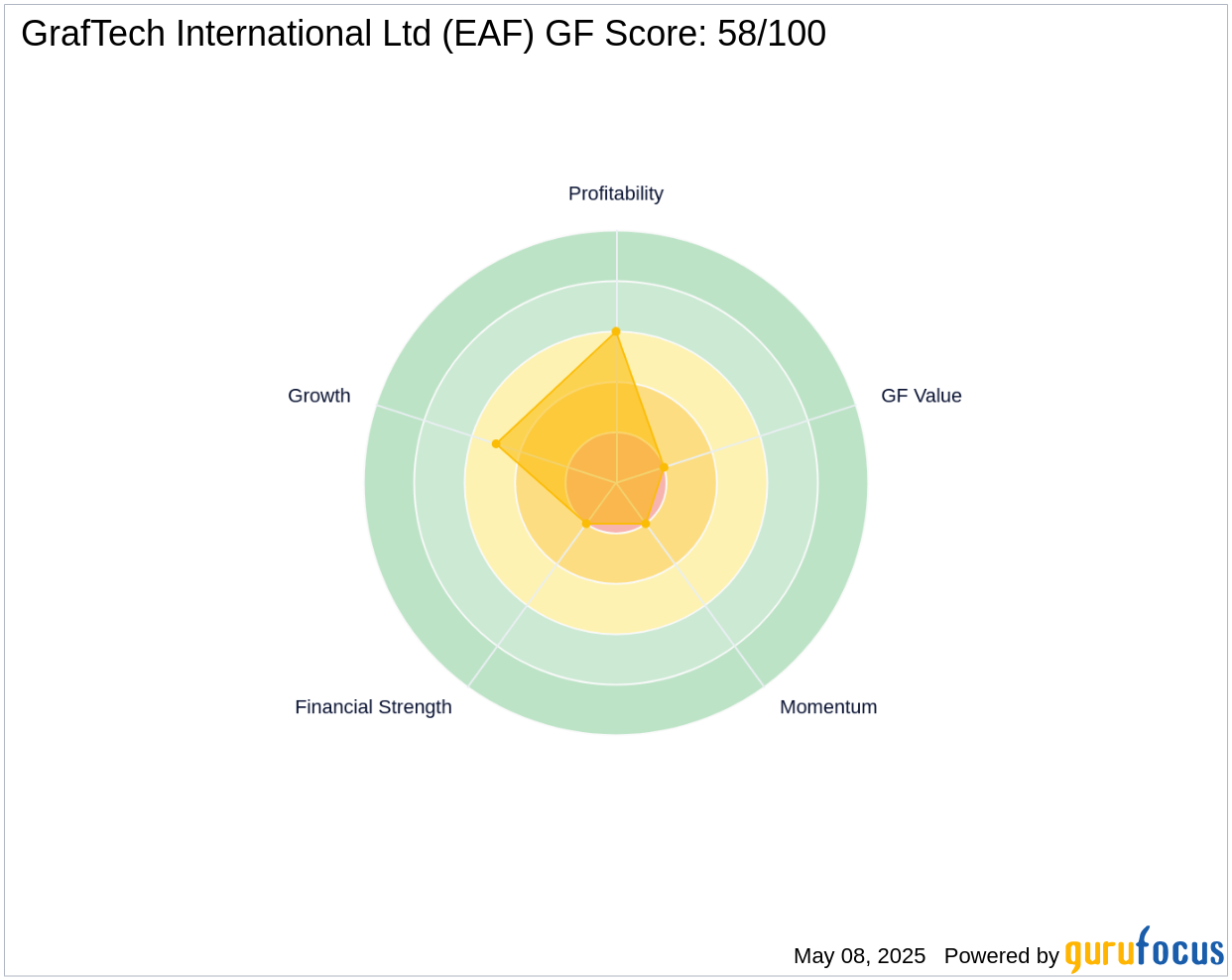

GrafTech's financial metrics present a challenging picture. The stock has a GF Score of 58/100, suggesting poor future performance potential. Since the transaction, GrafTech's stock has experienced a -16.91% decline, and a staggering -95.07% drop since its IPO. The company's revenue growth over the past three years is negative, with a rank of 2,758 in revenue growth. These figures highlight the financial hurdles GrafTech faces, raising concerns about its valuation and future prospects.

Performance and Growth Indicators

GrafTech's performance indicators further underscore its financial challenges. The company has a Financial Strength rank of 2/10 and a Profitability Rank of 6/10. Its Growth Rank is 5/10, and the GF Value Rank is 2/10. The Altman Z score of -0.24 indicates potential financial distress. Additionally, the Piotroski F-Score is 4, suggesting weak financial health. These metrics collectively paint a picture of a company struggling to maintain growth and profitability.

Conclusion: Market Implications of Grantham's Decision

Jeremy Grantham (Trades, Portfolio)'s decision to reduce holdings in GrafTech International Ltd reflects a prudent approach given the company's financial challenges and market performance. The significant reduction in shares suggests a lack of confidence in GrafTech's ability to overcome its current hurdles. Investors should carefully consider the potential risks associated with GrafTech's valuation and performance metrics before making investment decisions. As Grantham's track record shows, identifying and avoiding speculative bubbles is crucial for long-term investment success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.